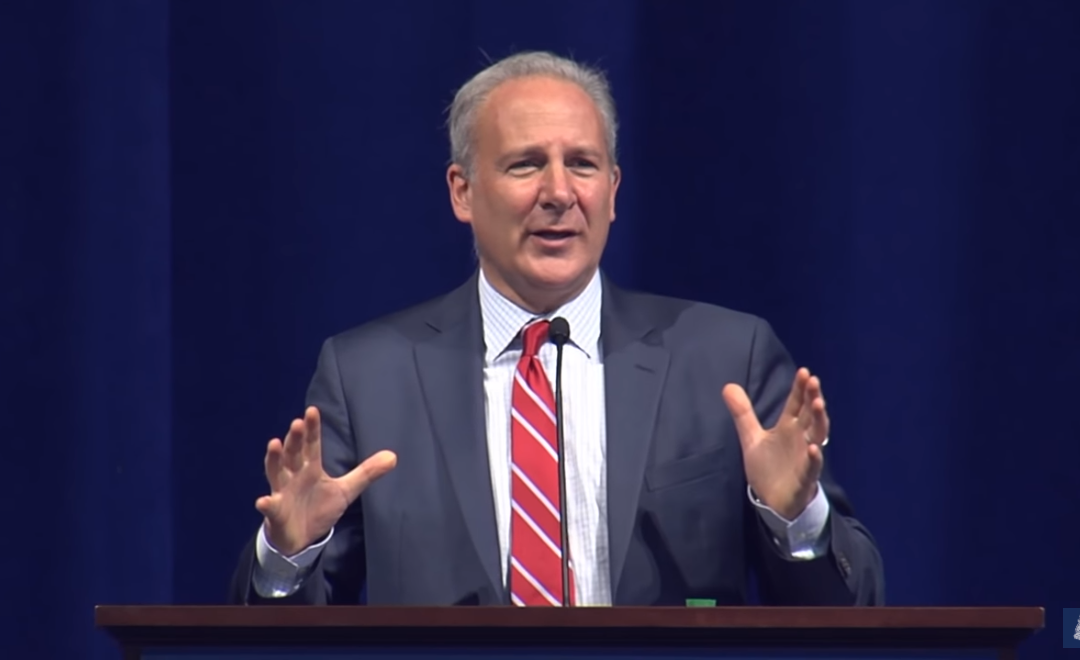

Economist, precious metals expert and full-time Federal Reserve critic Peter Schiff began a recent speech by saying the Great Recession was the fault of the Fed.

“In case the people in this room didn’t know, the financial crisis of 2008, which I had been forecasting for some time, and the Great Recession that ensued, was caused predominantly by the Federal Reserve.”

The Fed managed to rescue the economy, Schiff admitted, but only by creating another monster bubble bigger than the one that popped to start the crisis. This new, bigger bubble is about to burst and the Fed will only repeat the same mistakes again — but it won’t work this time, he said.

First, the Fed facilitated the crash by pushing rates too low after the dot-com crash, and most people didn’t know we were in a bubble leading into the ’08 crisis, particularly Republicans, said Schiff, a libertarian. George Bush cut taxes and the economy was strong, but they didn’t see the bubble, said Schiff, who was correctly sounding the alarm at that time.

“Most people were in denial, just like they are today,” he said. “And the economic collapse that is going to follow the bursting of this bubble is going to be far more dramatic.”

The reason it will be worse, Schiff says, is because in addition to dropping interest rates to zero and keeping them there for a whopping seven years after the ’08 crisis, the Fed also employed quantitative easing, or QE. It was a bold, drastic monetary policy at the time, running three rounds of bond buying (known as QE1, QE2 and QE3) to pump cash into the economy.

The Fed said it would eventually be able to normalize rates and shrink its balance sheet, but as we’ve seen the past few months, it has stopped shrinking its balance sheet, is again lowering rates and once again employing a form of “stealth QE” that the Fed refuses to call … QE.

Schiff called out this “stealth QE” again today on Twitter.

Looks like the Fed did another $104.15 billion of Not QE yesterday. The Fed claims it’s only temporary. But that’s what Bernanke claimed when the Fed started QE1. Milton Freedman once said “Nothing is so permanent as a temporary government program.” The same applies to QE!

— Peter Schiff (@PeterSchiff) October 18, 2019

And since the Fed has encouraged all of this debt, it can’t allow rates to rise to normal levels.

“So, I kept warning that these policies were going to be never-ending, that it would be QE infinity, that it would never stop,” Schiff said.

But the difference this time is it won’t work because we’ve never been able to properly normalize.

“The belief that the policy worked was completely predicated on the fact that it was temporary and that it was reversible, that the Fed was going to be able to normalize interest rates and shrink its balance sheet back down to pre-crisis levels,” he said. “Well, when the balance sheet is $5 trillion, $6 trillion, $7 trillion, when we’re back at zero (interest rates), when we’re back in a recession … nobody is going to believe it is temporary.

“Nobody is going to believe that the Fed has this under control, that they can reverse this policy. And the dollar is going to crash. And when the dollar crashes, it’s going to take the bond market with it and we’re going to have stagflation. We’re going to have a deep recession with rising interest rates and this whole thing is going to come imploding down.”