Welcome to you Friday earnings edition of What My System Says Today!

We are on the brink of the Christmas season, and earnings reporting has slowed to a mere crawl.

Today, rather than focusing on “bullish” and “bearish” earnings for the next week (which is shortened due to Christmas), I want to look back at all of 2025 and analyze the earnings of the S&P 500.

First, I’ll look at earnings and revenue growth of companies in the benchmark, then I will break down each sector’s performance in 2025.

There’s a good bit to get into, so let’s get started…

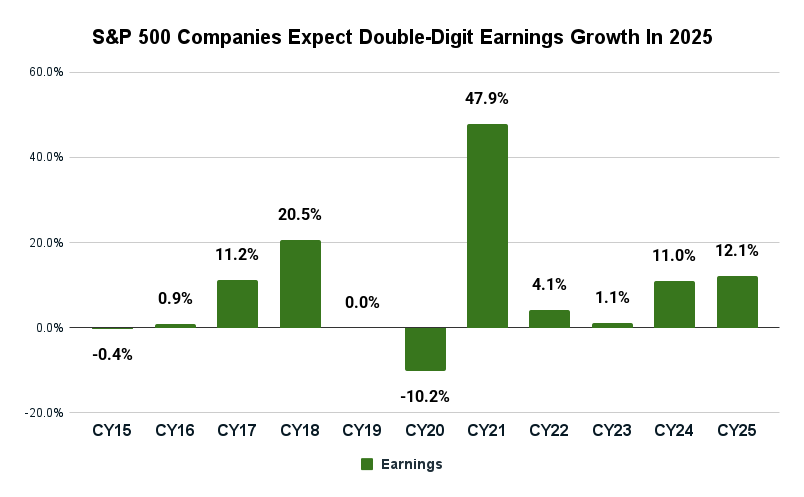

Double-Digit Earnings Growth In 2025

For the second consecutive year, the S&P 500 is on track to post double-digit earnings growth.

It comes on the heels of minute growth in 2022 and 2023.

At 12.1%, 2025 will mark the third-highest percentage of earnings growth for the benchmark since 2015.

I would argue it is the second-highest as 2021’s 48% growth came following the COVID-19 market crash in 2020, leaving expectations for 2021 to be somewhat low.

If it holds, 12.1% is above the 10-year average annual earnings growth rate of 8.6%.

According to data firm FactSet, three of the top five contributors to earnings growth in 2025 are “Magnificent 7” companies Nvidia Corp. (NVDA), Alphabet Inc. (GOOGL) and Amazon.com Inc. (AMZN).

Overall, the “Magnificent 7” companies reported an earnings growth rate of 22%, while the remaining 493 companies in the benchmark had only 9% growth for the year.

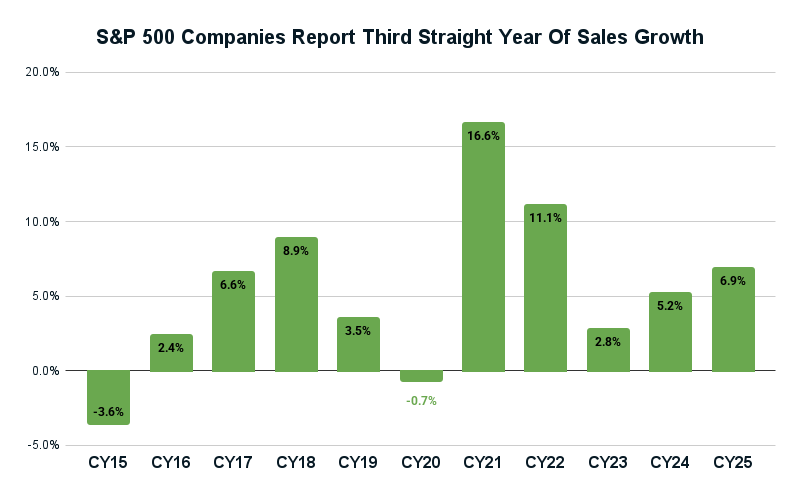

In terms of revenue, it was also a good year for the S&P 500:

For the third straight year, companies in the benchmark notched revenue growth.

In 2025, year-over-year revenue growth was 6.9% — the third-highest growth rate since 2015. That is above the 10-year trailing average of 5.3%.

It’s also important to note that the net profit margin for the S&P 500 reached a 10-year record at 12.9%.

Now, let’s break down earnings and sales by sector…

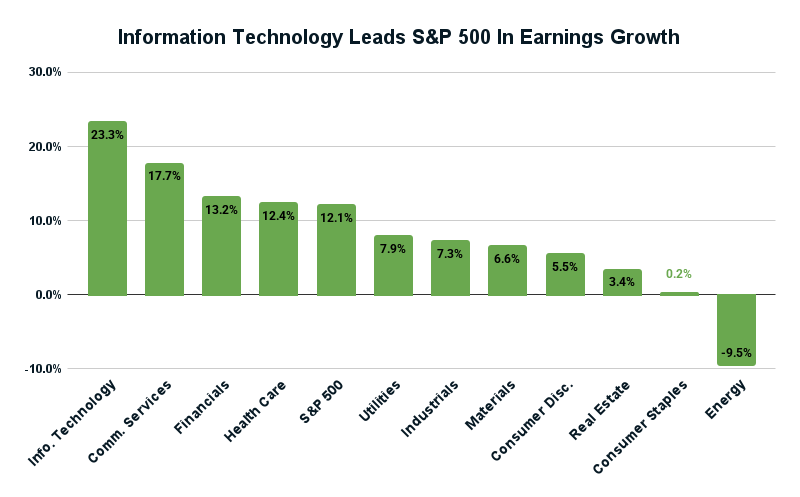

Information Technology Leads The Way On Earnings

At the sector level, 10 of the 11 sectors of the S&P 500 are expected to report year-over-year earnings growth in 2025.

Four of those 10 will report double-digit year-over-year earnings growth:

Information technology leads the sector growth at 23.3%, followed by communication services (17.7%), financials (13.2%) and health care (12.4%). All four came in above the S&P 500 average of 12.1%.

Only the energy sector (-9.5%) posted a year-over-year decline in earnings in 2025.

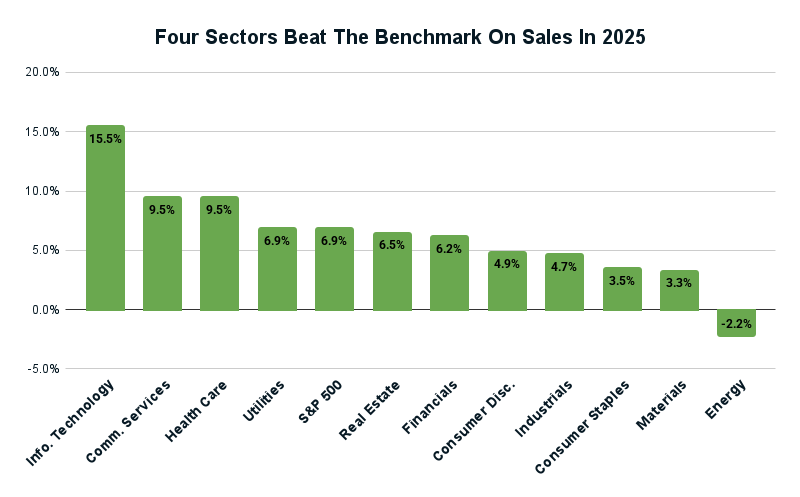

It’s a similar story when we look at sales for the year:

As with earnings, the information technology sector led year-over-year sales growth with 15.5%, followed by communication services (9.5%), health care (9.5%) and utilities (6.9%).

Interestingly, only information technology reported a double-digit rise in sales for the year, while the energy sector notched the only year-over-year decline (-2.2%).

When you break down earnings, sales and net profit margin, 2025 was a good run for companies in the S&P 500.

They have certainly set a high bar going into 2026.

That’s all for me today. I hope you all have a great weekend.

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets