It’s that time again!

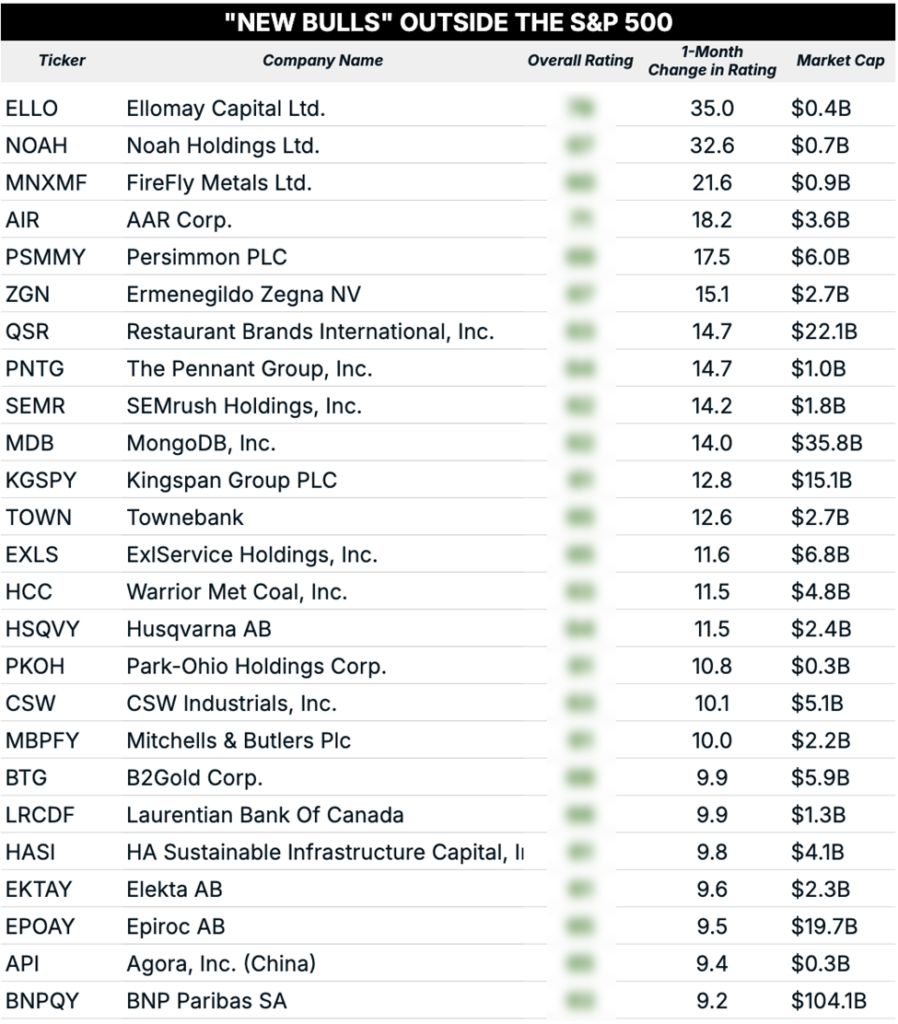

On Thursdays, I highlight stocks that have recently popped up on my Green Zone Power Ratings system as newly “Bullish,” meaning they just crossed the threshold of a rating of 60 or better.

This isn’t a “buy list.” I like to think of it as a fishing pond for new ideas and as a place to look for budding trends. I like to look for sectors that are overrepresented… or underrepresented.

So, what exactly is my system saying today?

Let’s take a look…

“Old Economy” Making a Comeback?

For today’s screen, I took the top 25 newly “Bullish” stocks and sorted by their one-week jump in rating.

Stocks can experience a large jump in their Green Zone rating for any number of reasons, but large moves often come with earnings releases that show significant sales and earnings growth or that show the stock getting significantly “cheaper” on its value factor.

Before we dig into the specifics, let’s make some general observations about the list.

To start, it’s a distinctly “old economy” grouping of stocks. Tech stocks are definitely underrepresented.

Data cruncher MongoDB (MDB) and AI-powered digital marketing firm SEMRush Holdings (SEMR) are notable exceptions.

MongoDB is sitting close to its 52-week highs and rates an exceptionally high 95 on its momentum factor. It also rates a stellar 92 on growth and a respectable 63 on quality.

It’s a volatile stock, so expect this one to be choppy, but it’s certainly got the wind in its sails for the moment.

SEMRush recently announced that it was being acquired by software giant Adobe (ADBE), which explains its recent jump in price. Adobe will be buying the company for $12 per share. So, we have a potential “merger arbitrage” opportunity to make a straightforward 11 cents per share, based on current prices and assuming the deal goes through as planned.

Moving on from tech, Italian fashion house Ermenegildo Zegna (ZGN) made the cut this week, with its rating jumping 15 points. Apart from its namesake Zegna brand, the company also owns the Tom Ford brand.

Zegna shares have been pushing higher for months, and the success of the company is typical of the consumer divide that has really widened over the past couple of years.

Wealthy consumers – the kind that can drop a couple thousand dollars on a flashy suit – have never had it better. However, middle-class and working-class consumers are really struggling. You can see this in the chronic underperformance of consumer staple stocks, something I’ve been tracking in What My System Said Today for the past several weeks.

I also want to highlight a familiar name, small-cap copper and gold miner FireFly Metals Ltd. (MNXMF)…

FireFly has popped on and off of our newly “Bullish” list over the past few months. I highlighted the company back in October, noting that “If investors are starting to pile into speculative miners plays like FireFly, there’s really only one reason: they believe that metals prices are going higher, and they’re looking for leveraged ways to play it.”

I’d reiterate those comments today. While stocks are generally higher to start the year, investors are still looking for ways to hedge what will likely be a chaotic year. As I wrote on Monday, with the U.S. involvement in Venezuela, we’ve already had a year’s worth of news in just the first week of 2026.

Gold is hovering near all-time highs, and for good reason. If we really are returning to a muscular military policy in Latin America and elsewhere, military spending will only rise. That’s a big deal when annual budget deficits are already pushing $2 trillion per year.

And then there is the uncertainty surrounding tariffs…

The Supreme Court may rule as early as tomorrow on the legality of President Trump’s tariffs. If they rule them unconstitutional, it’s unclear what exactly happens next. Does the government have to refund the billions in revenue already collected? At the very least, it would mean less revenue going forward, which would blow out the budget deficit further.

Having a little gold exposure is smart. It’s insurance against uncertainty and against instability in the dollar. And gold miners are an aggressive way to speculate on a continued rise in gold.

To good profits,

Adam O’Dell

Editor, What My System Says Today