While people are freaking out over the coronavirus crash, far too many are also panic-selling stocks, leaving the world’s richest to gobble up what they see as big-time sales and “bargains of a lifetime.”

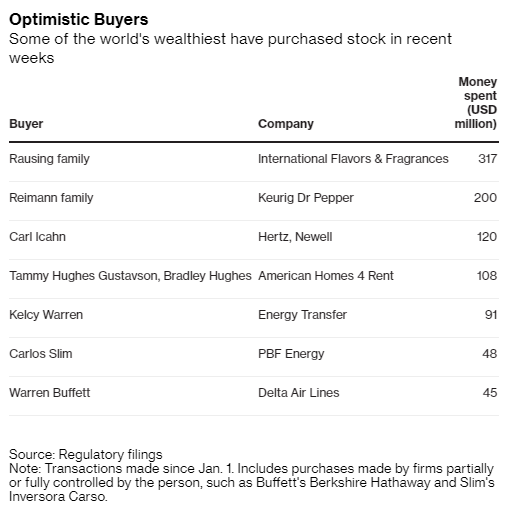

With markets tumbling from record highs in record time, names like Warren Buffett and Carl Icahn, among others, have spent more than $1 billion combined to bump their holdings in good companies whose shares have been slashed to bargain-basement prices.

Household names like Delta Air Lines Inc. (NYSE: DAL) have seen their shares prices lose half or more of their value in a single month. On Feb. 19, when the S&P 500 closed at yet another all-time record high, shares of the American airline titan were trading at $58.41.

Since then, Delta has tanked to about $22 a share as of 3 p.m EDT today, a decline of more than 62%.

Cue Warren Buffett’s Berkshire Hathaway (NYSE: BRK.B), which has since swooped in to gobble up $45 million worth of Delta shares.

Icahn upped his Hertz Global Holdings Inc. (NYSE: HTZ) and Newell Brands Inc. (NASDAQ: NWL) stakes with a $120 million purchase.

According to Banyan Hill Publishing Chartered Market Technician Michael Carr, having a plan and sticking to it is how the best invest.

“Investors like Icahn and Buffett had a plan. They knew they would buy when these stocks fell and they stuck to their plans. It sounds simple but sticking to your plan is responsible for a large amount of your investment gains — or losses if you have a bad plan, like many individual investors do,” said Carr, the editor of . “Individuals tend to plan to hold on for the long run, then they abandon that plan when prices fall. They sell, and then they are unable to muster the courage to buy back in later.”

The heirs of the Tetra Laval fortune also sunk $317 million into International Flavors & Fragrances Inc. (NYSE: IFF), according to Bloomberg, as equity markets around the world plummet due to the COVID-19 outbreak.

Also per Bloomberg, amid the sell-off, corporate executives, board members and their biggest shareholders are buying back stocks in their own companies at the biggest rate relative to sales since 2011.

“These are bargains of a lifetime if we manage this crisis correctly,” Pershing Capital Management founder Bill Ackman tweeted this week. Though, the “bargain of a lifetime” statement is on the condition the U.S. temporarily closes its borders.

And President Donald Trump did just that today.

“As we did with Canada, we’re also working with Mexico to implement new rules at our ports of entry to suspend nonessential travel,” Trump said. “These new rules and procedures will not impede lawful trade and commerce.”

Stop Panic-Selling Stocks — Have a Plan and Stick to It

One way to play the sell-off if you’re sitting on cash you’d like to invest is to ease your way in.

Did you like Delta at $58 when stocks were riding high?

If so, you’ll love it at $22. Put a percentage of what you want to invest in now and if it falls to say $15 a share, put a little more in, and so on.

Timing is everything, but timing the stock market is next to impossible — even for the most skilled professional investors and traders in the world.

So you need to have a plan — and panic-selling stocks should never be part of it.

“Mark Cuban shared his plan on CNBC recently. He’s not selling. The chance to sell passed,” Carr said. “He’s now adding 1% or so of his cash reserves to his portfolio on every down day. If you did sell in a panic, and you really are a long-term investor, consider that kind of plan. Put 1-2% of your cash back in stocks every down day. With zero commissions, there’s no excuse not to do that.

“When all your cash is back at work, put together a shopping list like Buffett and Icahn did and be prepared for the next time this happens. But if you are a trader focused on the short-term, this is your ideal market environment so trade your plan and ignore the panic. But you’re probably already doing that since all traders have plans.”

Editor’s note: Are you selling off your stocks or are you buying deals? Perhaps a little of both? Share your strategy below.