Potential homebuyers are struggling to qualify for mortgages as interest rates rise.

The average rate on a 30-year mortgage was 5.55% last week, almost doubling over the past year.

When rates were 2.87% a year ago, buyers worried that home prices were too high.

Analysts warned that mortgage rates would increase, driving potential buyers from the market.

That would sink prices.

This sounded like good news for some buyers.

But it hasn’t worked out that way.

Home Prices Rise With Mortgage Rates

Prices are still rising.

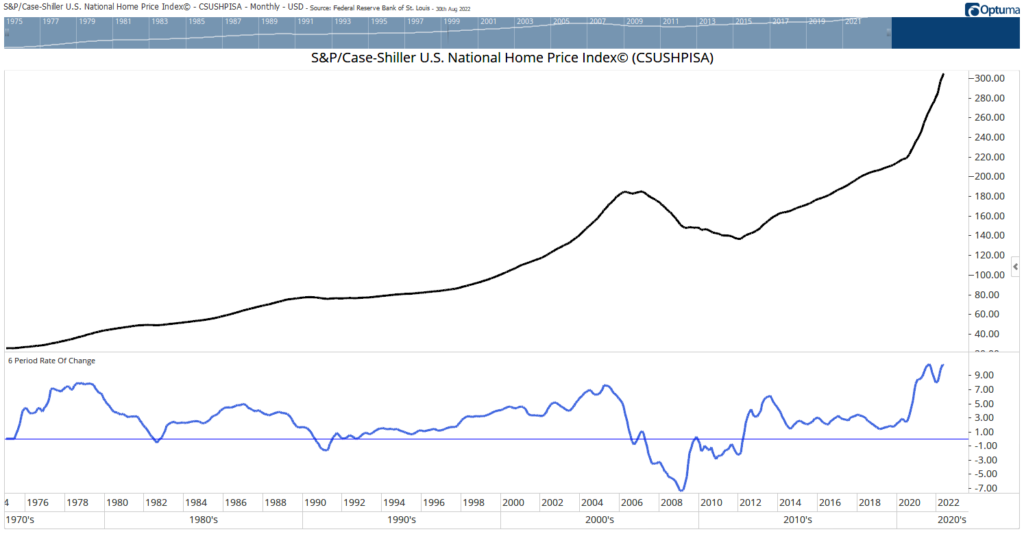

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported an 18.0% annual gain in June, down from 19.9% in the previous month.

Price increases do seem to be slowing.

The U.S. National Home Price Index posted a 0.6% month-over-month increase in June, the latest available data.

But price appreciation is still rapid.

The six-month rate of change in the index, shown at the bottom of the chart below, that metric is at an all-time high.

High Mortgage Rates Aren’t Hurting Home Prices

Higher mortgage rates have slowed the housing market.

But that is not what potential buyers were hoping for.

S&P noted in its data release: “It’s important to bear in mind that deceleration and decline are two entirely different things, and that prices are still rising at a robust clip.”

The report also provided hope for potential buyers: “As the macroeconomic environment continues to be challenging, home prices may well continue to decelerate.”

Don’t Expect Another Housing Market Crash

The crash of the housing market remains improbable.

Homeowners are in better financial shape than they were 15 years ago when the housing market crashed.

Lenders maintained tight standards throughout the recent boom, and nothing is forcing the subprime borrowers to sell.

Without distressed sellers, prices could hold steady.

Bottom line: Current owners may be reluctant to sell because buying a replacement home would be expensive.

This market leans toward holding steady, at high price levels, for some time.

Click here to join True Options Masters.