Back in August 2018, the Saudi Arabian government brutally assassinated a man named Jamal Khashoggi.

It was a “rogue” operation that ended with yet another journalist dead for the crime of speaking truth to power.

Except — that’s not the whole story…

Click below to watch today’s video:

Video Transcript:

Hello and welcome to Moneyball Economics with your host, me, Andrew Zatlin.

Let’s take a trip down memory lane…

Let’s go back to August 2018, about the halfway point of Donald Trump’s first administration. When suddenly, news gets out that Saudi Arabia has assassinated a prominent journalist. Not just assassinated him, they did it in their embassy in Turkey and not just assassinated, they brutally killed him, act his body up with a bone saw and dispose of the remains in acid.

The Turks who bugged the Saudi embassy were all too happy to release the tapes. Turks and the Saudis don’t really get along. They don’t see eye to eye, but nevertheless, huge moral outrage ensued around the world.

A journalist sacrificed his life yet again for standing up to power … except that’s not exactly what was going on off on the side. Let’s talk about this guy. His name was Jamal Khashoggi, and he wasn’t just an ordinary journalist.

No, no, no.

His grandfather was the personal doctor to the first king of Saudi Arabia.

His [uncle], Adnan Khashoggi, while he was a billionaire, arms merchant who helped the Saudis get billions and billions and billions and billions of dollars of weapons.

Khashoggi didn’t just stop there either…

We’re talking fabulously wealthy, and his son, the one who was killed, Jamal Khashoggi, was a similarly well-established player except he wasn’t part of the royalty, and he was talking back to the hand that was feeding him. He bit it hard and they crushed him in their fist, but it doesn’t really matter who he was.

The fact is he was brutally assassinated and the world was outraged, and the US stood up to him under Trump and said “we’ll, ignore this if you buy a billion dollars’ worth of weapons.” And so the lesson for today is that oil money in particular is very powerful and persuasive.

So let’s take a step back and fast forward to today’s world.

Let me throw out a couple of things that may be kind of on your radar, but maybe you didn’t connect the dots yet…

We’ve got Russia at war in Ukraine. We’ve got Syria being overthrown, we’ve got Venezuela and we’ve got Iran. Okay? Now, all of these four global hotspots have one thing in common, and it is oil. Oil, for example, as an enabler of bad behavior.

If you look at Russia attacking Ukraine, well, they couldn’t do that if they didn’t have oil revenues. Same thing with Iran. Iran destabilizing everywhere they touch again without oil revenue, they would not be able to do that. What about Venezuela? Well, there again, Venezuela is the world’s largest proven reserves of oil.

Whoever controls Venezuela has their finger on the biggest oil tap in the world, and guess what? The US just put a $25 million bounty on the head of Venezuela’s president.

We want to overthrow Venezuela, probably install someone favorable to us and our energy oil policies. And what about Turkey? Right? Syria was overthrown thanks to the backing of Turkey.

Why does Turkey want to get Syria under their control? Simply control the pipelines that are funneling gas and oil across that region from the Middle East to Europe.

So you’ve got four regional hotspots all linked to oil, whether they’re producing it, whether they’re trying to acquire it. The key point here is that oil is very much an issue, and now you’ve got Donald Trump entering the scene…

Donald Trump has initiated some policies that really make me look at oil with some new eyes.

We talked about regional conflicts. How about regional opportunities? Did you notice, for example, that Saudi Arabia, the Prince, recently said this last week that Saudi Arabia would invest $600 billion in the United States.

Now what is he doing there?

Well, obviously he’s buying a nice partnership with the Donald that goes back a ways … but it’s also part of the Saudi Arabian effort to diversify away from oil.

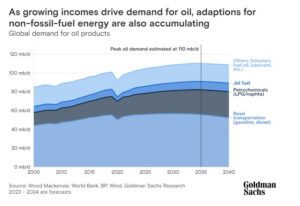

And the reason Saudi Arabia wants to diversify away from oil is that we are approaching peak oil demand. So here’s a chart coming from Goldman and others, and it shows pretty much that we are approaching in the next decade, peak oil demand:

Now, if you’re Saudi Arabia and you’re one of the premier sellers, the writing’s on the wall, isn’t it?

You know that you need to get out of the oil game, or at least you need to be prepared for it. Now, whether it happens in 10 years, 15 years, it doesn’t matter. It’s on its way.

So putting $600 billion into the US is probably a smart move because by the time one set of revenue slows down, you can leverage your situation in the us, plus 600 billion gets you a lot of favors.

Again, oil money is powerful, okay?

Now, that doesn’t mean just because we are at peak oil demand that oil is going away anytime soon.

No, no … we’re always going to be reliant on oil. It’s just we’ve gotten to a place where we’re over reliant in the US, Europe, and many other countries such as China. So whoever controls the pipelines has significant revenue and significant geopolitical power.

This is why Turkey is trying to do what they’re doing, try and grab the pipelines that run in and near Syria.

I mean, after all, if you’re looking at Europe, they don’t produce their own oil, and so they rely on the Middle East. Moving that oil from the Middle East and natural gas from the Middle East is challenging. In fact, there are pretty much only three paths…

One, you can go from Eastern Russia, that’s where the major pipeline is, all the way. Well kind of either through or right next to Ukraine, get it? That’s part of why Russia’s doing what they’re doing with Ukraine.

Another was called Nabucco, and that was going across the north of right where Syria and Turkey are. They wanted to create an alternative pipeline. It was kind of underway as a balance to what’s going on with Russia and their ability to leverage that pipeline for geopolitical strength over Europe.

And guess what? It was working.

Well, a third pipeline is also being considered because nobody wants Turkey to have control because everyone knows that Turkey will use it.

Two massive advantage to the Turks, right? Well, remember when I said that the Turks released those tapes of the Saudis killing Khashoggi? Yeah, they’re not buddies, and there’s a long history here. Ottoman Empire stuff. Remember, Saudi Arabia was created in return for destroying the Ottoman Empire, but even still, there’s bad blood between them.

The Turks love the Muslim Brotherhood. They support it. The Turks are looking to expand their empire again.

Meanwhile, Saudi Arabia wants to be the imperial power in the Middle East, so we have some problems there.

So that’s why a third option, a new pipeline is being considered that would run across Saudi Arabia into Egypt and up. Heck, it might even go through Israel in some offshoots, quite frankly, because Israel is even more safe and closer, and it might be a great way to throw some money to the Palestinians if it runs across the territory that the Palestinians would get.

Bottom line, it’s all about oil.

It’s all about access to oil.

Now, enter the Donald.

Donald Trump has said energy dominance is what he wants to see.

The question is, how do you get there, right? Well, one way is, as he’s always said, pump, baby pump.

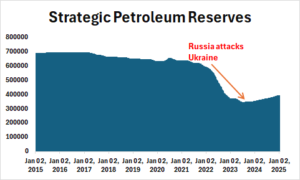

So produce more oil. But if you do that, if you increase the supply of oil, prices come down and producers make less money, and this is where Trump is coming into play. This chart is a chart of what we have in the US called the Strategic Petroleum reserve, or SPR:

As you can see, we are in a sharp deficit in the SPR. We basically under Biden, when Russia attacked the Ukraine, drew down our oil supplies, drew them down massively, and that was in order to stabilize oil prices because the Russia, Ukraine war was basically hurting oil supplies, especially when you try to say, we’re not going to buy Russian oil. We drew it down.

We haven’t really replenished it to replenish. It will take 300 million barrels of oil. That’s about 20, 25 billion at today’s prices. Yeah, it gets cheaper if you pump, and the price per barrel is lower, but this is the message that Donald is sending.

It would take almost nine months of US oil production to fill these strategic petroleum reserves back up. So Donald is doing both things…

He’s creating supply and he’s basically signaling to the oil markets in the us. If you produce more, prices will come down, but I’m willing to buy basically all the excess oil you can produce for a few years. This is all to your benefit. Prices may be lower, but guess what? Profits will be higher because you don’t have to pay shipping costs. It’s all staying in the us.

This is a very clever way to ensure both US energy dominance around the world, as well as ensure low prices. Low gas prices translates into lower inflation, and that offsets any kind of inflation coming in from his tariffs.

At the end of the day, recognize energy is a very big factor going forward. There is an energy boom about to start. You need an energy position in your portfolio. We’re in it to win it folks. Zatlin out!

Andrew Zatlin

Editor, Superforecast Trader