Moving in retirement isn’t an easy decision to make, but broadening your horizons using cost of living may help you find a location that wasn’t on your radar.

A recent study by the Transamerica Center for Retirement Studies found that an impressive 65% of respondents cited affordability as the most important factor when relocating in retirement. The next closest answer was proximity to family and friends at 48%, while good weather rounded out the top three at 42%.

It makes a lot of sense when most retirees will end up relying on a fixed income of Social Security along with regular withdrawals from retirement accounts.

If you’re worried about cost of living on a fixed income, which the 2020 Simplywise Retirement Confidence Index showed 49% of Americans are, moving in retirement can make a lot of sense.

But what should you be looking for when deciding where to move after leaving the workforce? While it can be tough to parse out the cost of living in every city in America, there are some resources that can help you narrow your search down a bit.

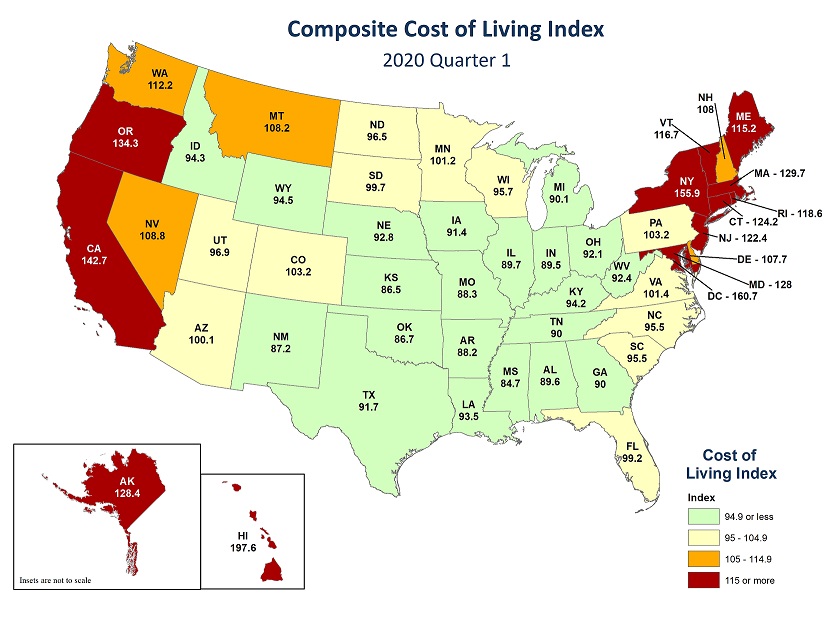

The Missouri Economic Research and Information Center has compiled a handy index ranking the average cost of living across all 52 U.S. states and territories using. Using 100 as a baseline, the index breaks down some of the cheapest states to relocate to based on common expenses like groceries, housing and transportation.

As you can see, the Northeast and West Coast are brutal when it comes to cost of living, with California and New York scoring higher than 140 on the index. Florida, a popular target for many retirees is on the higher side, but is still lower than 100 at 99.2.

Other states in the Southeast are much more appealing if low cost of living is a goal for you in retirement.

Factoring in cost of living can be a huge benefit when planning to move in retirement. In the most extreme example, older single renters living in Washington, D.C. pay an average of $11,000 more per year than those in Alabama, according to UMass Boston study.

If you wanted to generate $11,000 more per year out of a retirement fund while withdrawing 4% every year (a common withdrawal amount), you would need an extra $275,000 in your retirement account.

That’s no small feat, especially if you are close to retirement already.

Another cost to consider is taxes on Social Security. While many states do not tax the benefits program that currently supports over 63 million Americans, there are 13 states that still do.

These tax policies vary from state to state, but reading up on where your destination lands on the list can help you avoid a nasty surprise from the tax man. Here’s a handy guide to get you started.

If moving in retirement is a goal for you, make it a top priority in your post-work plan so you can lock in that lower cost of living as soon as possible. If you wait too long, you run the risk of paying more and having to drain more out of your nest egg than planned.

Broadening your criteria to include cost of living can reveal some lesser-known cities and states that maybe weren’t on your radar.

Moving in retirement is no small feat, and factoring in cost of living means you are setting yourself up for a better future.