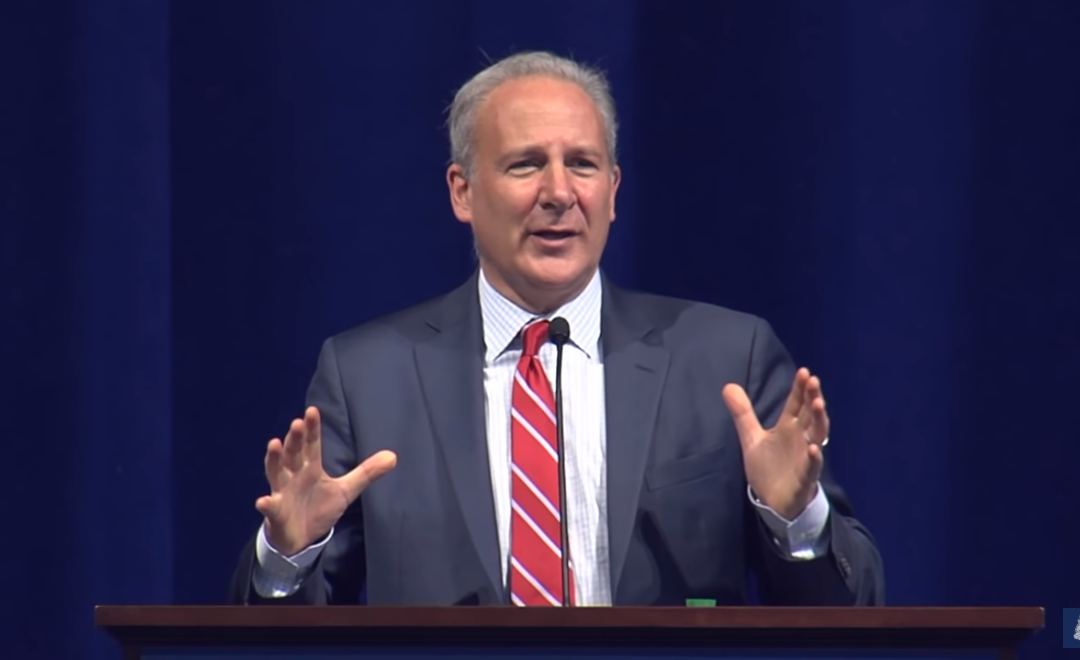

Euro Pacific Capital CEO and economist Peter Schiff said on a recent podcast that the amount of debt the U.S. is currently carrying — which is only going up — is impossible for it to pay off, and that when the big recession hits America will default.

The current U.S. national debt is well over $22 trillion right now and only growing under U.S. President Donald Trump and a Congress that seemingly no longer cares now that Barack Obama is no longer in office (though, the Democrats never cared then, either).

So while the debt it going up, the Federal Reserve has cut interest rates three times in fourth months and the money printing presses have begun again — just don’t call it “quantitative easing,” says the U.S. central bank, with a nudge and a wink.

“The economy is getting sicker,” Schiff said on a recent podcast episode of “Off the Chain.” “And that’s what the central banks are doing when they cut rates and they print money — they’re actually making the underlying economy sicker, even though it doesn’t look sicker because they’re just measuring the spending that goes on and they’re ignoring the debt that’s behind it.”

The debt has to be paid at some point, though, we usually pay it by issuing new debt. According to Schiff, there will come a judgment day, a time when the U.S. can no longer just issue new debt with IOUs. So in turn the Fed will print more money, resulting in runaway inflation, which will crash the U.S. dollar.

“If the inflation rate is 4% or 5%, compounding — and you’re getting 0% interest on your dollars — that’s a one-way ticket to a disaster,” he said. “I think inflation is going to break out all around the world.

“That’s when it hits the fan — because now the debt bubble pops. We’ve built an entire economy based on the perpetuation of this continuing — that we can run trade deficits forever and budget deficits forever and keep having low interest rates and consumer prices that aren’t going up.”

Which is exactly why the Fed has restarted QE — though it denies that outright.

“That’s why the Fed is back doing QE,” he said. “There’s just not enough private demand for all the debt the government is selling.”

How it all ends, Schiff says, is one of two ways: a dishonest default (not paying it back), or an honest default, which would mean paying back the creditors only a percentage on the dollar, which of course would be less than they’re owed.

“The important thing to recognize is we’re defaulting no matter what,” he said. “It is impossible to repay the debt.”

Schiff has been making this sort of prediction for years now and it hasn’t come to pass as of yet — which doesn’t mean it won’t happen, especially considering QE is among the newer, once-crazy monetary policies employed by the Fed.

So what will get things back on track? Only a “severe recession,” Schiff said.

“We’re going to have to have a severe recession if we’re ever going to build a viable economy,” he said. “This bubble won’t go on forever.”