I hope you didn’t get suckered into buying oil last week.

After sharing why I think gold is a better bet than oil, shares of the SPDR Gold Trust (NYSE: GLD) gained 4% on the week, while oil ETFs fell between 6% (NYSEARCA: BNO) and 16% (NYSEARCA: USO).

But that’s just one week’s action. And I want you to know that opportunity in gold is far bigger, and will last for far longer, than most folks realize.

I wrote two recommendations on the SPDR Gold Trust during the first week of March, before I officially joined Money & Markets as Chief Investment Strategist.

I presented it as a great diversifier for any stock-heavy portfolio, since there’s historically been little correlation between the two asset classes. And any time you combine two non-correlated assets, your overall portfolio benefits from the increase in diversification.

That recommendation has paid off nicely for the past month. Shares of GLD have gained more than 6%, while the S&P 500 has lost nearly 14%.

And one of the gold-mining stocks I have for my Cycle 9 Alert readers is up more than 11% — a move that allowed us to lock in a 116% profit on our bullish call options.

But there are a couple of other reasons why I think gold is a particularly good investment right now — factors I began sharing as far back as last October, when I spoke at an investment conference and offered five ways to hedge a long-stock portfolio (GLD was one of them).

The first is the simple fact that gold tends to peak some six to 18 months after a major peak in the stock market.

Realize, I was preaching this in October 2019, well before stocks peaked on Feb. 19, when the S&P 500 and Nasdaq both reached all-time record highs.

And whether or not you believe that peak in stock prices will be easily and quickly recovered, gold prices have remained remarkably strong as stocks tumbled 30% or more from late-February … just as I said they would when a significant peak in stocks eventually developed.

The second reason is based on the fact stocks — particularly the S&P 500 — have had a great run over the past several years, while gold on the other hand has struggled mightily.

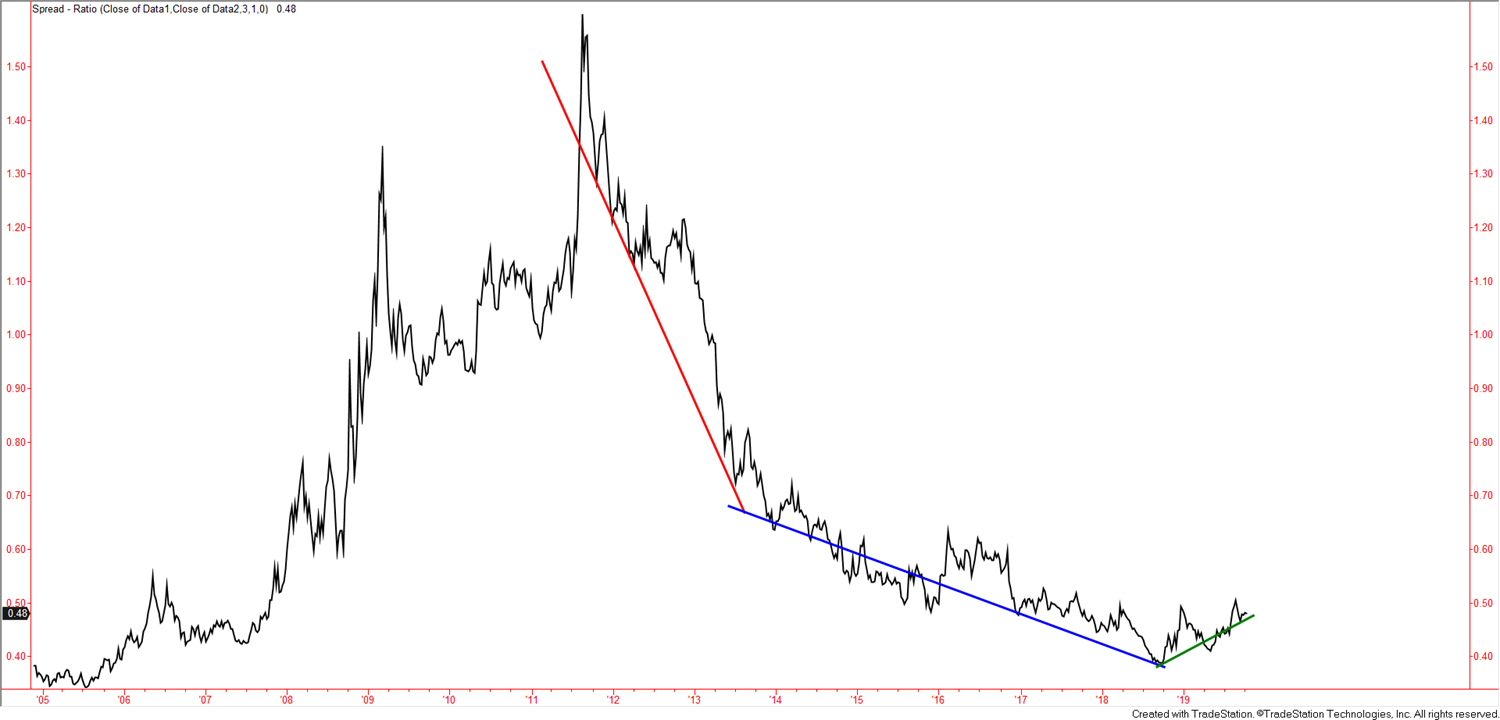

The best way to show this is with a chart that compares the two markets. This is the chart I presented during that October 2019 investment conference, showing the price of gold (GLD) divided by the price of the S&P 500 (SPY) over time …

Notice how I drew three lines, highlighting how the underperformance of gold was steep (red line) between 2011 and 2013, less steep (blue line) between 2013 and 2018 … and how this relationship began to turn (green line), in favor of gold, from late 2018 into late 2019.

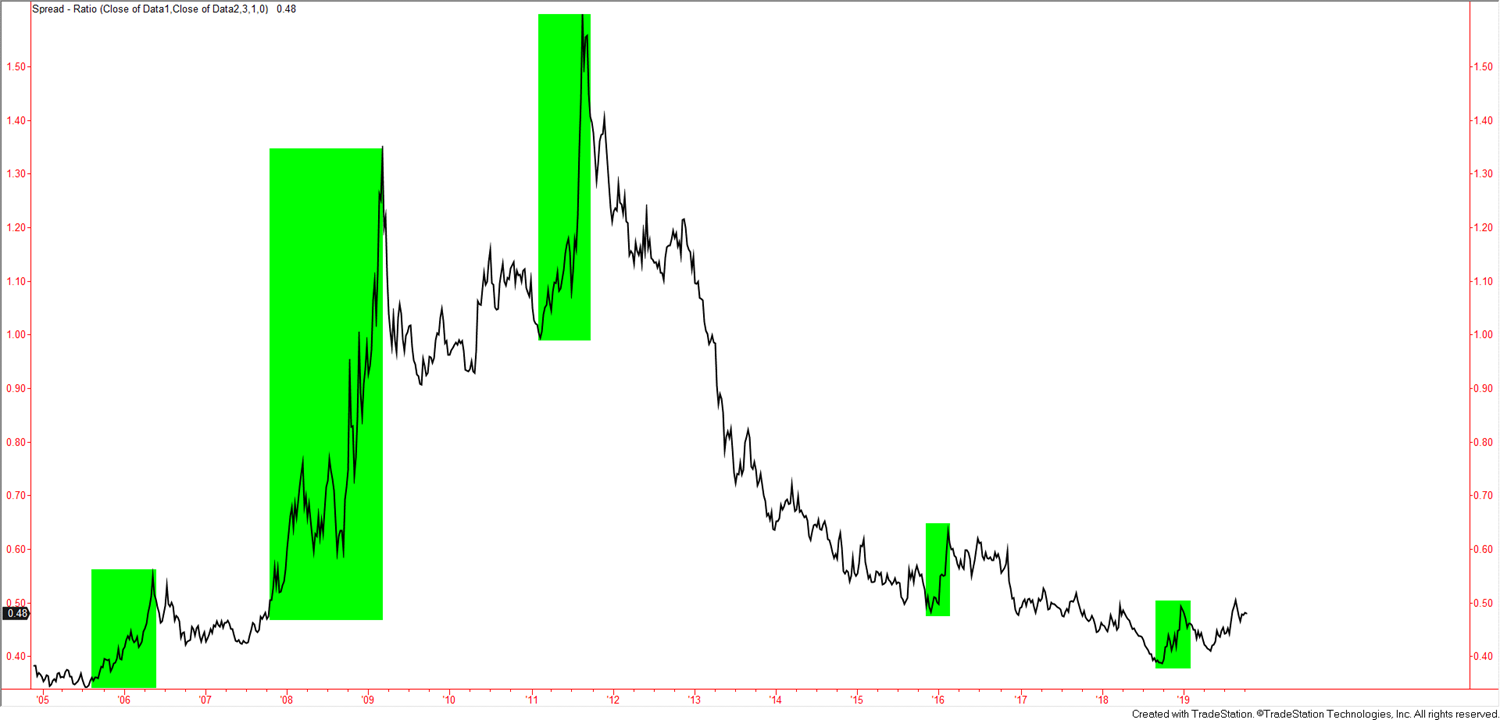

I also showed the same chart with highlighted time periods indicating spikes in the gold-to-stocks ratio. As of October 2019, the chart looked like this:

From left to right, the green highlights show gold’s outperformance of stocks during the 2006 property bubble, the 2008 Great Financial Crisis, the summer 2011 downgrade of U.S. debt, the “worst January ever” of 2016 and the awful fourth quarter of 2018.

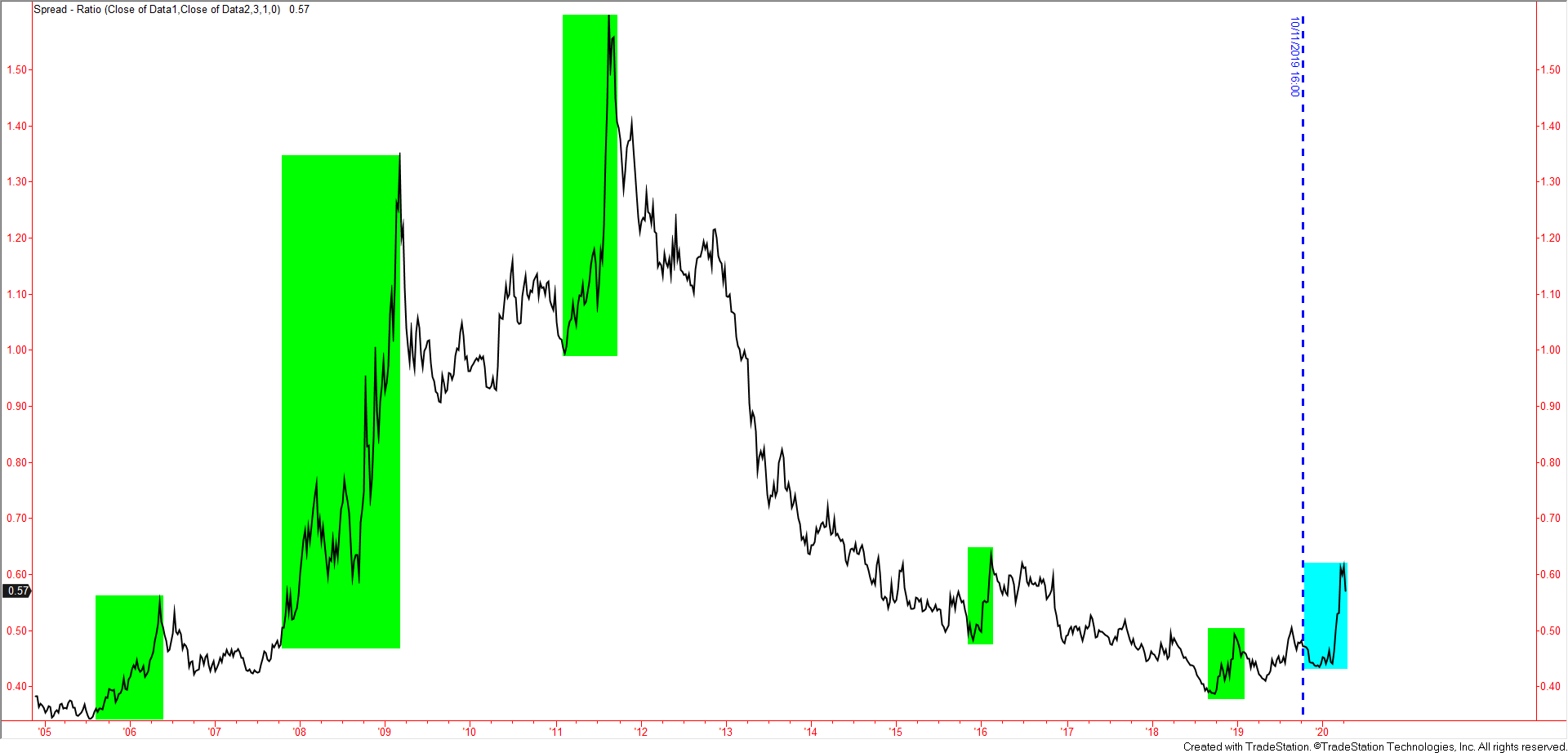

Of course, now that we’re living through what may be called the Great COVID-19 Crisis of 2020… we can update this chart:

Sure enough, the gold-to-stocks ratio has spiked higher throughout the crisis (blue highlight)!

Gold Shines, and It’s Just Getting Started

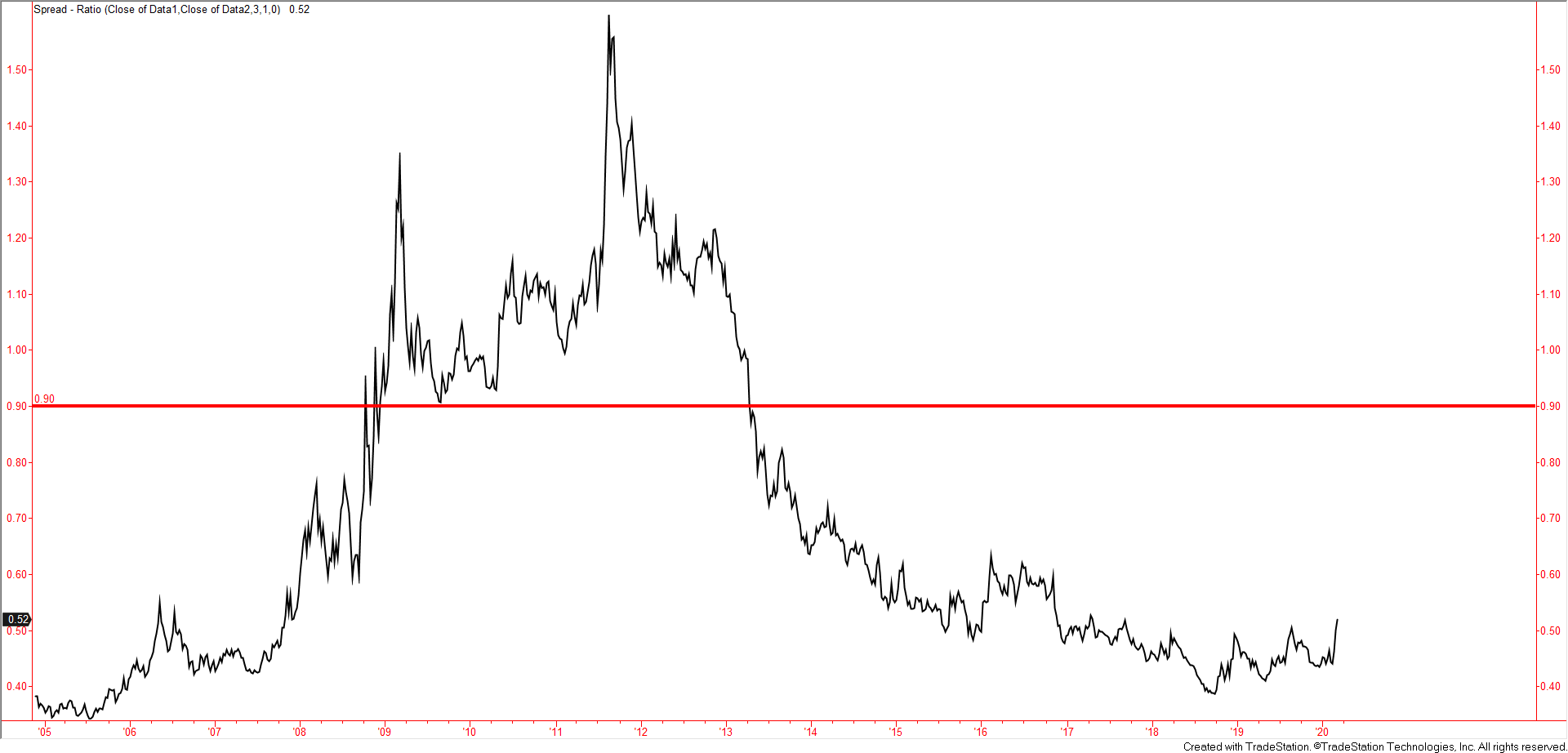

And I think gold’s run is just getting started. You can see how the ratio could still climb significantly ahead on its way to the metric’s longer-term average.

I think it’s reasonable to expect this ratio to mean-revert higher, to roughly 0.9… where the horizontal red line is drawn below:

Of course, there’s also the “gold bug” argument: that central banks are destroying the value of fiat currency through reckless monetary policy, and so gold, thanks to its scarcity and resistance to government manipulation, is the only true store of value.

I’m not exactly a gold bug, myself, but I certainly understand and respect the thesis.

And to be frank, the fact that the Fed made an emergency move to lower interest rates by half a percent (essentially two cuts), outside of its normal policy meetings, and after just a 10% decline in stocks from all time highs… after folks have already been wondering for years now if/when the Fed would “run out of bullets”… and then, last week, they piled on another $2.3 trillion of liquidity!

Well, that’s certainly raised my eyebrows and will no doubt get gold bugs all around the world pretty worked up!

All told, I still think the SPDR Gold Trust is a great way to gain direct, diversifying exposure to the upcoming gold rally.

And if you’re looking for a little more action, I’m homing in on a number of gold stock plays in my Cycle 9 Alert service. As I mentioned, we locked in a 116% gain on one gold stock last Thursday… but I think this trend is just getting underway, so I expect to jump on many more opportunities in the space.

To good profits,

Adam O’Dell

• Adam O’Dell is the Chief Investment Strategist for Money & Markets and editor of Green Zone Stocks, Cycle 9 Alert and 10X Profits.