Gold futures pushed higher early this week, and analysts say now is the time to buy gold as selling has subsided.

The Federal Reserve recently said it is increasing its asset purchase program “in the amounts needed to support smooth market functioning and effective transmission of monetary policy to broader financial conditions and the economy.” The latest quantitative easing program has presented a potentially profitable situation for precious metals investors.

That pushed gold prices up 4% on Monday, prompting analysts at Goldman Sacks Group Inc. (NYSE: GS) to tell their clients that now was a good time to buy gold. Futures tacked on another 4% in gains Tuesday as a result.

“We have long argued that gold is the currency of last resort, acting as a hedge against currency debasement when policymakers act to accommodate shocks such as the one being experienced now,” Jeffrey Currie, head of commodities at Goldman Sachs said.

Banyan Hill Publishing’s Matt Badiali thinks because gold is a reliable store of value and market gyrations suggest the climb in prices will continue, an environment is there to invest in gold.

Why Is Now a Good Time to Buy Gold?

Just like the market, gold prices can fluctuate for any given reason.

If equity prices go down, investors rush to safe havens like gold and bonds to pare back potential losses. The opposite is also true. When equities are up, economic confidence is high and there is less investment in gold.

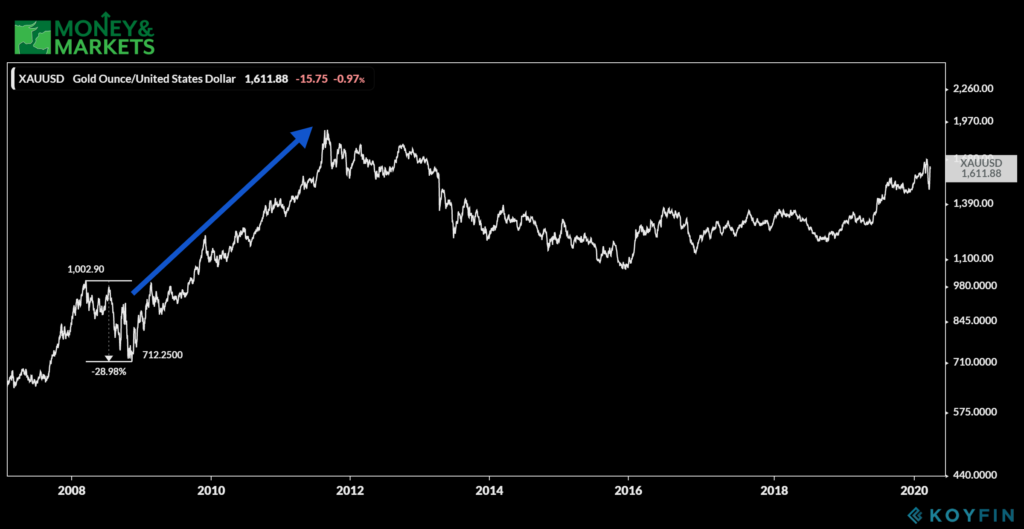

Gold is known to fall abruptly — like in 2008 when prices fell 30% — and take a little more time to bounce back. The rebound from the 2008 fall reached nearly $1,970 an ounce in 2011.

It happened again in 2016 when gold fell below $1,100 an ounce, rebounding a few years later.

The Fed’s new QE policy announcements over the last two weeks will start pushing gold higher.

“That’s all the more reason we need to buy gold now,” Badiali, a geologist who has traveled the world studying and visiting precious metal mines, said. “Since 2000, the price of gold is up over 500%. It’s trading around $1,600 per ounce at last glance. That’s still 23% below its 2011 high.”

He added he would not be surprised to see gold reach $2,500 per ounce by 2022.

How You Should Buy the Yellow Metal

The good news is there are many different ways to invest outside of just buying up gold bars.

Another way to buy into gold is to find specific companies that own gold mines and produce the metal. You can see our three gold stocks to buy now here.

There is also a wide range of exchange-traded funds and trust funds — which is a little more liquid than owning physical gold.

Badiali recommended maintaining the precious yellow metal in your portfolio all the time. But, if nothing else, investing in it provides a solid insurance policy against a potential recession.

“The fact is, this crash will likely end in a recession,” Badiali said. “All the money pumped into the system could cause inflation. Gold will act as an insurance policy. It will soar in value, which will give us something to feel good about.”