Yesterday I told you about a large midstream oil and gas company poised to earn big profits for investors.

Today, I’m going to move further down the pipeline for another opportunity.

This is a large downstream energy company that’s an outstanding value stock.

Downstream energy companies refine crude oil into gasoline, diesel, jet and other fuels.

The International Energy Agency projects global oil demand to reach 104.1 million barrels per day in less than five years.

That’s great news for refineries as they increase output.

Today’s Power Stock is a $3.9 billion downstream energy company: PBF Energy Inc. (NYSE: PBF).

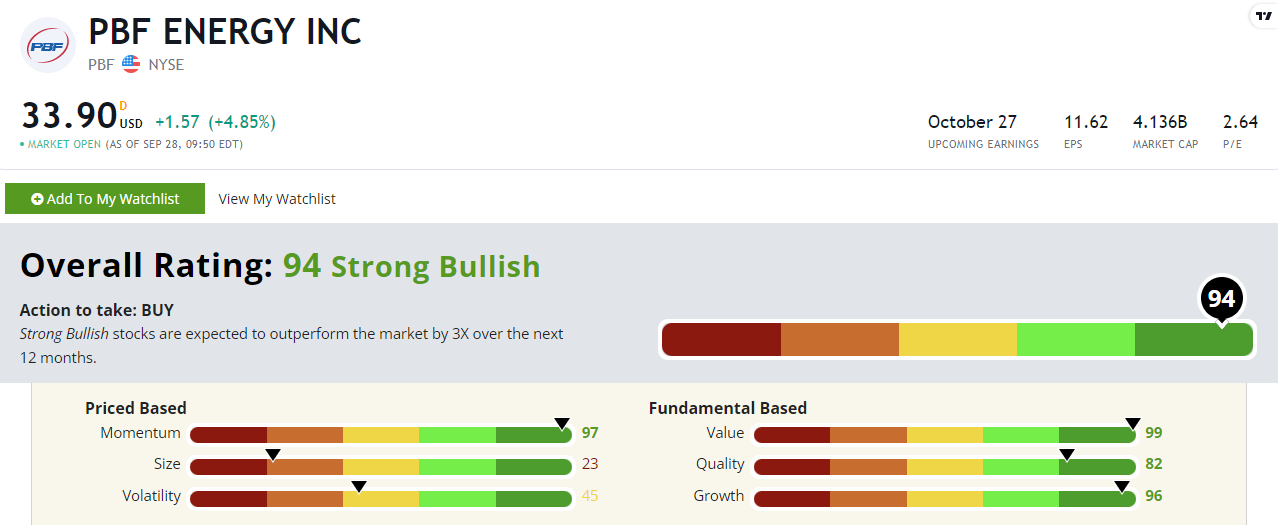

PBF’s Stock Power Ratings in September 2022.

PBF Energy refines crude oil into petroleum, transportation fuels, heating oil and lubricants.

PBF stock scores a 94 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

PBF Stock: Outstanding Value + Strong Momentum

Here are two highlights from PBF’s outstanding second quarter:

- Revenue came in at $14.1 billion — an increase of 107.4% over the same quarter a year ago … and its best quarter for net sales since 2018!

- It was the sixth consecutive quarter of year-over-year sales growth.

PBF stands out as a strong momentum stock, rating a 97 on the metric. (I’ll dive deeper into that below.)

But I want to point out PBF’s outstanding value.

It scores a 99 on our value factor — putting it in the top 1% of the more than 5,000 stocks we rate on that metric.

PBF trades with a price-to-earnings ratio of 2.8 — three times lower than the downstream energy industry average.

Its price-to-sales and price-to-cash flow ratios are also almost three times lower than its industry peers’.

This tells us PBF is a much better value stock than others in its industry.

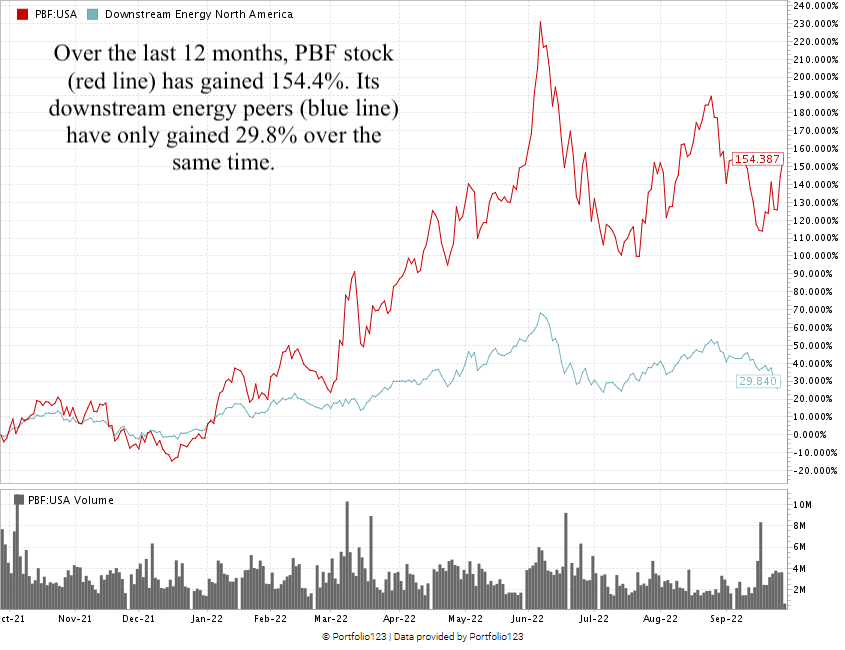

Created September 2022.

From its low in December 2021 to its 52-week high in June 2022, PBF stock rocketed up 287.8%.

It pared back some of those gains due to broad market headwinds, but PBF is still up 154.4% over the last 12 months.

That’s the “maximum momentum” we love to see in stocks.

PBF Energy stock scores a 94 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least 3X in the next 12 months.

Demand for oil and gas isn’t waning anytime soon.

PBF is a strong oil refiner and comes in as a great value for your portfolio.

Stay Tuned: Top Home Security Stock

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on home security stock with a twist.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.