Analysts scrutinize earnings reports. They look for trends in sales, expenses and earnings.

Because all analysts have access to the same data, the report is sliced and diced in every conceivable way as they search for an edge. This leads to detailed analyses that may or not be useful.

One may note inventory-to-sales ratios are moving up, while another may use seasonal trends to indicate inventory levels are too low. Both use the same data but reach different conclusions.

To find more data, analysts listen to post-earnings conference calls. Management adds some details that help analysts see beyond the numbers.

This strategy is used for individual companies, but larger economic trends are also important to track.

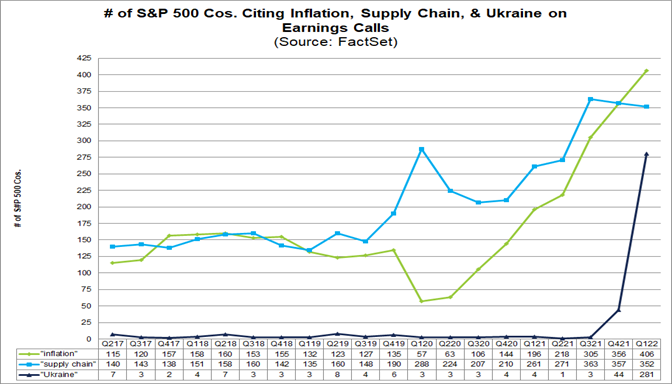

In the most recent quarter, according to FactSet, a majority of companies holding conference calls mentioned three terms: Ukraine, inflation and the supply chain.

S&P 500 CEOS Are Worried About 3 Things

More than half (59%) of the companies in the S&P 500 mentioned Ukraine.

But inflation and the supply chain were the biggest worries:

- 85% of S&P 500 companies mentioned inflation.

- 74% mentioned the supply chain.

Source: FactSet.

Ukraine is a small factor for most S&P 500 companies. FactSet estimates that, overall, companies generate about 1% of their revenues in Ukraine and Russia.

This is a small part of international revenue, which accounts for about 40% of total sales.

Executives on the calls worried about how the war in Ukraine affects global supply chains and the inflationary pressures the conflict causes.

The sectors associated with Ukraine support that argument.

End the Ukraine War, End Inflation?

In total, 76% of companies in the energy sector and 75% of companies in the consumer staples and materials sectors cited Ukraine on their calls. These are the companies at the leading edge of inflation. They depend on raw materials that continue to rise in price.

Bottom line: In the chart above, you can see companies mentioned inflation (green line) well before Ukraine (dark blue line) became a topic of concern.

The war has complicated the supply chain issues that drive inflation, but it appears inflation will last long after the war ends.

P.S. Even with supply chain issues and inflation plaguing markets, my colleague and mentor, Mike Carr, knows there are still opportunities to profit.

With his newest indicator, he can watch every stock in the S&P 500 to see where greed is cropping up at any moment.

And profit as those spikes of greed play out — even in a bear market.

How can he be so sure?

Well, just look at the fact that backtesting proved the Greed Gauge would have 3x’d the S&P 500 over the last two decades…

Or how it would have delivered gains in 7 of the last 9 market downturns.

Mike just revealed the full details in an exclusive presentation.

Click here to join True Options Masters.