Yield isn’t super easy to find these days. With bond yields anchored close to zero and the S&P 500 paying out less than 2%, dividend investors don’t have a lot of places to look.

But in one corner of the market, high yields are still the norm: midstream oil and gas pipelines.

The pandemic hammered energy stocks. They were slower than the rest of the market to catch up, but that’s changing.

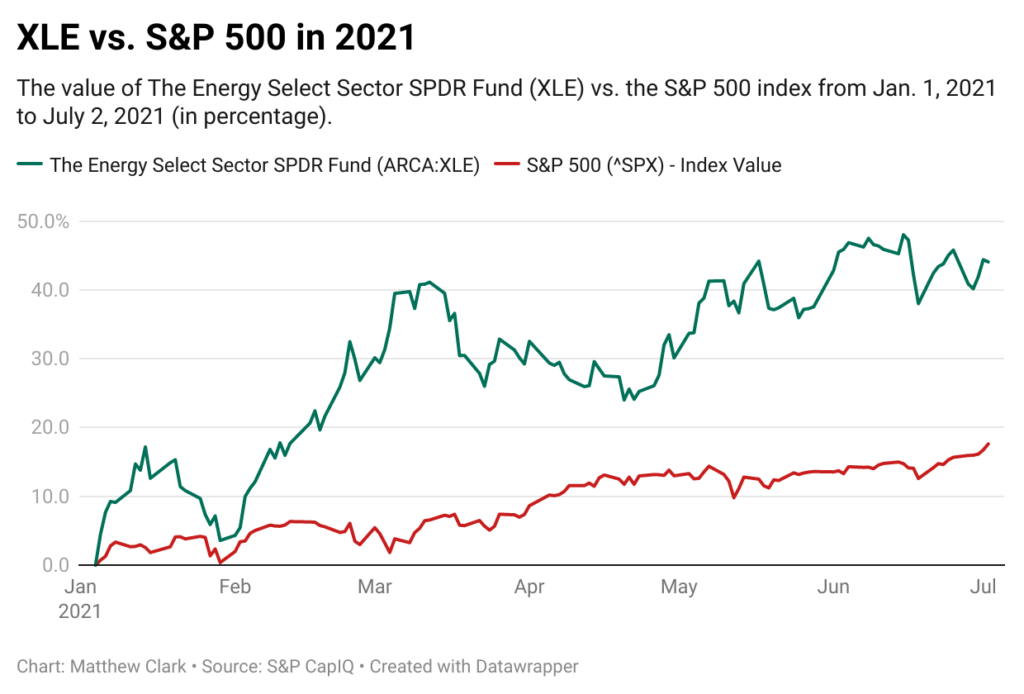

With life getting a lot closer to normal in 2021, energy stocks have been one of the best-performing sectors year to date. The Energy Select Sector SPDR ETF (NYSE: XLE) is up about 40% thus far in 2021, compared to a 15% rise in the S&P 500.

As a group, energy stocks are still cheap relative to the broader market. Energy infrastructure stocks — which tend to be less sensitive to swings in oil and gas prices than exploration and production companies — are an exceptional bargain these days.

A Pipeline to Solid Payouts

This brings me to midstream leader ONEOK Inc. (NYSE: OKE). ONEOK owns and operates a sprawling network of natural gas gathering, processing, storage and transportation assets consisting mostly of pipelines. When it comes to making money, 85% of its revenues are fee-based. Commodity price swings have no effect on that portion of its business.

It’s also a dividend-paying machine. Last year, during one of the most challenging environments in modern history, the company raised its dividend from $3.53 per share to $3.74, a respectable 6% bump. ONEOK has raised its dividend by a total of 54% since 2015, which is outstanding performance during a stretch that was a real struggle for many of its peers. At current prices, the stock yields about 6.5%.

I’d also point out that ONEOK is a regular, good-old-fashioned corporation that pays regular dividends. It’s not an MLP and has none of the cumbersome tax reporting that comes with that structure.

ONEOK’s Green Zone Rating

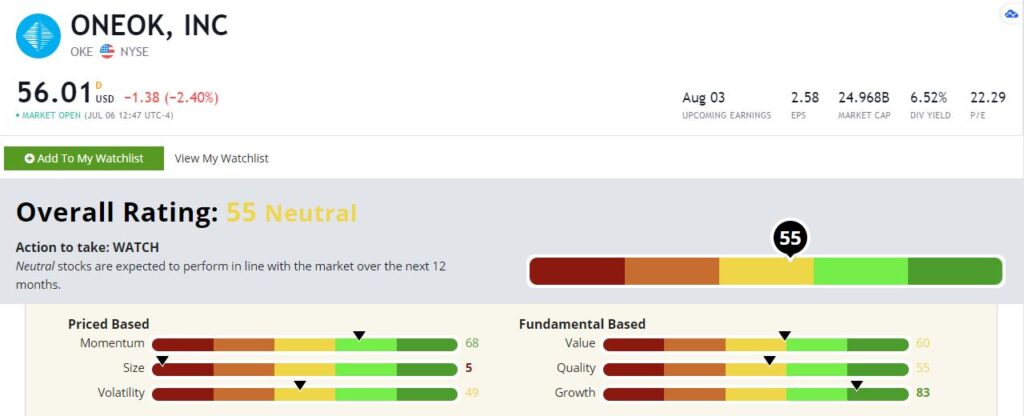

ONEOK rates in the middle of the pack on our Green Zone Ratings system with an overall score of 55. I’d like to see a “Bullish” rating of 61 or higher, but I’m comfortable owning ONEOK at its current rating. Let’s dig a little deeper into the details to see why.

ONEOK Inc.’s Green Zone Rating on July 6, 2021.

Growth — This might seem crazy given the state of the energy markets in recent years, but ONEOK is a growth dynamo with a rating of 83. The global supply glut in energy hasn’t had an impact on ONEOK’s business. The company continues to build out its transportation and processing infrastructure, supplying the country with the energy it needs.

Momentum — ONEOK’s stock price got hammered last year. But since the pandemic low, the stock has enjoyed a nice run, rising by more than a factor of four. Momentum begets more momentum as investors look to ride winning stocks higher. And I think it’s highly likely ONEOK continues to move higher as investors continue to scramble for yield. It scores a 68 on this factor.

Value — Pipeline stocks get punished on our value factor as non-cash expenses like depreciation tend to skew the numbers. That said, ONEOK still rates reasonably high with a value rating of 60. And let’s not forget that market-crushing 6.5% dividend yield.

Quality — A lot of pipeline stocks rate poorly on our quality factor, as this metric favors companies with low debt and high profitability based on standard accounting. Pipelines carry higher-than-average debt and have depressed reported earnings. So, ONEOK’s quality rating of 55 is actually quite solid. That’s higher than the market average of 50 despite the structural disadvantages this sector faces.

Volatility — Our volatility factor is an exercise in what to avoid. We don’t need the absolute lowest volatility stocks, but we want to avoid the high-volatility bombs. You’re a lot more likely to get hurt by a high-volatility stock. Well, we don’t have a lot to worry about with ONEOK. Its rollercoaster ride last year notwithstanding, ONEOK is not a volatile stock. It rates a 49 here, putting it in the middle of the pack.

Size — ONEOK is a large stock with a size rating of 5. That’s ok. In a dividend stock, I‘m more comfortable sticking with larger names a lot of the time.

Bottom line: So, there you have it. ONEOK isn’t the highest-rated stock in our universe by any stretch. But it’s a high-yielder with a history of raising its payout, and its overall score isn’t a huge red flag.

To safe profits,

Charles Sizemore

Editor, Green Zone Fortunes

Charles Sizemore is the editor of Green Zone Fortunes and specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.