Two factors move prices: supply and demand.

In the oil market, global economic growth drives demand. It’s rare that the global economy contracts even though individual countries suffer periodic contractions. Global growth tends to be slow but steady.

OPEC estimates demand will increase about 2% a year. Growth could be less than this if inflation slows global growth … or if China is unable to fully reopen its economy … or if global tensions associated with Ukraine increase.

There are other threats to growth. But there are few risks that growth will be faster than expected.

Oil Supply and Demand

Supply is sometimes less steady than demand in the global oil markets.

A shale oil boom dramatically increased supply several years ago. But financing challenges and regulations reduced the flow of oil from that source. New sources of oil are coming online in Africa, but this could take time to fully reach its potential.

Here, risks are to the downside. Accidents or natural disasters can adversely affect supply. Geopolitical tensions can as well. Traders saw this when Russian oil was sanctioned after its invasion of Ukraine.

As always, the most important source of supply will be OPEC, a group of nations mostly in the Middle East that work closely together to maintain a relatively balanced market.

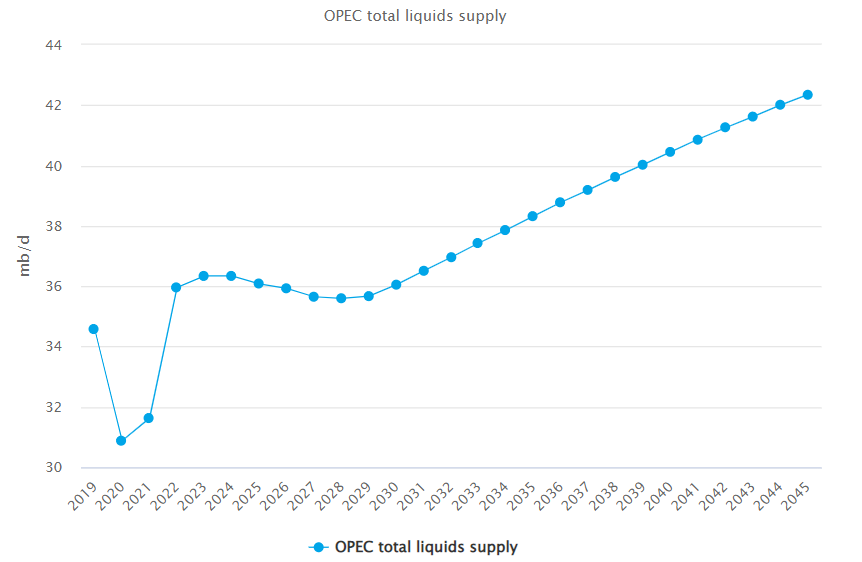

The chart below, from OPEC’s World Oil Outlook, shows production is likely to decrease slightly over the next few years.

After 2030, supply is expected to grow. OPEC countries are working to expand their capabilities, but these projects take time. Until they come online, existing infrastructure is stretched and is expected to dip.

Bottom line: OPEC’s decreased output puts long-term pressure on oil prices. This is another reason to expect a multiyear bull market in oil.

And my colleague Adam O’Dell is ready to take advantage of oil’s price surge.

In one week, he’ll reveal his No. 1 oil stock for the next super bull market.

He believes this stock has everything it needs to soar 100% in only 100 days, and he can’t wait to show you why next Wednesday.

So click here to sign up, and set a reminder to tune in at 4 p.m. Eastern on December 28.

Michael Carr, CMT, CFTe is the editor of two investment trading services — One Trade and Precision Profits — and a contributing editor to The Banyan Edge. He teaches Technical Analysis and Quantitative Technical Analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.