Pfizer Inc. (NYSE: PFE) helped the world overcome the worst of the COVID-19 pandemic by developing an innovative vaccine. How does Pfizer stock look now?

Pfizer is a major pharmaceutical company with a wide range of products.

From vaccines and treatments for cancer, to drugs that help people with mental health issues, Pfizer has pioneered the way forward in health care for a long time.

But what can investors expect from this medical giant over the next few years?

Let’s take a look at the current state of Pfizer’s business and what we can expect from it in 2023. We’ll also see how the company scores within our proprietary Stock Power Ratings system.

Overview of Pfizer’s Current Business

At present, Pfizer has more than 100 products on the market, ranging from prescription drugs to over-the-counter medications.

The company also produces vaccines, as well as treatments for conditions like cancer and Alzheimer’s disease.

In terms of sales, Pfizer’s biggest markets are the United States and Europe, where it generates around 55% of its total revenue. The company also has a presence in Asia and Latin America.

In terms of financial performance, Pfizer has consistently posted strong results over the last few years.

Its trailing-12-month revenue for 2022 was $99.6 billion, a 22% increase over 2021.

This indicates that despite ongoing challenges throughout the COVID-19 pandemic, Pfizer remained profitable and continues to be an attractive investment opportunity for potential investors.

That’s a good sign for Pfizer stock.

Outlook for 2023

Looking ahead to 2023, it’s likely that Pfizer will continue its success as one of the world’s leading pharmaceutical companies.

It’s expected to launch several new products in the coming year, including treatments for conditions such as diabetes and depression as well as a number of new vaccines developed in partnership with other pharmaceutical companies.

Additionally, it is likely that Pfizer will continue expanding its presence in emerging markets such as China and India where demand for healthcare products is growing rapidly.

As such, it seems that investors who are looking for steady returns should strongly consider investing in Pfizer stock over the next few years.

Let’s see what Stock Power Ratings says…

Pfizer Stock Power Ratings

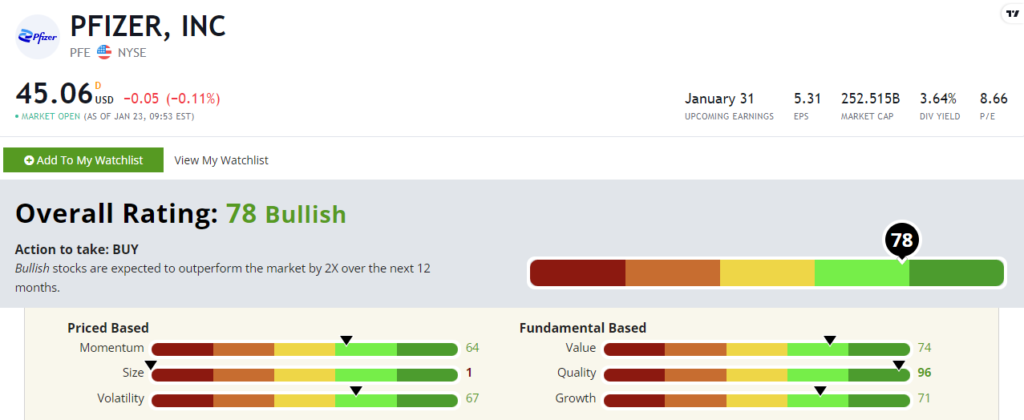

Pfizer stock rates a “Bullish” 78 out of 100. That means our system expects the stock to outperform the broader market by 2X over the next 12 months!

I mentioned that strong revenue growth, and that’s reflected in PFE’s Bullish 71 out of 100 score on our growth factor.

It has also increased its cash on hand 21.6% year over year to $36.1 billion, according to its latest quarterly report. That’s part of the reason it scores a massive 96 on our quality factor.

It’s also trading at a good value compared to the S&P 500, which helps on its 74 value factor score. PFE trades at a 6.9 price-to-earnings ratio as I write. The S&P 500 is more than three times higher at 20.9!

Bottom Line: Overall, there are many reasons why investors should consider investing in Pfizer stock over the next few years.

And our Stock Power Ratings system agrees with that assessment as PFE rates a “Bullish” 78. That means its set to outperform the broader market by 2X over the next 12 months.