The price of crude oil is an economic indicator. For now, the global economy requires oil to grow. While the role of alternative energy sources like solar and wind is growing, oil is still used to power much of the global economy.

If the global economy is growing, oil demand should be increasing. Supply changes relatively slowly since it takes time to drill a well or increase or decrease production. Because demand can change quicker than supply, changes in oil prices are usually driven by changes in demand.

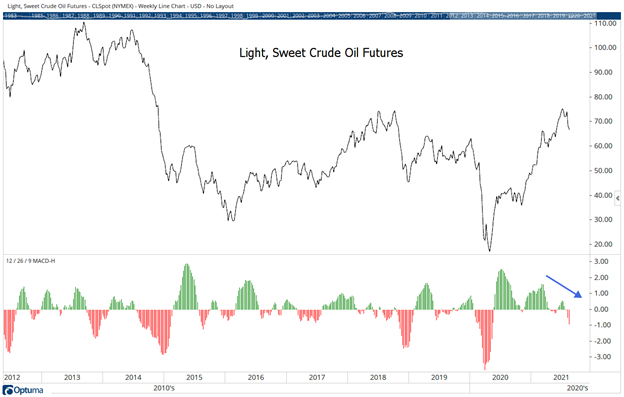

The chart below shows the price of crude oil futures. MACD, a popular momentum indicator, is shown at the bottom of the chart. Momentum is bearish, and the price of oil has stopped going up — indicating that the global economy is back to the pre-pandemic normal of slow growth.

Oil Futures’ Bearish Momentum Indicate Slowed Growth

Source: Optuma.

Oil Prices Suggest a Weaker Economy

The Wall Street Journal attributed the weakness to the fact that traders are “worried that fresh restrictions to slow the spread of the Delta variant will weaken the global economy and crunch fuel demand.”

Oil should also be rising based on increased tensions in the Middle East.

News reports indicate the U.S., the U.K. and Israel are “blaming Iran for a fatal drone strike last week on an Israeli-linked tanker near the coast of Oman in the Arabian Sea, and the U.S. said it would work with allies to develop a response to the incident.”

Israel is also advocating for change in Iran, “Israel’s Ambassador to the U.S. and U.N. Gilad Erdan said that Jerusalem would ultimately like to see Iran’s ayatollahs overthrown, in one of the most far-reaching comments by an Israeli official in favor of regime change in Tehran.

“In the end, we would ultimately like to see [the government] overthrown and [for there to be] regime change and Iran,” Erdan told Army Radio on Thursday when asked about Israel’s strategy vis-à-vis the Islamic Republic.”

Tensions like this usually spark higher oil prices. The fact that prices are down could be telling us the economy is in trouble.

I’m not quitting anything…

I’m just showing people a new way to make money in the markets.

My typical approach targets setups in individual stocks. With roughly 3,000 U.S. stocks, there’s plenty of opportunity.

But my new approach has simplified everything and boiled the markets down to one repeatable trade in the same ticker symbol.

The annual return was 132% last year. Click here to see how we did it. And most importantly, how it could benefit you.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.