In commercial building, the letters “LEED” make an office building, school or retail building stand out in a crowd.

It stands for Leadership in Energy and Environmental Design. The designation on a building means it is eco-friendly (i.e., less carbon emissions, electricity efficiency and built with sustainable materials).

The market for more efficient buildings has grown in a hurry:

In 2011, the revenue for companies that design, consult on or build efficient buildings was just $35 billion.

As of 2020, that revenue almost tripled to $94 billion.

According to the U.S. Green Building Council, the U.S. has 6.3 billion gross square feet of LEED-certified buildings.

It’s clear that companies are investing in more green technology and infrastructure for their buildings. I have high conviction that this trend will yield massive profits.

Today’s Power Stock is NV5 Global Inc. (Nasdaq: NVEE).

NV5 Global is an engineering and consulting firm that works with companies on infrastructure, utilities, construction, real estate and environmental building.

The bread and butter of NVEE is its work to help its clients reduce their environmental footprints by designing energy-efficient systems for new and old buildings.

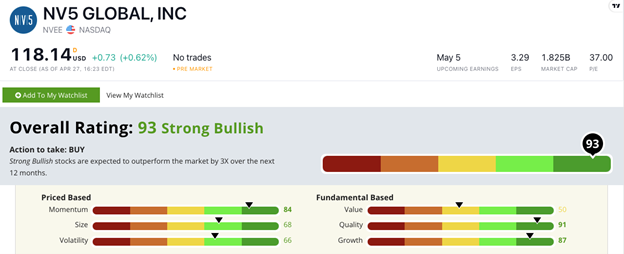

NV5 Global stock scores a “Strong Bullish” 93 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

NVEE Stock: Solid Quality, Growth and Momentum

Researching NVEE, two items came to my attention:

- In 2021, NVEE acquired Sage Renewable Energy Consulting. This expands NV5’s clean energy consulting capabilities.

- Last year, the company increased its gross revenues to $706.7 million — more than doubling its gross revenue in just five years.

NVEE rates in the top 9% of stocks in our universe on quality — scoring a 91 on the metric!

The company’s gross margin of 53% dwarfs its facilities and construction services peers, which average only 19%.

Its returns on assets, equity and investment are positive, whereas the sector averages are flat or negative.

NVEE is a robust growth stock with a one-year annual earnings-per-share growth rate of 94.5%.

The company grew its quarter-over-quarter sales by 17%.

NVEE scores an 87 on our growth metric.

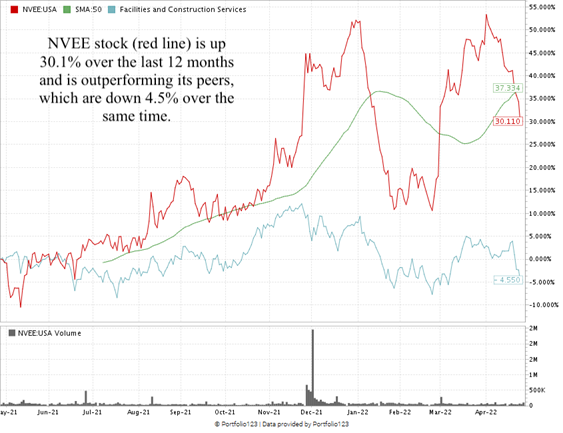

Since December 2021, NVEE has hit a 52-week high twice, as you can see in the chart above.

Despite market headwinds, the stock remains up 30.1% from where it was a year ago. Plus, NVEE crushes its facilities and construction services peers … which are down 4.5% in the last 12 months.

NV5 Global stock scores a 93 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

NVEE rates in the green on all but one of the metrics we use on our Stock Power Ratings system. It has strong growth potential and continues to rake in cash … which makes shareholders happy.

Stay Tuned: Take Advantage of the Steel Boom

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on one steel company involved in producing the materials used in construction.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets