Research and development, or R&D, is the lifeblood of the biopharmaceutical industry.

According to the Congressional Budget Office, biopharma companies spend 25% or more of their revenues on R&D of new drugs and products to help save lives.

Only the semiconductor industry spends more than biopharma on R&D.

The chart above shows how much pharmaceutical companies spend on R&D.

Analysts expect spending to hit $254 billion by 2026 — an 85% increase from 2012.

But startup biopharma companies face a problem: Most don’t have the revenue to reinvest in R&D. That leaves them to look for new capital to fund development.

I’m pleased to reveal today’s Power Stock: SWK Holdings Corp. (Nasdaq: SWKH), which helps growing biopharma startups.

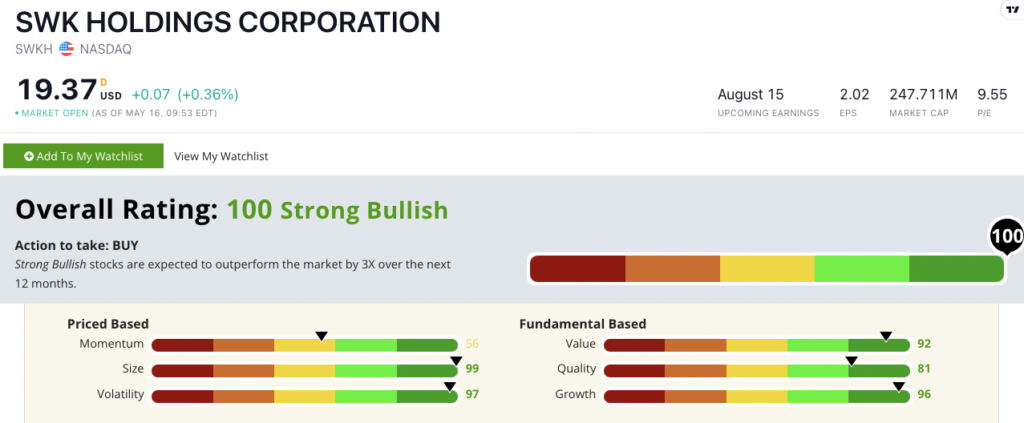

SWKH Stock Power Ratings in May 2022.

SWKH helps biopharma companies raise the capital they need to develop life-saving drugs and devices.

It helps secure lines of credit, get royalties for new drugs and assist with company acquisitions.

It doesn’t get much better than SWKH’s Stock Power Rating: a “Strong Bullish” 100 out of 100. We expect it to beat the broader market by 3X in the next 12 months.

SWKH Stock: Outstanding Fundamentals + Low Volatility

After a deep dive into SWKH, here’s what stood out to me:

- The company grew its assets from $273.9 million in 2020 to $282.7 million in 2021.

- At the same time, SWKH reduced its total liabilities 54% from $33.4 million in 2020 to just $15.4 million in 2021. That tells us the company increased profits!

SWKH’s fundamentals are about as sound as they come — value and growth, in particular.

From 2020 to 2021, SWKH grew its earnings per share by 400% and its sales by 52.4%, earning it a 96 on our growth metric.

The stock trades at a reasonable price-to-earnings ratio of 9.5 — a fraction of its investment services peers, which average 34.

SWKH’s price-to-book value is 0.93, while its cousins average 1.35.

That gives SWKH a rating of 92 on our value metric. This stock is cheap, folks!

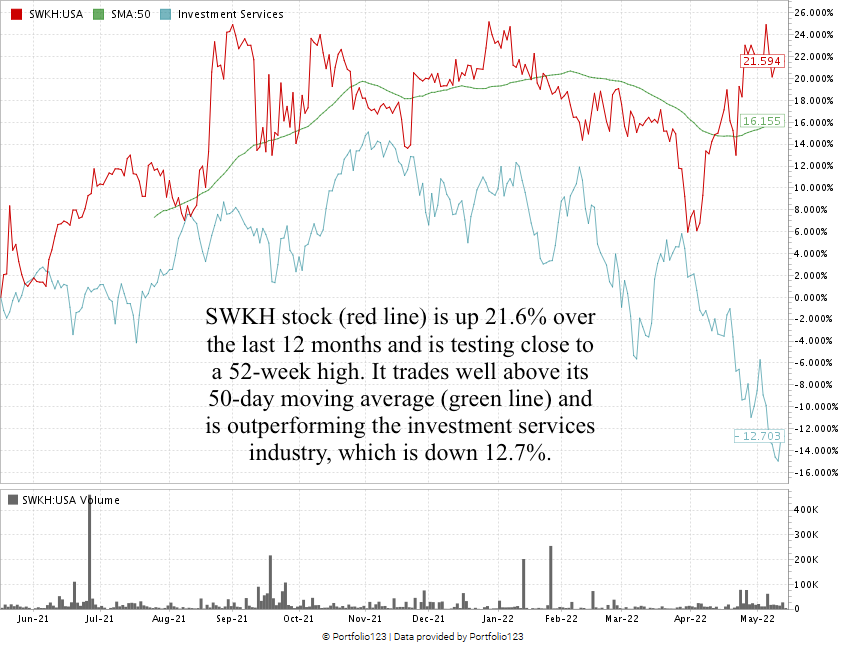

Over the last 12 months, SWKH stock has tested new highs.

As you can see in the chart above, it recovered from a dip in April and is 21.6% higher than it was a year ago. It’s crushing the investment services sector, which is down 12.7%.

The stock is trading above its 50-day moving average.

SWK Holdings Corp. stock scores a perfect 100 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

New biopharma companies will always need extra capital, especially in the development phase of drug trials. They rely on SWKH and similar companies for their financial needs.

Stay Tuned: High Value, Solid Quality Mining Power Stock

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify.

Stay tuned for the next issue, where I’ll share all the details on an excellent company that mines something unusual!

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Got a comment to share with my team and me? You can reach us anytime at Feedback@MoneyandMarkets.com!