Occasionally, the Federal Reserve uses a word that sticks in the public conversation. Alan Greenspan famously noted that there was “irrational exuberance” in the stock market in 1996. In March 2009, Ben Bernanke made “green shoots” famous as he saw signs of economic recovery.

In March, the current Chairman, Jerome Powell, introduced the word “transitory” to the public. He noted: “A transitory rise in inflation above 2%, as seems likely to occur this year, would not meet this standard.” The standard he mentioned is inflation of more than 2% that “is on track to moderately exceed 2% for some time.”

The latest inflation data shows the Consumer Price Index (CPI) was up 5.4% in July compared to a year ago. Analysts pointed out that the index for all items less food and energy — known as core inflation — rose 4.3% over the last 12 months. That’s lower than the 4.5% increase in the previous report, which indicates price gains are slowing.

Home Prices Suggest Transitory Inflation to Rise Next Year

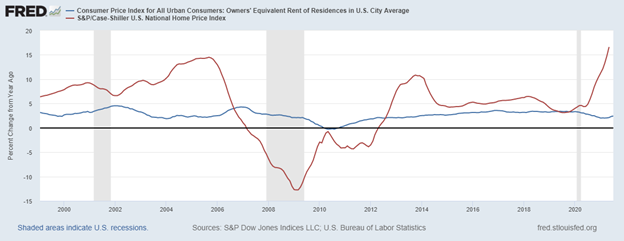

A fact the inflation doves are ignoring is in the underlying calculation of the CPI. Housing costs account for 30% of the CPI. The Bureau of Labor Statistics uses a formula to calculate the owner’s equivalent rent (OER) rather than home prices to try to hold down the rate of inflation in housing.

OER is less volatile than home prices, as the chart below shows. Home prices are the red line, OER the blue line.

Home Prices Spiked Earlier This Year

Source: Federal Reserve.

Home prices lead trends in OER by about a year. Home prices turned sharply higher last summer. OER is now tracking that trend. This will drive CPI higher through at least the end of the year.

Inflation is now on a trajectory the Fed will struggle to reverse. Fed officials will maintain their “transitory” narrative for months, but that will inflict even more damage on the economy.

While I didn’t exactly design the internet, I can take full credit for this.

I’ve created a first-of-its-kind innovation in the financial markets. It allows everyday traders to get ahead making one simple trade per week.

Click here to see how it works.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.