Investors sometimes believe prices can only go up.

In the 1960s, this led to one-decision stocks. These were a group of about 50 stocks that were so good that the investor only needed to decide to buy.

The companies were disrupting their markets and would deliver large gains to investors.

Dubbed the “Nifty Fifty,” the companies included American Express Company (NYSE: AXP), Walmart Inc. (NYSE: WMT) and Walt Disney Co. (NYSE: DIS). The list also included Schlitz Brewing, Kresge (aka Kmart) discount stores and Revlon.

As investors learned, stocks can move down as well as up.

Investors learned the same lesson in the housing market.

What Goes Up Must Come Down

Driving the housing bubble of the mid-2000s was the belief that home prices only go up.

When the bubble burst, home prices fell more than 60% in some markets like Las Vegas.

Last year, investors adopted that philosophy in a new market: sneakers.

Air Jordans, Nike Dunks and Air Force 1s delivered strong gains for resellers as markets developed for the shoes.

According to The Wall Street Journal: “The resale market rose to $6 billion in sales annually, according to research firm Cowen and Co., which expects the market to get bigger over the coming decade.”

Individuals looking to flip shoes drove this market.

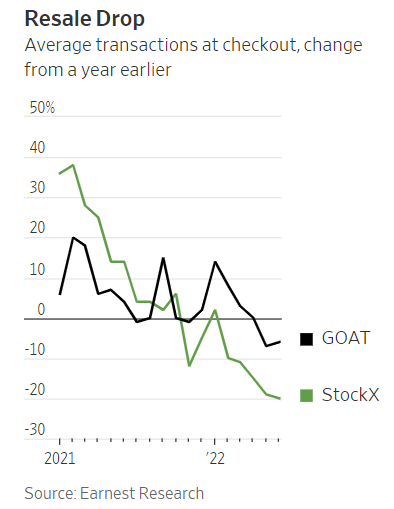

But StockX and GOAT, two popular shoe resale exchanges, are now reporting price drops in the sneaker market.

Source: The Wall Street Journal.

Of course, some market participants see the dip as a buying opportunity.

What the Sneaker Market Means for Bitcoin

Sneaker resale is a market fueled by the Federal Reserve and stimulus checks.

It’s the same for bitcoin and other cryptocurrencies.

There are no fundamentals and no reason for high prices.

Some may love collecting high-priced sneakers.

But take the easy money out of the economy, and the gains in a small collectible market disappear.

We saw this happen in the late 1990s when Beanie Babies soared with an accommodative Fed.

Bottom line: History is repeating itself with sneakers and bitcoin.

P.S. I developed a strategy that’s ideal for this environment. It benefits from price rallies and declines.

Back testing this strategy produced a 43,000% return over seven years!

To see the life-changing strategy I developed, sign up and tune in later today at 8 p.m. Eastern.

As soon as you sign up for my free presentation, you can see the controversial asset at the center of my strategy — as well as tons of content on why NOW is the perfect time to start trading it.

Michael Carr is the editor of True Options Masters, One Trade, Precision Profits and Market Leaders. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.