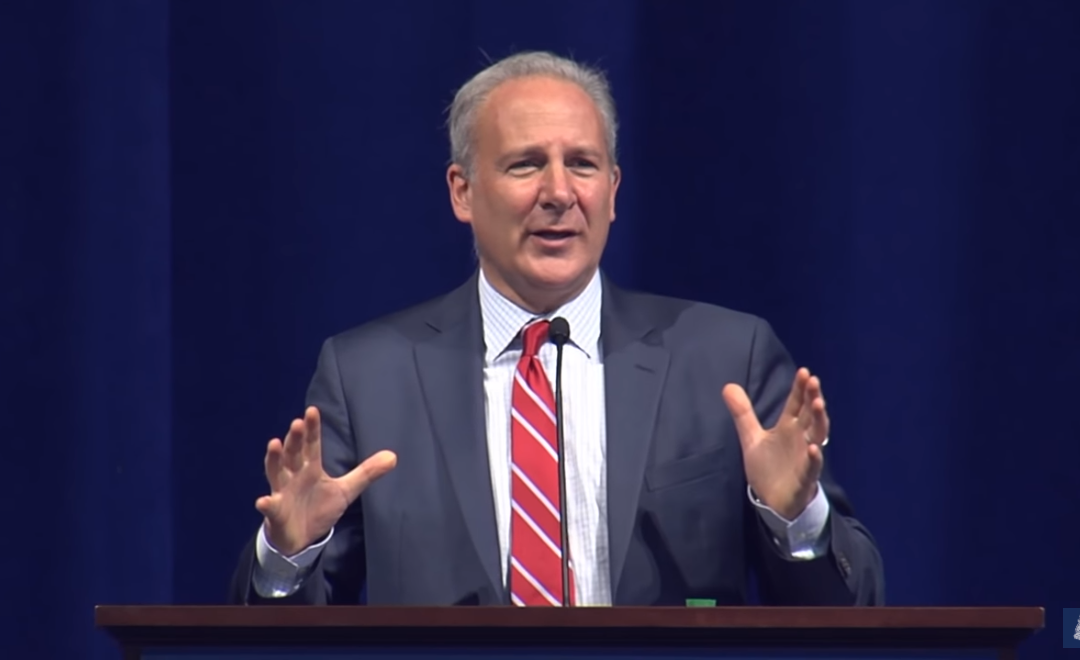

Economist Peter Schiff has been sounding the alarm of late regarding the Federal Reserve’s policies, and he thinks the central bank will take rates back to zero and restart quantitative easing — and that still will only further inflate the bubble before a massive collapse.

The Fed successfully pulled the U.S. economy out of the Great Recession by dropping interest rates all the way zero, where they remained for almost a decade, and with three rounds of QE, which has reflated the real estate bubble, blown up a bond bubble and helped pump up the stock market to new record highs.

Schiff, appearing on the Tom Woods Show last week, admitted he didn’t think the Fed would be able to rescue the economy last time around because he underestimated how the world would so quickly accept the previously outrageous QE — pumping new money into the economy through bond purchases — but things are different this time around.

“The next round of quantitative easing is going to have to be much, much bigger than the last one. They took the balance sheet up to $4.5 trillion last time. They might have to take it up to $10 or $20 trillion this time,” Schiff said. “They may have to do $200 or $300 billion of QE every month as opposed to $85 billion. And when they were doing it before, we had a lot of support. The Chinese were big buyers. The Russians were big buyers. You know, I don’t see that kind of appetite for U.S. debt anymore.

“I don’t think we’re going to have a whole lot of help from those other countries who are already trying to minimize their exposure to the dollar now. I don’t think they’re really going to step it up in order to enable QE4.”

Another problem facing the Fed this time around are monstrous deficits already in excess of $1 trillion compared to the $250-$300 billion deficits the country had at the time under President George W. Bush.

“Is there any way the Federal Reserve can monetize $3 or $4 trillion per year of government debt without the dollar falling and without igniting a bigger increase in inflation?” Schiff said. “If the Fed tried to inject enough stimulus into this economy to try to reflate an even bigger bubble than the ones we already have, I just think the economy dies of an overdose. We overdose on stimulus and we destroy the dollar. And then we have massive inflation.

“But what would be required to stop it would be so politically damaging in the short-run that they may opt not to stop it, which is even worse. It just happens a little bit later.”