All price moves in the stock market are based on emotion. At the most basic level, nothing else matters. This contradicts what most analysts and investors believe.

They may think earnings or economic trends affect prices of stocks.

The truth is that it’s not the news that is important. It’s how investors feel about the news that creates price moves.

If earnings beat expectations and investors are optimistic, the stock price moves up as analysts increase estimates for next quarter. If investors are pessimistic, the stock price falls and analysts attribute the earnings beat to one-time factors.

This should make market analysis more difficult. But it makes analysis simpler in some ways. To determine if prices are likely to trend up or down, analyze emotions rather than news.

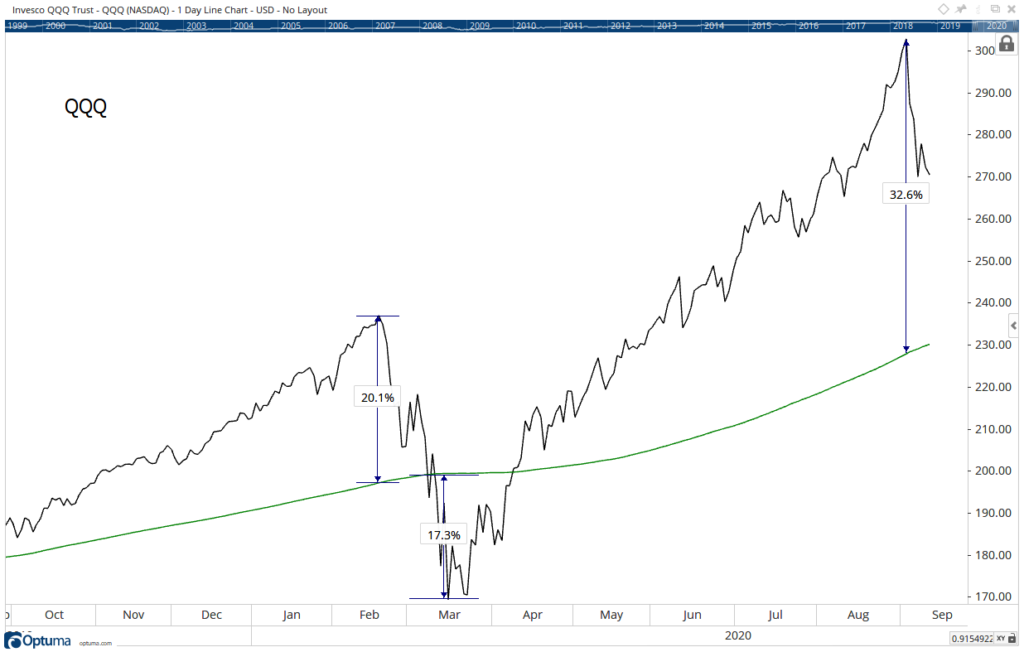

One tool to assess emotions is the distance prices move from the 200-day moving average (MA). This indicator shows the distance from the MA to the market price in percentage terms. High levels of excitement push prices far from the MA.

The chart of Invesco QQQ Trust (Nasdaq: QQQ) below, shows the distance at recent extremes.

Excitement Pushes Prices to Extremes

Source: Optuma

Watch This Moving Average Trend

In February, with prices more than 20% above the MA, traders were overly optimistic. Extremes in optimism tend to give way to extremes in pessimism. At the low, prices were more than 17% below the MA.

That pattern is typical. Often, there is a degree of symmetry in the market with large swings above the MA being followed by large swings below the MA. This makes the recent reading of 32% above the MA important.

Prices are likely to fall below the MA by an amount similar to the level they peaked at. When the bottom is in, QQQ may be more than 20% below the MA.

This is one of the riskiest market extremes in history. And the decline that lies ahead could be one of the worst in history.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.