February is beach season in Peru. It’s a month of early happy hours by the sea, lots of grilling and pondering investment ideas while staring at the Pacific Ocean.

By the time March rolls around, I feel the need to go into detox mode, cutting back on red meat, booze, cigars and just about everything else that makes life enjoyable. In keeping with the observance of Lent, I suffer by eating a lot of salads in March.

I ponder this as I wolf down a bag of chips and stare out at the horizon. I still have a few days left until the fun stops.

This brings me to my dividend stock of the week, PepsiCo Inc. (Nasdaq: PEP). I recommended fellow beverage giant Coca-Cola Co. (NYSE: KO) earlier this year, and I like PepsiCo for many of the same reasons.

PepsiCo sells garbage. But it’s tasty garbage:

- Soft drink brands including Pepsi, Mountain Dew and 7 Up.

- Salty snack brands like Lay’s potato chips, Cheetos and Tostitos.

- Healthier options such as Tropicana juice, Gatorade sports drinks and even Quaker Oats.

So, I suppose it’s not all garbage.

Why This Is a Good Stock Right Now

There’s a lot of unknowns in this market. How far will Russia go in its invasion of Ukraine? Will the Federal Reserve get aggressive and raise interest rates faster than expected? When will inflation crack?

The beauty of a stock like PEP is the durability of its business.

Regardless of how any of these macro themes play out this year, demand for sodas and salty snacks should be unaffected. This is a company whose businesses are just about as close to recession-proof and stress-proof as you can get.

PepsiCo’s Dividend and Stock Rating

PepsiCo pays a market-beating 2.6% dividend and has a long history of raising that dividend. It’s hiked it for 49 consecutive years!

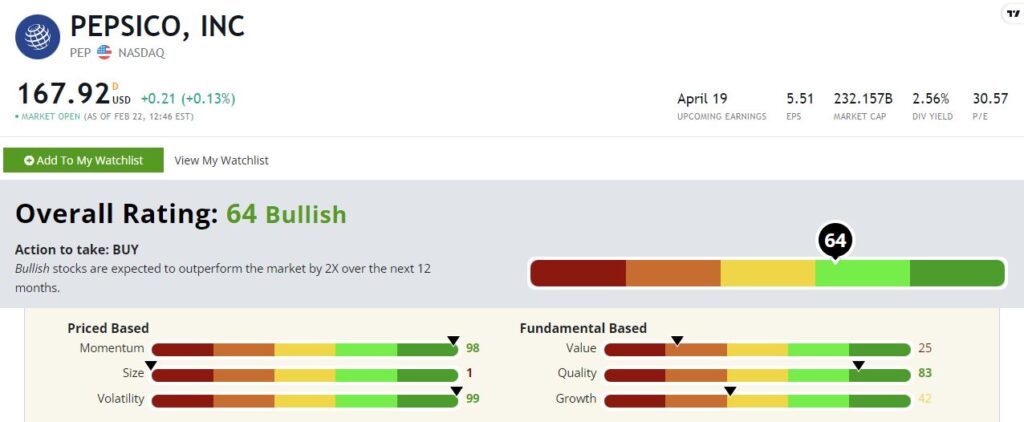

PepsiCo rates a “Bullish” 64 on our Green Zone Ratings model. Bullish stocks are set to beat the overall market by two times over the next 12 months.

Let’s break that down further.

Volatility — PEP is one of the least volatile stocks in our universe with a factor rating of 99. That’s what I like to see in an income stock! Slow and steady wins the race here. PepsiCo’s stock will move, of course. But its shares are less volatile than 99% of the broader market, which reflects the conservative nature of its underlying businesses.

Momentum — Here’s a bit of a surprise for a low-vol stock. PepsiCo rates a near-perfect 98 on our momentum factor. Some of this is due to investors rotating out of high-growth names and into more conservative staples. But a longer-term look at PepsiCo shows a stock that has been on an almost uninterrupted climb since 2008.

Quality — Profitability and balance sheet strength are at the core of our objective quality rating. PepsiCo rates well here at 83. Its strong focus on branding is a major factor in its ability to charge premium pricing, which in turn results in higher margins. This is a durable advantage that took a century to build.

Growth — PepsiCo isn’t a growth dynamo. It rates a mediocre 42 on our growth factor. But that’s OK. We don’t expect market-crushing growth in soda and chip volumes here. What we want is a high-quality, stable producer. And PepsiCo gives us that.

Value — PepsiCo isn’t cheap, rating a 25 on our value factor. I’d prefer it to rate a little higher here, but high-quality companies rate lower on value a lot of times. Investors don’t mind paying up for quality.

Size — PepsiCo is a large company with a market cap of over $230 billion. It’s a global brand that just ended an eight-year contract sponsoring the Super Bowl Halftime Show, for crying out loud! It rates a 1 on size. But again, that’s OK. We’re buying this because it’s a large, stable, no-drama company that pays a consistent dividend.

Bottom line: PepsiCo isn’t a stock that will get you rich tomorrow. But it is a stable company with a dividend that is bond-like in its safety and consistency. And unlike a bond coupon payment, PepsiCo’s dividend will almost certainly rise over time, giving your income portfolio a better chance to outpace inflation.

To safe profits,

Charles Sizemore Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.