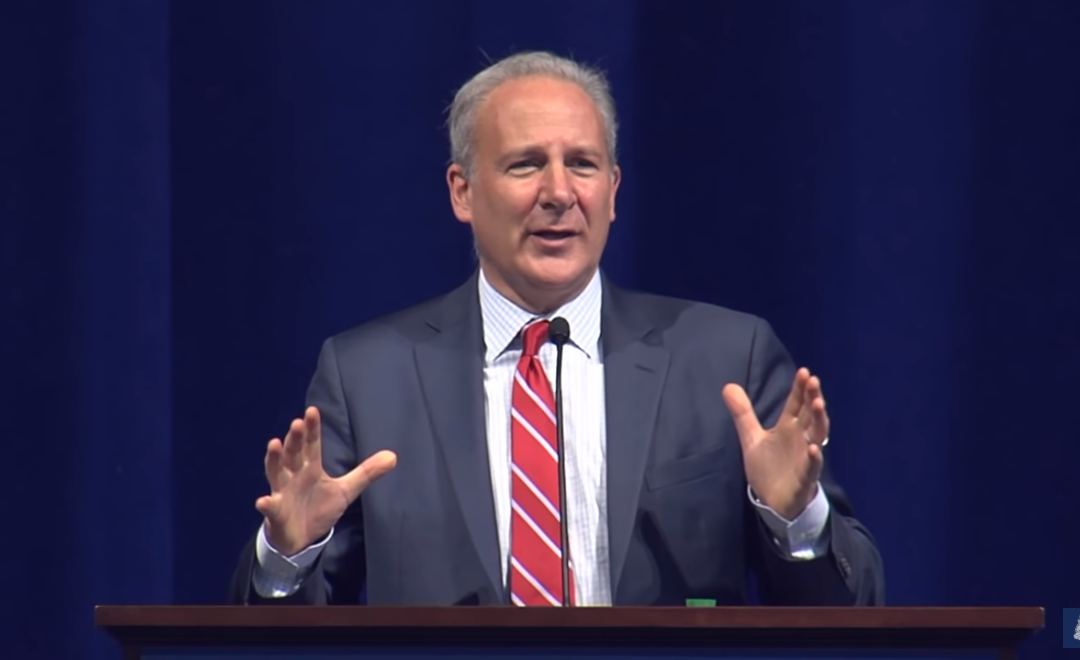

Economist, precious metals expert and Euro Pacific Capital CEO Peter Schiff said on a recent podcast that while many are worried about the state of volatile financial markets and a slowing global economy, he thinks a recession worse than the 2008 financial crisis is coming.

And the Federal Reserve won’t be able to do anything about it.

“We’re going into a worse recession than the recession that we called the Great Recession,” Schiff said on the podcast “Quoth the Raven.” “And I don’t think the QE is going to be able to offset the impact of the recession, and the decline in earnings, and the deterioration of credit quality of debt.”

The Great Recession was the worst financial disaster to the U.S. economy since the Great Depression, which started with the market crash of 1929, so predicting one even worse in the near future is a pretty bold call.

But that’s the call Schiff is going with, and he said the Fed won’t be able to do anything about it because: 1. It kept rates too low for too long and; 2. It raised rates too fast when it finally tried to normalize.

“It’s not whether or not the Fed is going to cut 50 more basis points or 75 basis points — it’s cutting 200 basis points,” he said. “It’s going back to zero. And the problem is, that’s not enough.”

Schiff said once things finally start to collapse, the Fed will drop rates to zero (zero interest rate policy, or ZIRP), and restart another round of quantitative easing (QE), but that won’t be enough to keep markets afloat, Schiff said. In fact, it will sink the value of the U.S. dollar.

“It’s going to destroy the dollar because the dollar rally was built on the fiction that we were going to have higher rates,” he said. “When you tear that fiction apart, and the dollar starts to fall, there’s going to be no stopping it.”

Schiff said he’s holding about half of his portfolio in gold stocks to hedge his bets in a worst-case scenario. He’s also holding foreign stocks and currency in case the dollar does collapse.

“The recession is coming regardless of what happens on trade. This is all a bunch of noise. The air is already coming out of the bubble,” he said. “The Fed pricked the bubble by raising rates.”