Everything is bigger in Texas.

That’s debatable, but one thing is for sure: The amount of electricity the Lone Star State produces is massive.

According to the U.S. Energy Information Administration, the U.S. produced 4 billion megawatt-hours (MWh) of electricity in 2020.

Of that, Texas generated 474 million MWh, or 12%.

It generates so much power that it has its own utility grid, operated by the Electric Reliability Council of Texas (ERCOT).

The chart above shows the electricity Texas generated in recent years.

You can see that amount increased 5% in 2018. This is due to increased demand, not just in Texas but across the country.

This matters because ERCOT manages the grid in Texas and sells excess power to other grids across the U.S.

It’s not just Texans depending on reliable electric generation. It’s the whole country.

One of the biggest electricity producers in Texas is the Power Stock I’m revealing today: NRG Energy Inc. (NYSE: NRG).

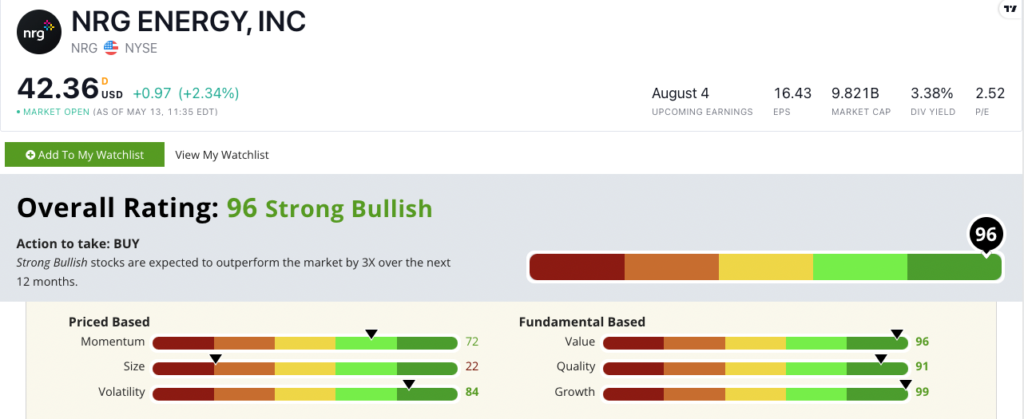

NRG Stock Power Ratings in May 2022.

NRG is a power company that delivers electricity to 6 million Texans.

It generates power using natural gas, coal, oil, nuclear and renewable battery storage.

The stock scores a “Strong Bullish” 96 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

NRG Stock: Massive Growth Potential, Strong Value & Quality

Here are a couple of items of note I found researching the company:

- In 2021, NRG reported an operating income of $3.3 billion … 200% more than the $1.1 billion it reported in 2020.

- The financials look even stronger after the first quarter of 2022. The company reported a net income of $1.7 billion for the quarter ending on March 31, compared to a loss of $82 million in the same quarter a year ago.

Few companies in any sector have experienced the growth that NRG has in the last 12 months.

The company grew its earnings per share by 330.5% from 2020 to 2021, and its annual sales growth rate is 200%!

That earns NRG a rating of 99 on our growth metric — putting it in the top 1% of all stocks!

NRG comes at an excellent value, with a low price-to-earnings ratio of 2.52. Compared to the electric utility industry average of 22.91, NRG is one heck of a bargain in the energy sector!

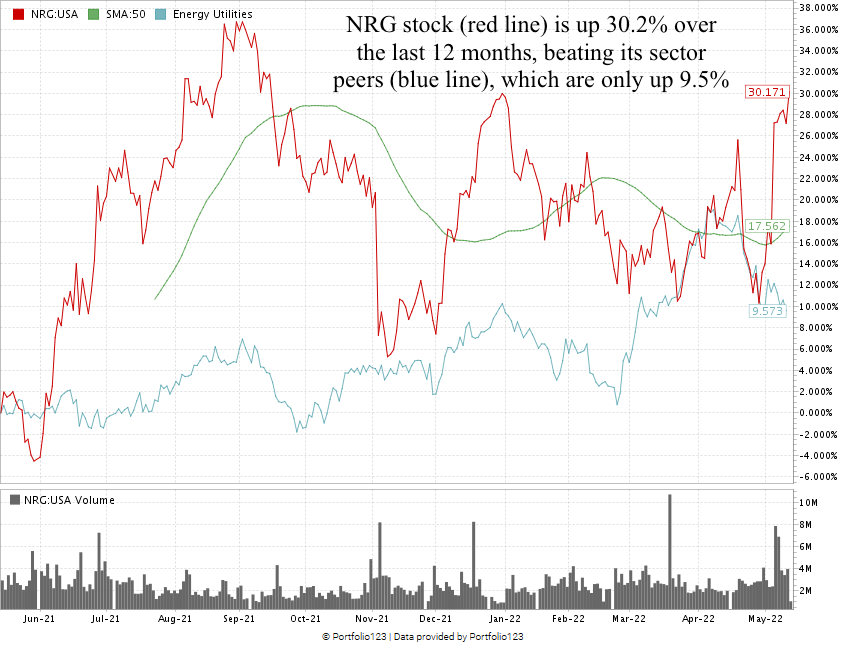

NRG stock experienced peaks as well as valleys in the last year, but it remains up 30.2% from a year ago.

The stock has weathered much of the recent market sell-off, and its stock performance beats its energy utility peers by about three times.

NRG scores a 96 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Bonus: The company’s forward dividend yield is 3.38%. So it will pay us $1.40 per share, per year to hold the stock. That dividend grew 8.3% in the last year!

Stay Tuned: Power Stock Helps Pharma Startups Fund R&D

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify.

Stay tuned for the next issue, where I’ll share all the details on a top-rated corporation that helps biopharma companies secure the capital they need to develop life-saving drugs and devices!

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Got a question or comment for my team and me? We'd love to hear from you! Reach out to Feedback@MoneyandMarkets.com.