Years ago, Dennis Gartman, the long-time financial newsletter writer with a rabid following on Wall Street, had a timeless quote. It’s one that every investor should jot down on a Post-it note and stick to their monitor:

“All news of value starts as an anecdote.”

You don’t just wake up one day and find yourself in a bear market or recession. There are always signs of something amiss… even if seemingly random and harmless at the time.

I thought of this when I read this little tidbit about AI darling Oracle (ORCL). The Financial Times reported this week that Oracle’s largest datacenter partner, Blue Owl Capital, had backed out of a planned $10 billion datacenter project.

Maybe Blue Owl simply wanted a better deal and decided to play hardball. Or maybe Oracle overplayed its hand and demanded pricing that Blue Owl just couldn’t accept. For all we know, Blue Owl’s CEO had a lousy round of golf that day and wasn’t in the mood to make a deal.

Or maybe…

Blue Owl took a look at the volume of data center projects coming online and got cold feet. Maybe they’re concerned that the AI profit model is still unproven… and that the boom in infrastructure spending is about to go bust.

There’s no way for us to get inside the minds of the Blue Owl folks. And it’s just one piece of news. But channeling Gartman’s quote, it could eventually prove to be the “anecdote” that catalyzes a snowball of critical thinking and concern over the capex binge that’s so far fueled what most people agree is “Stage 1” of a bigger AI mega trend.

So, what should we do with this information?

You know me. I don’t try to predict the future or make headline-grabbing market calls. I keep my ego in check, and I follow the data. I use my Green Zone Power Ratings system to objectively rate stocks based on measurable metrics related to their momentum, volatility, size, value, growth and quality. I ignore the noise and only invest in the best of the best.

As I wrote earlier this week, investors are still looking to take risks. They’re just a lot more hesitant to do it in tech stocks right now. There are better and far less risky opportunities elsewhere in this market.

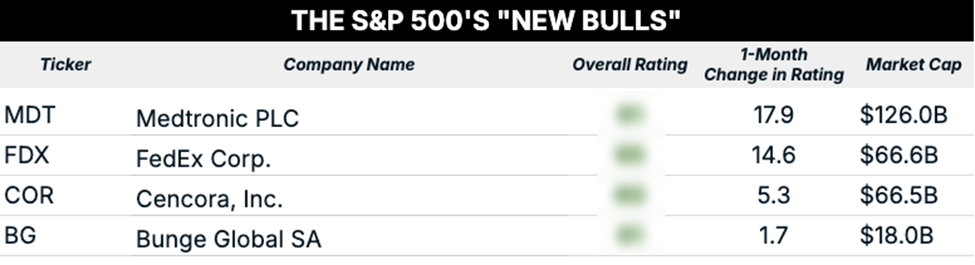

So with that in mind, let’s take a look at the S&P 500 stocks that are newly rated “Bullish” (rated 60 or higher) this week.

One thing you should notice immediately: There are no tech stocks on the list.

But, continuing a theme I’ve been covering for the past few weeks, we do see two healthcare stocks making the cut: medical device maker Medtronic (MDT) and pharmaceutical distributor Cencora (COR).

Newly Bullish Healthcare Stocks

Let’s cast the net a little wider and scan the list of newly “Bullish” stocks outside the S&P 500. I screened for the top 20 this week that had the greatest one-month change in rating.

Again, two things should jump off the page.

- There is a distinct lack of newly “Bullish” tech companies.

- There is no shortage of newly “Bullish” healthcare and biotech companies

Vanda Pharmaceuticals (VNDA), Avadel Pharmaceuticals (AVDL), Elekta AB (EKTAY), IDEAYA Biosciences (IDYA), and National Health Investors (NHI) are all in the business of delivering healthcare in one way or another.

Vanda has a diversified portfolio of treatments covering everything from sleep disorders to skin infections. Avadel’s main focus is the treatment of narcolepsy, or extreme daytime sleepiness. Elekta and IDEAYA are developing cutting-edge cancer treatments. And National Health Investors is a REIT operating a portfolio of retirement communities and nursing homes.

One common thread among these health stocks – along with the other 15 names on the New Bulls list – is a distinct lack of exposure to AI spending.

I’m bullish on healthcare in general and on biotech in particular.

While shares of the State Street SPDR S&P Biotech (XBI) followed the market to new highs in early 2021 and fell with it into the 2022 bear market … it was left there, “for dead,” for the next three years as the newly budding AI megatrend sucked all of the air out of the room.

This year, though, the biotech sector is on the move. Not only have shares of XBI made a clear bullish breakout of the bottoming pattern they formed from 2022 to 2025 … they’re up 34% year-to-date, which is more than every single major U.S. sector ETF, including the tech sector (XLK) … and a better return than six of the so-called “Mag 7” stocks, including Nvidia (NVDA).

I was asked at an investor meeting last week what impact AI would have on the health care sector specifically …

My answer was that AI’s beneficial impact on the sector will happen on a lag, largely for regulatory reasons and the simple fact that the first and second “innings” of a new mega trend is when the low-hanging fruits are plucked (and health care isn’t one of them).

However, I expect the most value will be found and leveraged in the health care space … eventually making chatbots and LLMs look like “child’s play” when they’re compared to the innovations we’ll see in the health care and biotech sectors.

Judging from this week’s crop of “New Bulls,” I’m not the only one anticipating tremendous opportunity in the marriage of AI and health care.

To good profits,

Adam O’Dell

Editor, What My System Says Today