Looking for small-cap companies that could be diamonds in the rough can be challenging, but it’s also important to step away from the big-name companies and look toward a few small-cap stocks to buy in 2020.

Small-cap companies are those with a market capitalization of $2 billion or less.

By nature, small-cap stocks are fairly volatile and their returns have generally underperformed that of the U.S. market in general, which is important to note.

That is the one thing investors need to keep in mind before investing in small-cap stocks. They are prone to large moves that surpass those of the broader market.

To find small-cap stocks that can earn a profit, investors have to drill down and find companies that have a low 60-month beta — meaning their volatility is low compared to that of the S&P 500.

Investors also have to find companies that have turned in high earnings-per-share growth.

For the purpose of finding those stocks, we looked at companies with 60-month betas below 1 with at least 100% earnings-per-share growth.

That gave us a list of three small-cap stocks to buy in 2020.

3 Small-Cap Stocks to Buy in 2020

1. Investors Title Co.

Market Capitalization: $245 million

EPS Growth over Previous Year: 8,471%

60-month Beta: 0.76

Annual Dividend Yield: 1.35%

Insurance is big business. One company that has stayed under the radar — but provided huge growth potential — is Investors Title Co. (Nasdaq: ITIC).

This company specializes in writing title insurance for real estate. When someone buys real estate, most often, they will buy title insurance.

Investors Title is relatively small with a market cap of $245 million, but its growth has been massive. Its earnings-per-share growth from 2018 to 2019 was more than 8,400%.

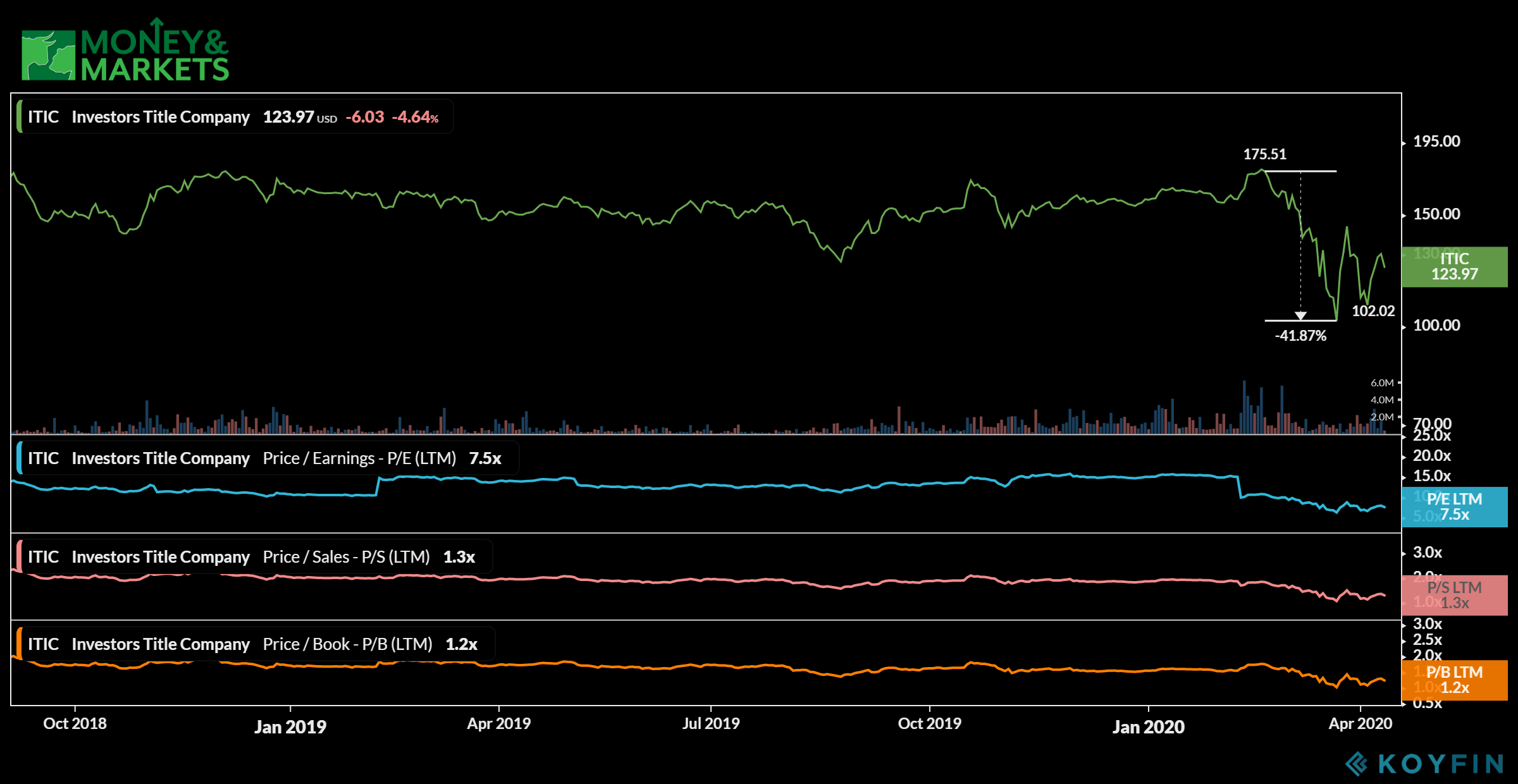

It reached its 52-week high of $175 per share in late February but retreated along with the rest of the market. The sell-off in equities cut more than 41% off its share price in short order.

However, the market rally in April brought that share price back to up around $123 per share — still leaving it plenty of room to reach its high again.

And, as you can see from the chart, its stock price has been fairly stable. It comes with a 60-month beta of 0.76 — making it even more stable than the S&P 500.

The company remains a solid value with a price-to-earnings ratio of 7.5, a price to sales of 1.3 and a price to book of 1.2.

On top of that, Investors Title offers shareholders an annual dividend yield of 1.35%. Its most recent dividend in March 2020 was $0.44 per share.

But the EPS growth is hard to look past, making Investors Title Co. one of three small-cap stocks to buy in 2020.

2. Nautilus Group

Market Capitalization: $111 million

EPS Growth over Previous Year: 140%

60-month Beta: 0.84

Annual Dividend Yield: 0.00%

As millions of Americans find themselves unable to go to the gym because of the coronavirus outbreak, they have to find ways to stay healthy and exercise at home.

Here is where Nautilus Group (NYSE: NLS) comes into the picture.

The company builds and sells cardio and strength equipment for home use. Its products include Bowflex and Schwinn bicycles. The company has a market cap of $111 million.

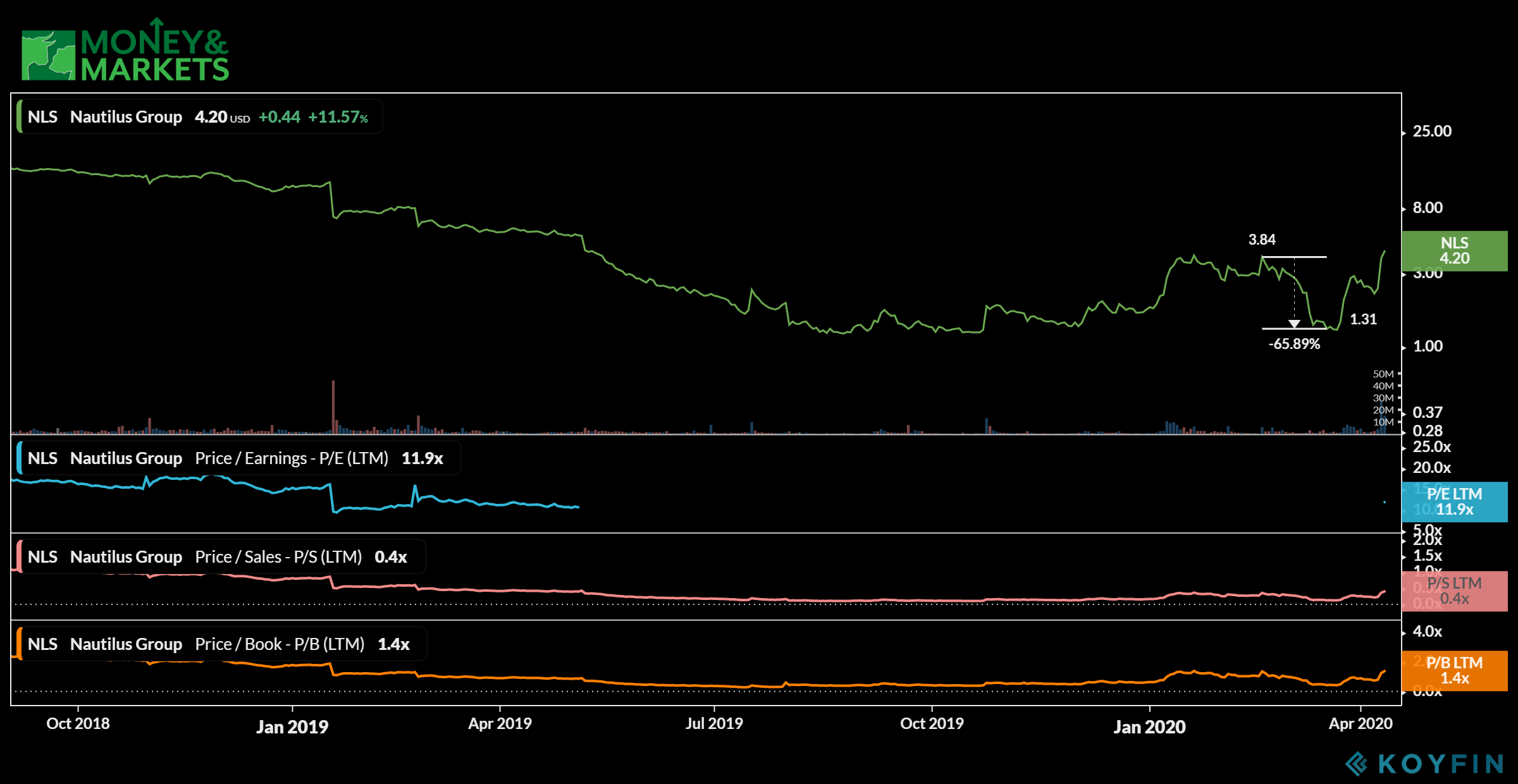

The company’s shares have trended downward in 2019 after surging to more than $15 per share in 2018. However, despite the market downturn of late, the stock has started to grow at a rapid pace. It’s now actually reached its highest price of 2020 and continues to grow.

Its stock price did suffer a 66% drop in late February but has rebounded nicely.

From 2018 to 2019 the company had a 140% growth in earnings per share and remains one of the less volatile small-cap stocks on the market with a 60-month beta of just 0.84.

Another strong factor for Nautilus Group is that it’s extremely cheap right now — trading at a little more than $4 per share. That means it is far below that $15 high, but as it continues to climb it could spell nice profits for investors.

It still holds a solid value with a price-to-earnings ratio of 11.9, price to sales of 0.4 and price to book of 1.4.

One other thing to note about Nautilus Group is that it does not pay a dividend to shareholders.

But the strong earnings growth despite its stock price falling makes Nautilus Group one of three small-cap stocks to buy in 2020.

3. Niu Technologies ADR

Market Capitalization: $519 million

EPS Growth over Previous Year: 257%

60-month Beta: 0.75

Annual Dividend Yield: 0.00%

People may not be driving their cars as much and the auto and oil industries are taking a hit with sluggish sales thanks to the coronavirus.

However, the mobility market is one that Niu Technologies ADR (Nasdaq: NIU) sees huge growth in. Especially since the company is developing smart e-scooters that can capitalize on 5G technology.

The Chinese-based company has a market cap of $519 million and it had annual sales in 2019 of nearly $300 million.

Comparatively speaking, Niu Technologies suffered a decline in its share price in February and March similar to that of the S&P 500.

Its stock dropped by about 38%.

The company has started to bounce back. It remains extremely cheap — trading at just under $7 per share.

From 2018 to 2019, it had an earnings-per-share jump of 257% and it remains less volatile than the overall market — a 60-month beta of 0.75.

Now, the Chinese market is starting to get back on its feet after the coronavirus outbreak. That means manufacturing is getting back to normal and demand will start to pick back up.

And with its adaptation to 5G technology, you can expect its e-scooters to be in demand.

Its strong return, cheap share price and low volatility makes Niu Technologies ADR one of three small-cap stocks to buy in 2020.

Just remember — and we can’t stress this enough — small-cap stocks are volatile, no matter what sector their business is in.

We have identified some of the least volatile stocks out there that have seen massive growth and offer potential profits for shareholders.

That makes these three small-cap stocks to buy in 2020.