Federal Reserve Chair Jerome Powell was upbeat about the strength of the U.S. economy in his twice-yearly speech to Congress on Tuesday, listing the ongoing coronavirus outbreak spreading from China as its biggest current threat.

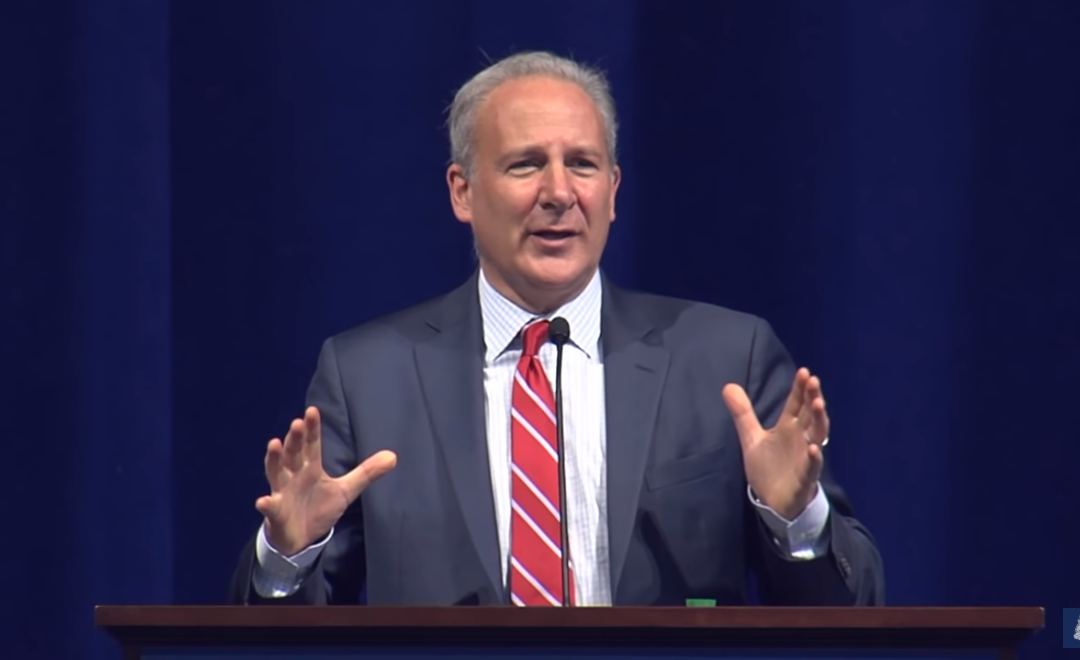

But it’s what the Fed chief said regarding the exploding national debt and deficit that left some, including economist Peter Schiff, scratching their heads. Powell essentially admitted that the Fed can’t fund the government forever and sooner or later, something has to give.

“Putting the federal budget on a sustainable path when the economy is strong would help ensure that policymakers have the space to use fiscal policy to assist in stabilizing the economy over a downturn,” he said while also defending the Fed’s repo operations as “technical measures support the efficient and effective implementation of monetary policy” and are not “intended to represent a change” in the stance of monetary policy.

But Schiff, a precious metals expert and long-time critic of Fed monetary policy, was having none of it on Twitter, saying Powell’s repo madness — or stealth QE — is nothing more than an excuse to “fool the markets.”

If Powell were honest he would have said, “As our failed attempt to normalize interest rates and shrink our balance sheet pricked the bubble, we reversed course to keep the air from coming out. We couldn’t truthful explain our actions so we made up an excuse to fool the markets.”

— Peter Schiff (@PeterSchiff) February 11, 2020

Powell is wrong. The longer the Fed remains active in the repo markets the harder it will be for the Fed to back away. That’s because the longer the Fed artificially suppresses interest rates the higher rates will rise and the more debt there will be to service when it stops.

— Peter Schiff (@PeterSchiff) February 11, 2020

Schiff then went on to bash increasing calls to raise the federal minimum wage and the price of home ownership, saying it’s not the way to build wealth, before returning to the economy and, specifically, how the $23-plus trillion national debt is a “systemic risk” to the U.S. dollar. Schiff also recently called the market “an inflation-driven bubble.”

Someone should ask Powell if the U.S. debt represents a systemic risk to the U.S. economy. Actually, there is no point in asking such an obvious question, especially since Powell will not answer it honestly. The threat is not just to the economy, but to anyone who owns dollars.

— Peter Schiff (@PeterSchiff) February 11, 2020