Economists are debating what caused inflation. One of the front-runners for the blame: the Federal Reserve.

Why? Because the Fed bought the Treasury securities that enabled the government to binge on spending.

This is more than an academic argument.

If the Fed caused inflation — and I agree that it did — its fight against inflation will have an adverse impact on the economy and the markets.

The Fed’s Blame Explained

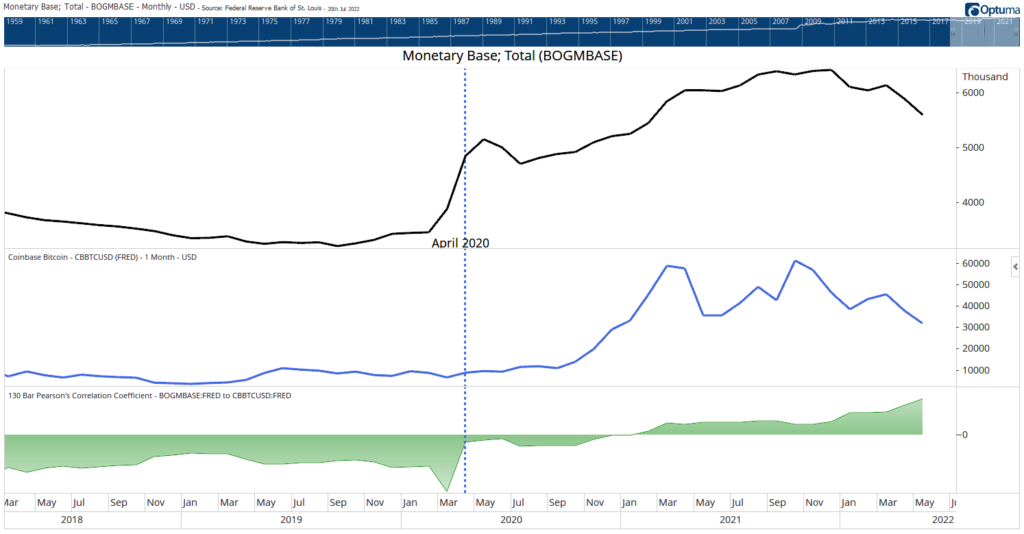

To see the Fed’s impact on markets, I charted the monetary supply, bitcoin (center of the chart below) and the correlation coefficient between the two at the bottom.

The vertical line is drawn in April 2020, when the Fed’s monetary boost was in full force. Monetary supply is shown as the monetary base, which includes money kept in banks plus the cash in circulation.

The Fed Changed Crypto’s Rise and Fall

A correlation coefficient is a statistical measurement of the relationship between two data series.

Correlation coefficients range from negative 1 to 1:

- A perfect positive correlation: A correlation coefficient of 1, which means the two variables always move in the same direction.

- A perfect negative correlation: A correlation coefficient of negative 1, meaning the two variables always move in the opposite direction.

- A correlation of 0 indicates the relationship between the two variables is random.

We would never expect a perfect correlation in financial markets. But correlations above 0.6 or below negative 0.6 are important.

The correlation between bitcoin and the monetary supply is 0.62.

During the pandemic, the correlation shifted. Prior to that, it was negative.

Stimulus spending in the pandemic changed that. Many individuals became speculators.

Their buying pushed prices up.

What This Means for Crypto’s Rise and Fall

Now the Fed is reducing the monetary supply.

The high correlation tells us that bitcoin may fall in this environment…

Which is also true of stocks with high correlations to the monetary supply.

This chart shows the Fed created bubbles, and it’s busy deflating them.

Bottom line: Now is the time traders should focus on the short term.

I always maintain a short-term focus, but I’m expanding that focus as part of my next trading revolution.

This new trade beat “buy and holders” by five times over seven years of back testing. And I think that’s just the beginning.

To see the controversial ticker I’ll be trading, click here and put your name down.

I’m unveiling this revolutionary trade in a presentation on Wednesday!

Michael Carr is the editor of True Options Masters, One Trade, Precision Profits and Market Leaders. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.