It’s hard to believe, but school is back in session here in South Florida.

I remember when school ended in May and didn’t start back up again until September, but those were the good old days.

Summer is getting shorter and shorter every year for these kids.

This got me thinking about ways to invest as everyone from pre-K to college heads back to school.

It led me to an online education trend that will knock your socks off. Then, I’ll use Adam O’Dell’s proprietary Green Zone Power Ratings system to identify a strong candidate for your portfolio.

Online College Was Popular Way Before COVID

Taking college classes online isn’t something new … it’s been around since 1985 when Nova Southeastern University created the first electronic classroom.

Once other schools saw the popularity of e-learning, the trend exploded. And by 2017, the global revenue of online universities was $65.6 billion.

Online schools took off in 2020 and 2021 as the world locked down during the COVID-19 pandemic. Students still needed to learn, but traditional brick-and-mortar colleges were closed, leaving online schools to pick up the slack.

Even though schools are open and functioning again, the popularity of online colleges continues to grow:

Online universities generated $114.1 billion in revenue in 2020. By 2027, Statista expects that revenue to expand to more than $238 billion.

That’s a 109% increase in total revenue in just seven years — and 43% expected growth from now!

It tells me the popularity of online colleges and universities isn’t slowing down.

Using Adam’s Green Zone Power Rating system, I’ve found a great way to capitalize on this massive trend.

Perdoceo Education: A Major Player in Online Universities

You may not know the name right off, but Perdoceo Education Corp. (Nasdaq: PRDO) has been in the online college game since 1994.

It operates two accredited universities — Colorado Technical University and American InterContinential University. The combined enrollment of those schools was 38,000 as of June 30, 2023.

Full disclosure: I’ve been teaching classes for another online university for the last seven years.

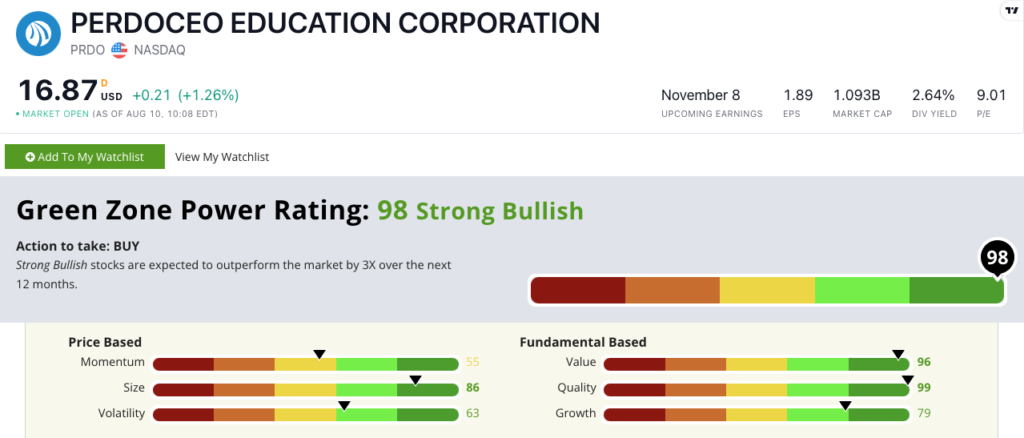

PRDO rates 98 out of 100 on our Green Zone Power Ratings system. This means we are “Strong Bullish” on the stock and expect it to outperform the broader market by three times over the next 12 months.

The stock earns a 99 on our Quality factor thanks to double-digit positive returns on assets, equity and investment. Its gross, net and operating margins also surpass the personal professional services industry averages.

It also gets high marks on Value where it earns a 96. This is in large part due to the fact that it trades with a price-to-earnings ratio that is four times lower than its industry peers. Its price-to-cash flow ratio is half the industry average.

This all tells me the stock is incredibly undervalued compared to the rest of the sector. And the company does an outstanding job at turning profits with higher ratios of profit to revenue — both things you want in a potential investment.

Bonus: The company has a forward dividend yield of 2.64% that pays investors $0.44 per share per year for each share they own.

Bottom line: Online schooling isn’t new, and its popularity continues to grow. The industry is set to generate more than $238 billion in revenue by 2027.

Perdoceo has been in the online university game since 1994 and continues to churn out profits, capitalizing on the growing trend of online enrollment.

These are compelling arguments to add PRDO to your investment portfolio.

Have a great week!

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets