President Trump’s Pfizer deal triggered a massive wave of buying in the health care sector last week.

And with the “art of the deal” being a go-to tactic in Trump’s playbook, I have no doubt the president will trigger another market-moving event in the coming weeks and months. We’re still in the early days of his second term after all.

With that in mind, it’s a perfect opportunity to take the “long view” on the health care sector to see if it’s set up for broader outperformance.

Let’s start by running my “X-ray” on the sector as a whole…

Still Leaning “Bearish”

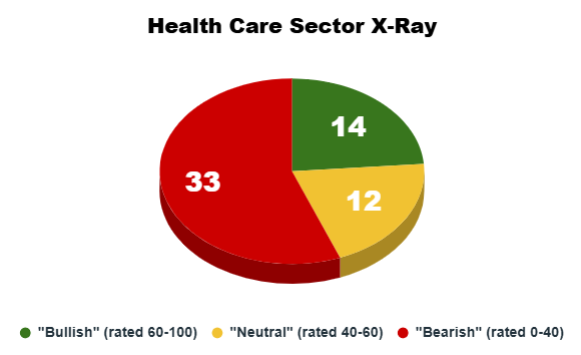

It’s been almost two months since I last ran my Green Zone Power Rating “X-ray” on the health care sector, and not much has changed…

In fact, compared to my August analysis, only one stock has moved from “Bearish” to “Neutral,” and the number of “Bullish” stocks remains the same at 14:

President Trump’s Pfizer deal could have an outsized effect on the sector, but it’ll take time for those deals to be reflected in my system. My system is based on data, after all, not news flow.

With the health care sector looking more “Bearish” overall, this confirms my idea that investing broadly with an exchange-traded fund (ETF) is not the best option right now. There will be clear winners and losers as these deals play out, and my system can help you identify them.

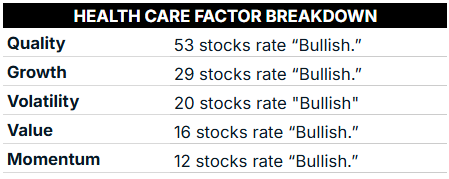

Moving on to my individual Green Zone Power Rating factors, one metric is still a common theme among health care stocks:

With 53 of 59 stocks (89%) rated “Bullish” on Quality, it’s clear that these are solid businesses that know how to allocate profits accordingly and keep debt in check.

On the other side of the coin, only 12 of 59 stocks (20%) rate “Bullish” on my Momentum factor. Roughly one in five stocks is actually rewarding investors with outsized price action in their portfolios.

Investing in a business that knows how to keep its books in check is great, of course. But if that investment isn’t rewarded with positive price momentum in your portfolio, it feels a bit like you’re wasting time and money.

This is exactly why I created my Green Zone Power Rating system with six factors in mind. It gives us a chance to find stocks that are exhibiting “Bullish” Quality and Momentum … or Growth and Momentum …

Or how about all three?

4 “Trifecta” Health Care Stocks

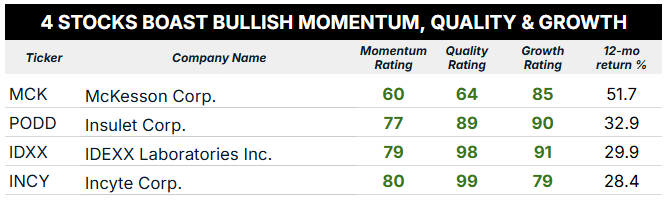

To wrap things up today, I ran a screen on the health care sector to find all of the stocks that rate 60 or higher on my Momentum, Quality and Growth factors. These are the stocks that have healthy, growing businesses … and that investors are buying into!

And of the 59 stocks screened, only four passed the screen:

Again, this is why rolling up your sleeves and being more selective about the stocks you buy can really pay off.

And the health care sector is a perfect example of this. Over the last year, the Health Care Select Sector SPDR Fund (XLV) has lost almost 5% of its value. Each of the four stocks above has absolutely crushed that performance!

They’re all beating the S&P 500’s 18% gain over the same time as well…

If you want to look up the overall ratings for these stocks in my system, click here for information on how to gain full access with a Green Zone Fortunes membership.

You’ll unlock the opportunity to look up the ratings on thousands of tickers, as well as access to my model portfolio and my Top 10 hotlist that highlights the best-rated stocks each week.

To good profits,

Editor, What My System Says Today