Mortgage rates are at their lowest level in 30 years.

If that wasn’t enough to get more people into buying homes, the coronavirus may have given them that extra nudge.

You see, according to Realtor.com, nearly half of everyone looking to buy a home is looking outside major metro areas.

On top of that, more than 51% of potential homebuyers have looked at properties in suburban areas.

So, low interest rates and the desire to move out of larger, populated areas are creating a boom in homebuying.

And companies offering mortgages benefit from this trend.

In July, we used Money & Markets Chief Investment Strategist Adam O’Dell’s Green Zone Stock Rating System to uncover a little-known mortgage company that would provide investors double-digit gains in a short amount of time.

Guess what?

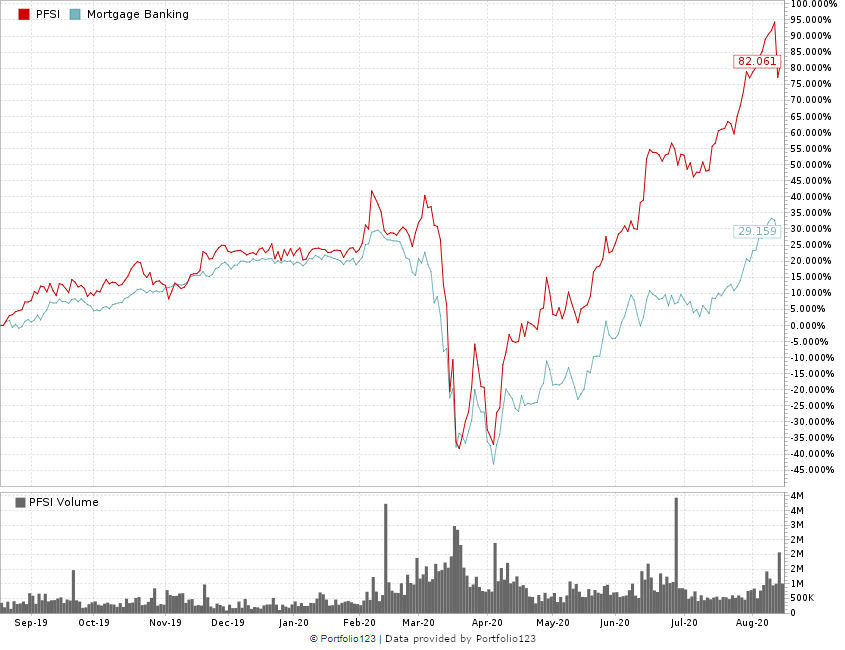

In just a month, PennyMac Financial Services Inc. (NYSE: PFSI) is up more than 20% since that recommendation.

I’m going to tell you why it happened and what you can do now.

How We Rated PennyMac Stock

When we evaluated PennyMac stock, it was one of the few stocks that rated highly on just about all the major factors Adam’s model considers.

It rated in the 90s on value and growth — indicating you can find a high-growth company that’s a great value!

The company’s profit margins were rated better than 91% of all other rated stocks.

PFSI’s sales growth is rated 92 on Adam’s model. It’s earnings-per-share growth is rated 96 while its net income growth earned a 99.8.

Why PennyMac Has Jumped

The biggest reason PennyMac stock has jumped more than 20% in the last month is because of its quarterly earnings report.

On August 6, the company reported blockbuster earnings for the second quarter.

It unveiled earnings per share of $4.39, blasting Wall Street expectations by more than $1 per share. It was significantly higher than the $0.92-per-share it reported in the same quarter a year ago.

The company’s quarterly revenue was $352.7 million, compared to $72.7 million a year ago.

Its massive growth was due to favorable interest rates for mortgages and the company’s continued development of new production technology to streamline its operations.

PennyMac’s board of directors also increased its second-quarter cash dividend to $0.15 per share — up 25% from the prior quarter.

All of that led analysts with Piper Sandler to raise their price target for PennyMac from $62 per share to $70.

What You Should Do Now

That outstanding quarterly report helped the company’s stock jump another 6% in three trading days — pricing the stock at more than $52 per share.

Fortunately for investors who did not get in when we recommended it, the stock pulled back under $50, giving you time to jump in for gains.

PennyMac Has Been on a Tear

Using Piper Sandler’s price target of $70 per share, if you buy now, you can look forward to a 42% jump in gains … but that’s only if you get in before the shares start to climb again.

If you took our recommendation a month ago, congratulations on your open gains. Hang on … there’s more to come.

If you didn’t, it’s not too late. Get in while the price remains below the $50 mark.