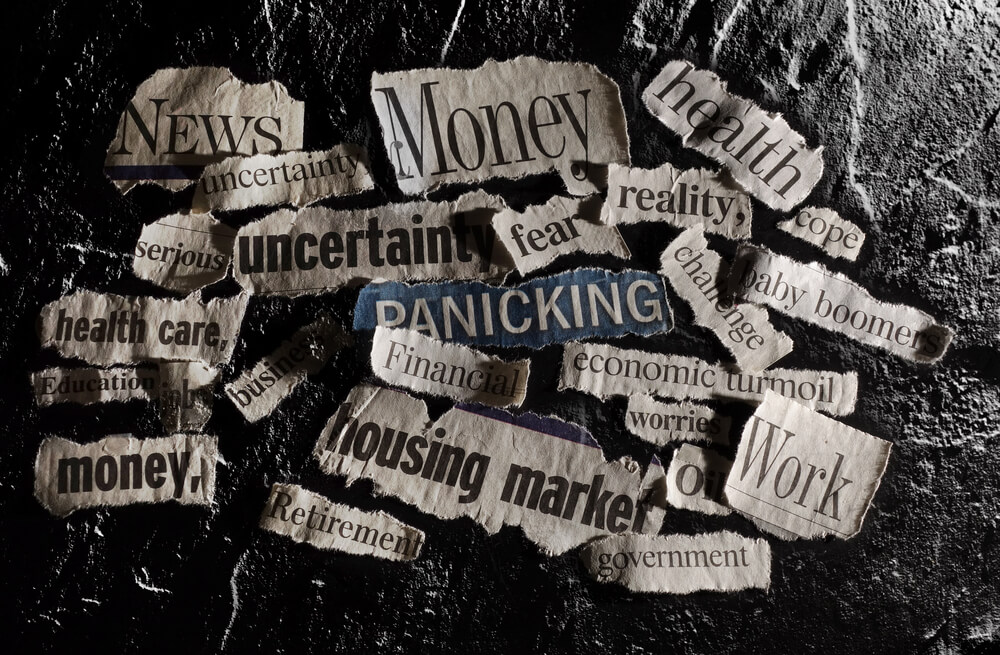

With the midterm elections now in our proverbial rear-view mirror, the stock market can resume to worrying about bread-and-butter issues like corporate earnings, interest rates, the rising threat of tariffs and the ongoing trade war.

The uncertainty is gone: Democrats control the House, Republicans the Senate, and the markets are likely to shift to new sets of political and economic concerns.

The S&P 500 has given returns of for the quarter of a midterm election and the two subsequent quarters a whopping 87 percent of the time all the way back to 1926.

Here is a quick summation of what’s likely to be ahead, per the New York Times:

- The likelihood of investigations of the Trump administration in the House of Representatives and perhaps, down the road, impeachment proceedings.

- The prospect of congressional gridlock and vituperation.

- Rising partisan conflict as politicians prepare for 2020.

At the same time, the markets will refocus on the bread-and-butter concerns that have weighed on stock and bond returns for much of the year.

Among these worries are the possibilities that:

- The rate of corporate earnings growth, unusually robust right now, has already peaked, creating a benchmark that most companies won’t meet next year.

- The Federal Reserve’s interest rate increases will slow the economy, puncturing the prices of risky assets like stocks, which have already begun to lose altitude.

- The Trump administration’s aggressive trade policy — and worsening foreign relations with allies and adversaries alike — will raise global tensions further and hurt the economy.

- After a long recovery, the economy will fall into a recession in the next two years, pushing stocks into a deep bear market.

This may seem like an excessively glum list, right after elections that sent the stock market into a bout of euphoria. If the markets abhor uncertainty, then these midterm elections were wonderfully reassuring.

The best outcome for the stock market would have been the Republicans maintaining control of the both houses of Congress. Consensus opinion in the past has been gridlock — where no one party controls all three branches of government — has been good for the markets.

But that data only bears out when a Democrat has been president and Republicans held either the House or the Senate.

Since 1901, in all such cases, the Dow Jones industrial average has outperformed its long-term average, an analysis by Bespoke Investment Group shows. When a Republican has been president during a stretch of gridlock, the market has lagged.

In the five previous congressional sessions since 1901 in which Republicans controlled the White House and the Senate while Democrats controlled the House — the political alignment in Washington starting in January — the annualized return has been a loss of 1.69 percent.