Statistically, you probably have a pet. One Wall Street brokerage recently found that 66% of U.S. households have at least one pet. Dogs are in an estimated 47% of homes, while cats are in a little more than a third (34%).

If you have a pet, you may spend some time online looking at pictures of pets. You may also realize why Wall Street is interested. Pets are a big business. According to Morgan Stanley: “Average annual household spending per pet could grow from $980 in 2020 to $1,292 by 2025 and expand further to $1,909 by 2030.”

This spending adds up. Pet spending amounted to about $100 billion in 2019. After growth that could average about 14% a year, this will amount to about $275 billion in 2030.

These estimates sound optimistic, but additional data in the research report indicates analysts might be underestimating the growth in spending.

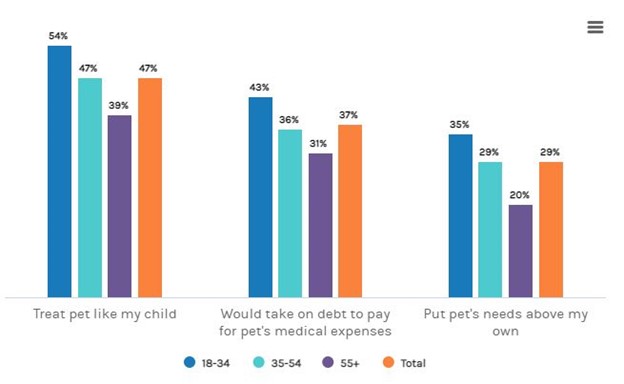

Almost half of households say they treat pets like children, and 37% would take on debt to pay for medical expenses. The tendency to spoil pets decreases with age, with younger pet owners more likely to spoil animals than older ones.

Younger Americans Will Spoil Pets More Than Older Owners

Source: Morgan Stanley.

Pet ETF Could Bring Handsome Profits

In addition to spending on health care, pet owners spend a large amount on food. In a survey, 79% of owners said they believe the quality of their pets’ food should match their own, with 72% saying they wouldn’t want to cut spending on food.

This is a large market, with a significant number of companies fighting for their share of the profits. One way to trade this theme is by walking the aisles of your local pet supply store and watching which products are popular.

Another way to invest in this trend is with an exchange-traded fund, ProShares Pet Care ETF (BATS: PAWZ). The fund’s largest holdings include companies that make medicines for pets in addition to food makers and pet supply stores.

With the economy expected to deliver strong growth in the coming months, companies serving pets could profit handsomely.

While I didn’t exactly design the internet, I can take full credit for this.

I’ve created a first-of-its-kind innovation in the financial markets. It allows everyday traders to get ahead making one simple trade per week.

Click here to see how it works.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.