I live in a pretty safe neighborhood in South Florida.

But that doesn’t mean I disregard home security.

I spend what I must to keep my loved ones safe.

And I’m not alone:

In 2017, Americans spent $2.4 billion on security for their homes, vehicles and businesses.

Statista projects that number will increase 250% to $8.4 billion by 2026!

That brings us to today’s Power Stock: mechanical and electrical cabinet lockmaker NL Industries Inc. (NYSE: NL).

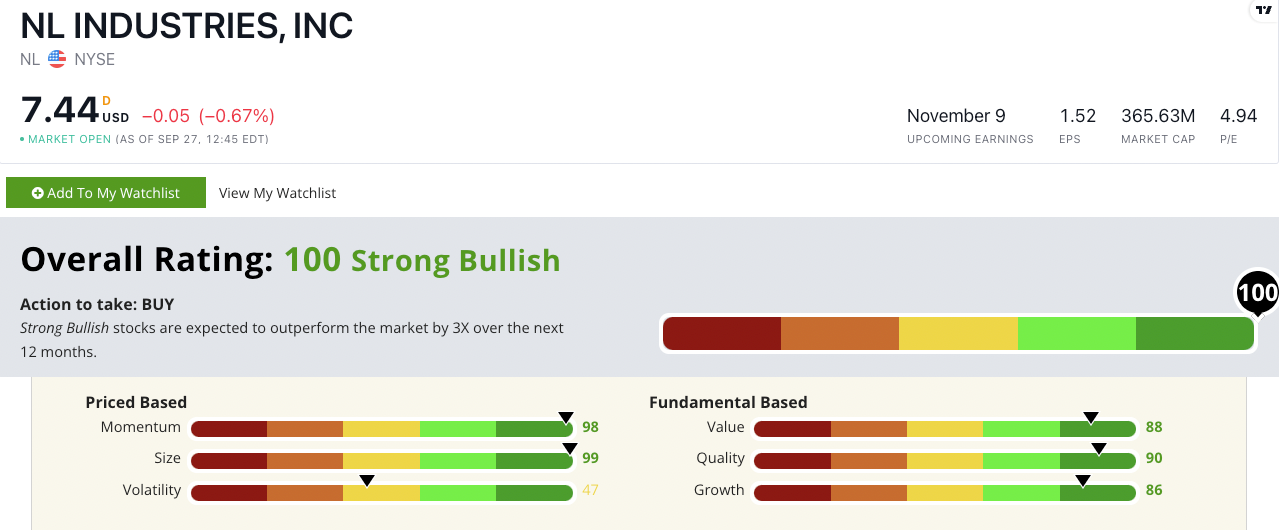

NL’s Stock Power Ratings in September 2022.

In addition to making locks for cabinets, vehicles and the health care industry, NL also makes titanium oxide pigments used to brighten products — like white paint.

NL Industries stock scores a “Strong Bullish” 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

NL Stock: Strong Momentum + Outstanding Fundamentals

NL turned in a solid second quarter.

Highlights include:

- Net income for the quarter was $31.1 million — a 133.8% year-over-year jump!

- Net sales were $83.7 million for the first six months of the year — a 16% increase from the same time period a year ago!

Those sales numbers show why NL scores an 86 on our growth metric.

NL is also a high-quality and high-value stock.

Its return on investment is 20.4%. The construction materials industry’s average, on the other hand, is a paltry 8.4% — NL knows how to turn a consistent profit.

For value, NL’s price-to-earnings ratio is nearly three times lower than the industry average, telling me it is a stronger value stock than its peers.

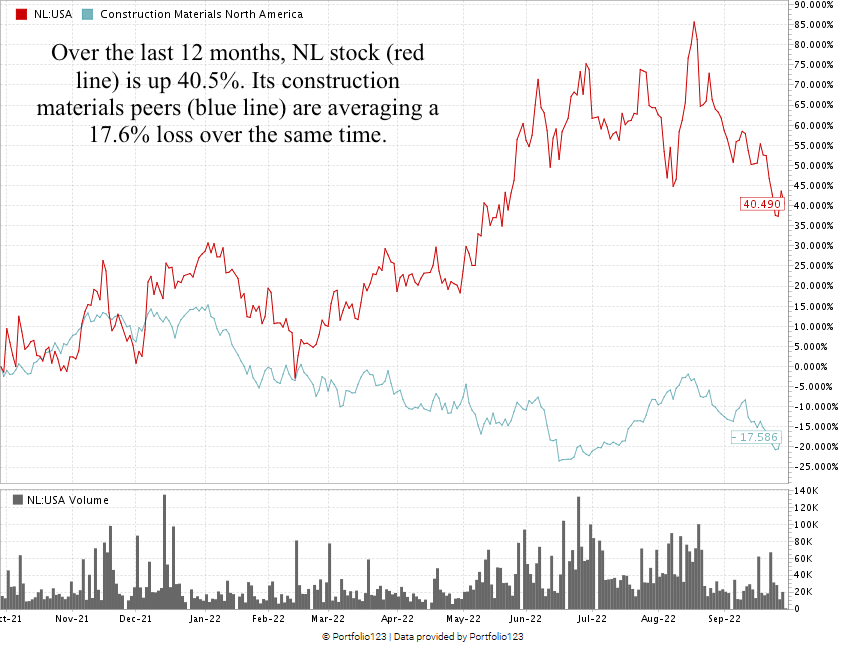

Created September 2022.

NL has done well over the last 12 months.

During that time, NL stock is up 40.5%, while its industry peers follow the overall market trend lower.

This stock shows you how we can use our powerful Stock Power Ratings system to highlight companies in Stock Power Daily that are outperforming while the rest of the market sinks.

And that’s why NL Industries stock scores a perfect 100 overall in the system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

We’ll do anything to keep our loved ones safe.

We won’t spare any expense.

I’m confident you can see why NL is a notable potential addition to your portfolio!

Stay Tuned: Refrigerant Stock Outperforms Peers by 100%

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a high-value refrigerant stock blowing its peers out of the water.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.