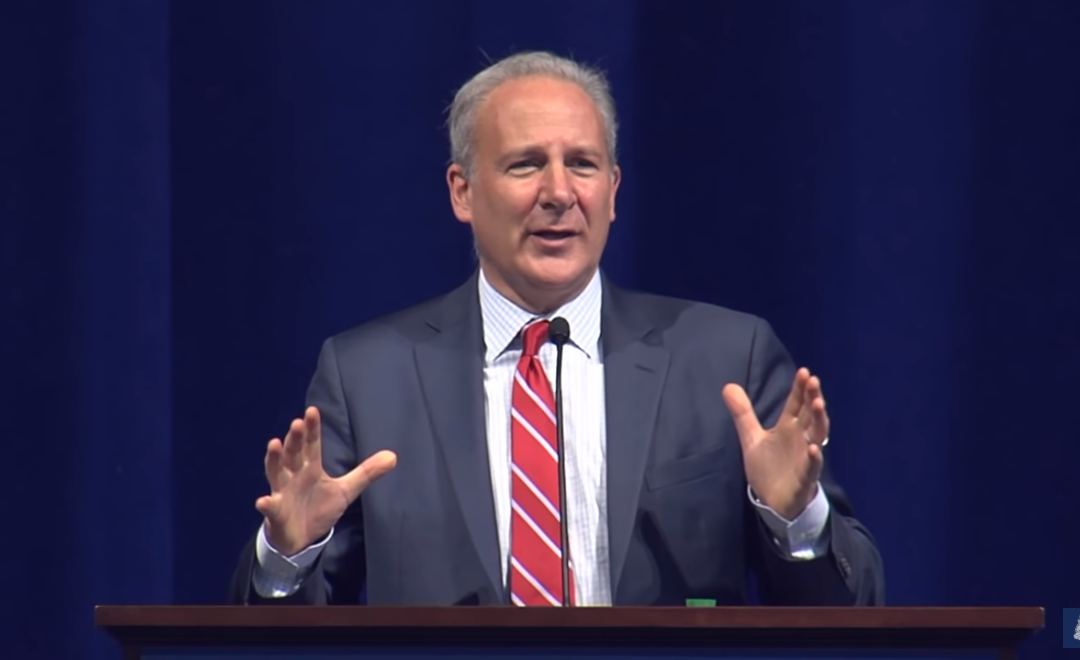

Economist and precious metals expert Peter Schiff notes on his latest podcast, with gold breaking out above $1,400 and ounce and silver rallying, we are seeing the first big signs the investment world is catching on and a bull run for gold is here.

“They’re going to cut rates no matter how high inflation goes because they can’t stop it.”

With the Federal Reserve hinting at an interest rate cut, interest in gold is on the rise. Schiff says the Fed is anxious to cut rates to try and postpone the next recession, which many experts, economists and company CEOs think will happen within the next year.

“Obviously, the reason is the Fed is so afraid of the next recession that they just want to do whatever they can to try to postpone that recession from happening,” Schiff said. “It’s not like they can stop it, but they want to postpone it. And the reason is because the Fed knows there’s nothing they can do, that basically their chamber is empty anyway. So you might as well shoot what you’ve got left because there’s no way they have enough firepower to deal with this recession the way they have been doing it.

“They can’t blow up a bigger bubble. They don’t have enough room between where rates are now and zero. And the amount of quantitative easing that would be required to monetize the enormity of the coming national debt is going to produce the overdose. So all these clowns can think of is we’ve got to postpone this no matter what.”

Every day they manage to postpone the next crisis, the worse the next crisis will be, Schiff said.

“If the recession is when the mistakes of the boom are corrected, why should we postpone that day?” he said. “The sooner we correct these mistakes the better.”

After strong consumer sentiment numbers came in, some of this week’s early gains have been slowed, leading Schiff to note this is the same old, same old with investors who fear that inflation is bad for gold and good for the U.S. dollar. The general consensus is the Fed will hold off on cutting rates if inflation starts to hit, but Schiff said that won’t be the case.

“They’re going to cut rates no matter how high inflation goes because they can’t stop it. But if they raise rates, they’re going to create in their minds a problem that is worse than inflation,” Schiff said. “So they would rather have inflation than the opposite, or what would be required to stop inflation, which would be a massive financial crisis because they have to raise interest rates and let this entire house of cards economy that they built on a foundation of cheap money — watch the entire thing implode.

“Higher inflation is not going to be seen as bad for gold. In fact, higher inflation is why people should be buying gold. The more inflation, the more gold you need to buy. So ultimately, higher inflation numbers, higher inflation expectations are going to be bought when it comes to gold, not sold.”

“Bond King” Jeffrey Gundlach also said Wednesday a rate cut is coming to stall an imminent recession.

Weak Treasury auction parade marches on despite a drumbeat of weaker economic data. Don’t be fooled: rate cut next week is not “insurance”.

— Jeffrey Gundlach (@TruthGundlach) July 24, 2019

For the dollar? Just the opposite, Schiff said.

“If the dollar is losing value, you want to get rid of dollars before it loses even more value,” he said. “But the markets haven’t figured this out yet.”

Now, Schiff said, the gold bull market is here.

“Now we have all the elements that we need of a gold bull market. Before, the problem was gold was going up but no one believed it. That’s why silver was still going down. That’s why nobody was buying gold stocks, because everybody expected gold to fall. People were just so conditioned to believe that the rallies would be sold that they couldn’t believe the breakout, so there was a lot of skepticism. We were climbing this little wall of worry. But now we’re breaking down that wall. Now we have silver outperforming gold and we have gold stocks outperforming the metal. That’s what happens in every bull market. Silver leads gold and stocks lead the metal. That’s what we’ve got, all three firing on all three cylinders. That’s it. The market is going higher. People need to get in. They need to buy physical gold and silver.”

Gold was going for $1,433.80 an ounce, and silver for $16.43 an ounce shortly after lunch time on the East Coast on Thursday.