Money & Markets Week Ahead for the week of December 6, 2020: Earnings are slowing down.

It should be a relatively slow week on Wall Street.

But I want to touch on the latest quarterly earnings. And I want to give some context for data sets to be released this week.

Here are some things investors should watch on Wall Street this week:

Slowdown in Earnings

Earnings season is slowing down.

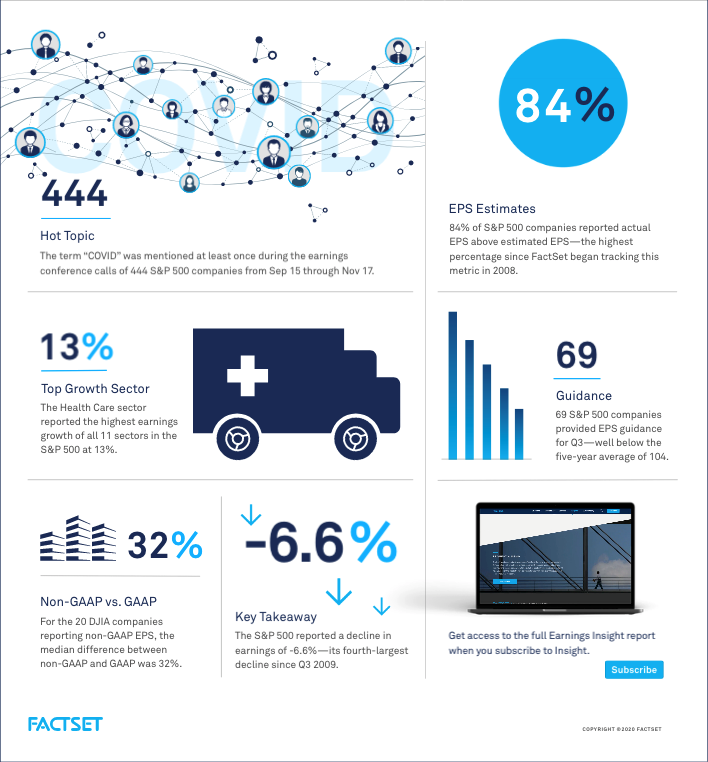

But let’s look at research company FactSet’s third-quarter earnings snapshot.

One of the most telling figures was that 84% of S&P 500 companies reported their actual earnings-per-share figures above Wall Street estimates.

That is the highest percentage since the company started tracking data in 2008.

At the same time, only 69 S&P 500 companies provided earnings guidance in the third quarter. That’s well below the five-year average of 104.

The drop can be attributed to continued uncertainty surrounding the coronavirus.

In fact, “COVID” was mentioned a total of 444 times during earnings conference calls with S&P 500 companies from September 15 through November 17.

Click here to view this infographic on FactSet’s website.

The sector with the highest earnings growth during the quarter was health care at 13%.

Overall, the S&P 500 reported a 6.6% decline in earnings during the third quarter. That’s the fourth-largest decline since the third quarter of 2009, according to FactSet.

On the IPO Front

There are no new initial public offerings (IPO) scheduled for this week.

Money & Markets Week Ahead: Data Dump

The National Federation of Independent Business (NFIB) will release its November Optimism Index on Tuesday.

The index provides a look at how small businesses view the U.S. economy as well as their individual prospects.

In October, the index notched its second-straight month at 104 — a historically high reading.

Small business owners indicated an uptrend in earnings but a decline in real sales expectations.

Analysts project November’s reading to be around 102 — not as high as October, but still an optimistic reading.

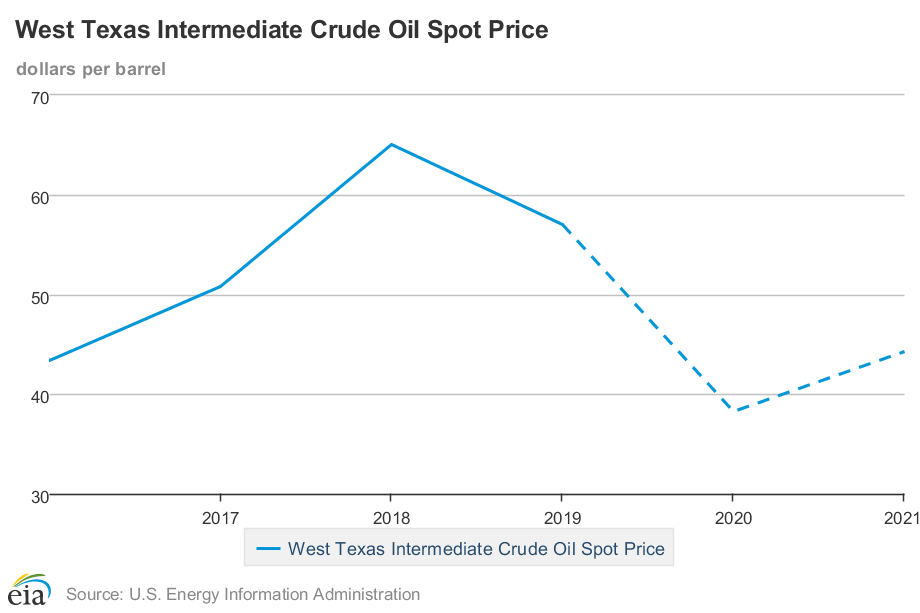

The U.S. Energy Information Administration will release its December Short-Term Energy Outlook on Tuesday.

The outlook in November painted an uncertain picture regarding supply and price due to COVID-19.

The EIA projected reductions in oil consumption along with an uptick in oil prices into 2021.

On Thursday, the Treasury Department will detail the balance of the federal budget for November.

Last month, analysts projected a budget deficit of $274.5 billion, but the deficit was actually $10 billion more at$284 billion.

The monthly federal budget has been in a deficit every month since September 2019.

The Bureau of Labor Statistics will also reveal November’s Consumer Price Index on Thursday.

This is the average change in the prices paid for consumer goods and services over time.

In October, the CPI for all consumer goods were unchanged from the previous month. Over the 12-month period, the CPI was up 1.2%.

Analysts project a slight change to the month-over-month figures and a 1.3% increase in the year-over-year numbers.

Earnings Reports

To finish off the Money & Markets Week Ahead, here’s a look at some of the key earnings reports due out next week:

Monday

Stitch Fix Inc. (Nasdaq: SFIX)

KLX Energy Services Holdings Inc. (Nasdaq: KLXE)

Tuesday

AutoZone Inc. (NYSE: AZO)

H&R Block Inc. (NYSE: HRB)

GameStop Corp. (NYSE: GME)

Wednesday

Adobe Inc. (Nasdaq: ADBE)

Campbell Soup Co. (NYSE: CPB)

Thursday

Costco Wholesale Corp. (Nasdaq: COST)

Lululemon Athletica Inc. (Nasdaq: LULU)

Ciena Corp. (NYSE: CIEN)

Friday

Construction Partners Inc. (Nasdaq: ROAD)

Value Line Inc. (Nasdaq: VALU)

That’s all for this week.

Until next time…

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.