Editor’s Note: Back in January, Chief Research Analyst Matt Clark identified an overlooked industry that was having a moment.

He used Green Zone Power Ratings to find one highly rated stock with market-crushing potential that was part of the climb higher.

This stock rallied hard in 2023 and is still rated “Strong Bullish” (see the updated ratings below). We thought it was a great opportunity to highlight the incredible potential of Adam O’Dell’s system as we head into 2024.

Energy stocks have been all the rage with investors over the year — and rightfully so.

However, another sector of the market is in the middle of a resounding rally: steel.

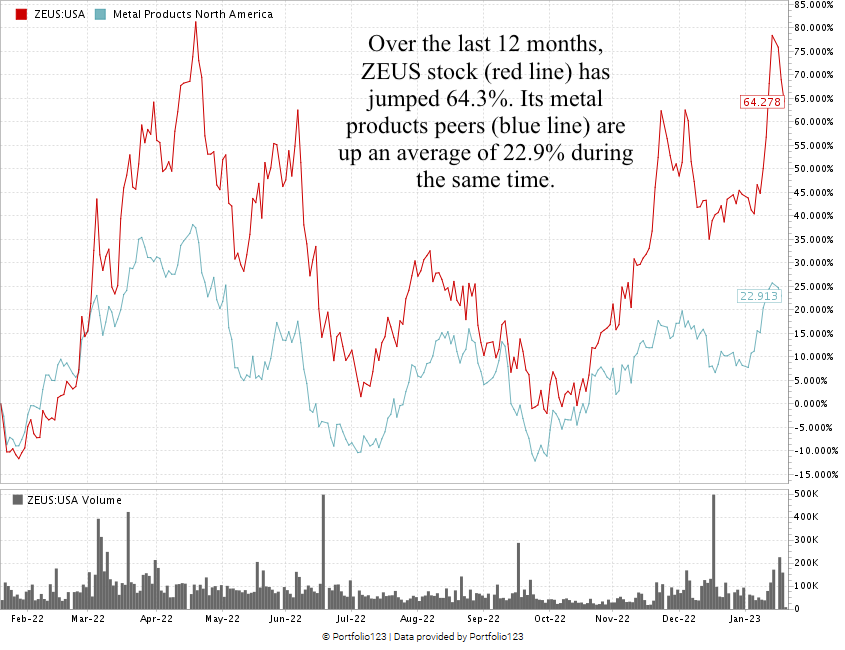

Check out this chart:

The NYSE American Steel Index tracks stocks involved in steel production or the mining and processing of iron ore.

It jumped 43.9% off its October 2022 lows … and I’m confident it will move higher.

I’ve found an exceptional company that manufactures and distributes steel worldwide.

It’s one of the highest-rated companies in our Stock Power Ratings system, a tool that analyzes more than 8,000 stocks!

I’m talking about Olympic Steel Inc. (Nasdaq: ZEUS).

ZEUS makes metal used in automobile manufacturing, renewable energy and military applications.

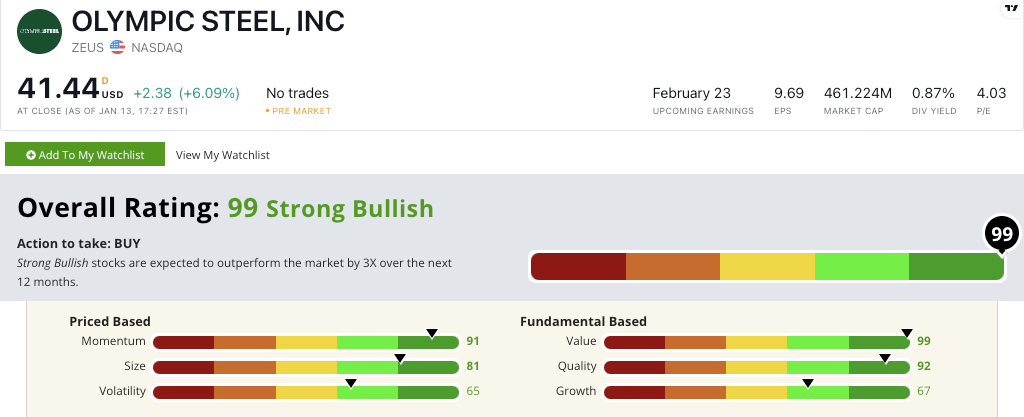

Olympic Steel’s stock scores a “Strong Bullish” 99 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

Olympic Steel Stock: Green on All Factors

The last several months have been good for Olympic Steel.

Highlights include:

- Quarterly sales of $634 million set it up for its best year of sales in company history!

- It recently completed the purchase of Metal-Fab Inc. — a company that produces commercial and industrial vents.

ZEUS scores a 99 on our value factor thanks to its price-to-earnings coming in at half the industry average.

Its price-to-sales ratio is four times lower than its nonenergy product peers — meaning it is trading at a much better value than its competitors.

ZEUS is also strong on our quality factor where it scores a 92.

Its returns on assets, equity and investment are all higher than peer averages.

This all tells us that ZEUS is a better value and quality stock than other steel producers.

But what may be most important right now is the stock’s market-breaking momentum.

Just look at the chart below:

Created in January 2023.

Over the last 12 months, ZEUS has climbed 64.3% — earning it a 91 on our momentum factor.

ZEUS scores a 99 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by 3X in the next 12 months.

While energy stocks have grabbed financial headlines due to outperformance during a bear market, steel is mounting a significant rally.

I believe this is just the beginning for the sector.

ZEUS’ momentum, quality and value are compelling reasons to add it to your portfolio.

Present-day Matt chiming in here…

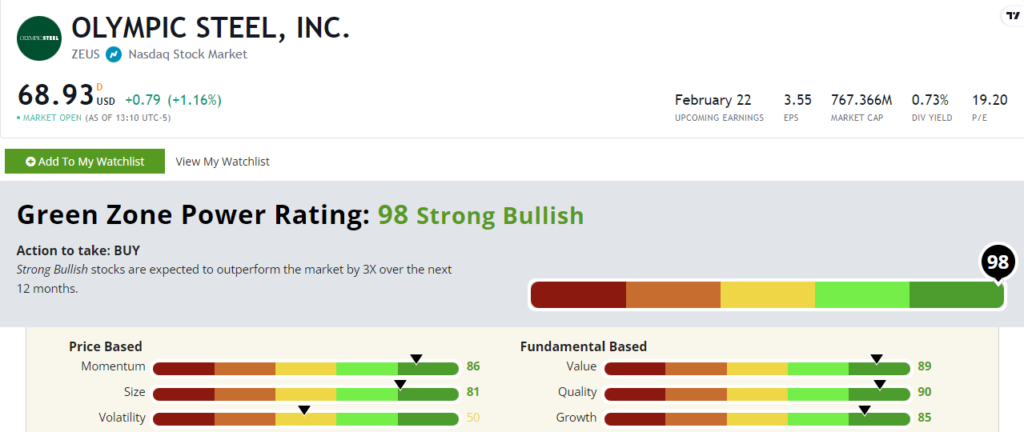

So how did Olympic Steel do since I wrote about it in January? And how does it rate in Green Zone Power Ratings now?

ZEUS Stock: A Quiet Steel Rally in 2023

I’m happy to say, ZEUS stock had quite a year since I found it 11 months ago.

It’s now up more than 70% since January 20 and an incredible 105% year to date. I don’t know if anyone had a triple-digit steel stock rally on their bold predictions for 2023…

The best part is that ZEUS stock still rates 98 out of 100 in Green Zone Power Ratings, so it’s set for more market outperformance from here.

It still rates an 81 or above on 5 out of 6 factors. That’s impressive!

We’ll keep an eye on this one as we head into 2024.

Talk to you all next week!

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets