Inflation caught the Federal Reserve by surprise. We can agree on that.

All of us who have shopped at a grocery store since the pandemic began have known prices were rising.

We also knew there were serious problems because shelves were never fully stocked.

Full shelves are a distant memory for any store now.

During the pandemic shutdowns, panic-buying led to shortages. After the economy reopened, supply chain issues developed. These concerns were another concept that seemed to catch the Fed by surprise. Officials must not pay attention to chicken sandwiches at fast food restaurants.

There was a shortage of sandwiches at Popeye’s a year before the pandemic hit. The fast food chain didn’t have enough chicken to meet demand. It was a supply chain issue. We see similar issues when new restaurants open and demand exceeds supply.

Weak Global Supply Chain

After months of lockdown, demand was bound to be high. Strains on suppliers and transportation companies were bound to happen.

Yet somehow no policymakers saw that coming.

More than two years later, they remain stretched, and shortages are a fact of life.

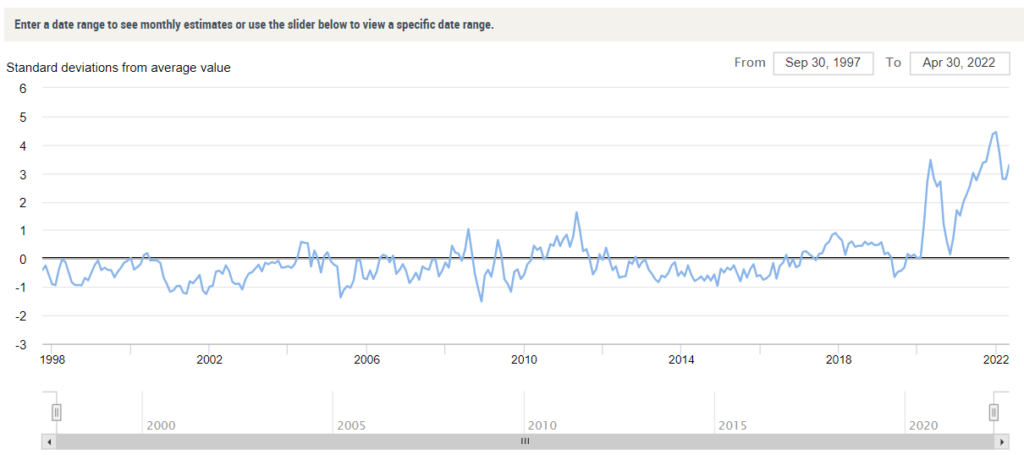

But the Fed is catching up. Economists created the Global Supply Chain Pressure Index, shown below.

Global Supply Chain Pressure Index

Source: Federal Reserve.

This index uses data from around the world to measure delivery times and backlogs. The results show supply chains were strong before the pandemic. For most of the 21st century, there was excess capacity.

Bottom line: That’s changed, and businesses are struggling to catch up. This is a decentralized problem, so there isn’t an easy solution. And recent progress in the index seems precarious.

The recent update was pessimistic. Economists noted “the potential for heightened geopolitical tensions to stoke supply chain pressures in the near term.”