During the height of the pandemic, there was a lot of fear and hardly any fun.

When it came to the latter, you took what you could get.

Or at least that was the case for my friends and me.

When the vaccines rolled around, we made it a race to see which vaccine we’d get.

An overwhelming majority of them got the Pfizer shot, while a few cool people like myself got the Moderna vaccine.

Only one friend of mine got the Johnson & Johnson jab, but he’s not in this fight.

Whichever vaccine you may or may not have received, there is no denying the race that was going on within the health care sector at that time.

And it’s still happening.

Pfizer Inc. (NYSE: PFE) rates a “Strong Bullish” 93 out of 100 on our proprietary Stock Power Ratings system.

We’ll take a closer look at its ratings in a second, but first, I wanted to look at one of the company’s latest moves…

Pfizer’s Booster Price Boost

When Pfizer first announced its release of the vaccine, it felt like we all took a collective sigh of relief.

We could visit our families again, go out to eat and maybe even go to the grocery store without fear.

Then came the boosters.

Getting an additional dose of the vaccine for extra protection wasn’t an issue.

But the U.S. government expects the inventory of purchased doses to run out within the first few months of 2023.

That’s problematic.

And now Pfizer has announced a price hike that is a shocking 100 times what it costs to manufacture the vaccine.

The pharmaceutical company said it could cost up to $130 for a single dose due to slowing demand.

Pfizer wants to keep revenue flowing in.

Looking closer at Pfizer compared to its industry peers, we can see why its revenue is important.

Let’s get started.

Pfizer’s Stock Power Ratings and Growth

We’ll get into the revenue in just a second with growth, but first, we’ll look at its overall ratings.

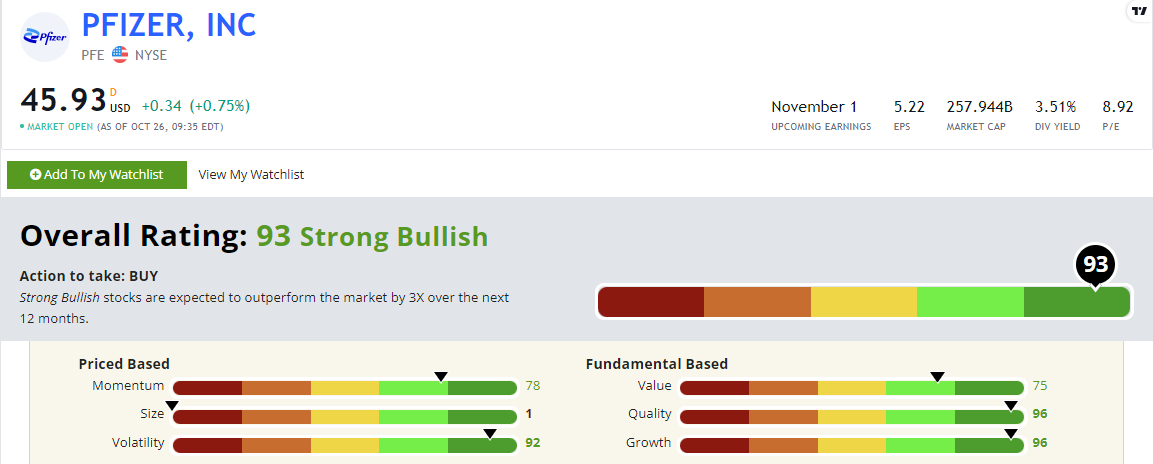

Pfizer’s Stock Power Ratings October 2022.

Pfizer rates a “Strong Bullish” 93 out of 100 on our Stock Power Ratings system.

This means we expect it to outperform its industry peers 3X over the next 12 months.

It rates in the green on five out of our six factors!

But it’s important to note its high growth rating of 96.

When we look at growth in our system, we are considering multiple factors over short- and long-term trends, including:

- Sales.

- Net income.

- And earnings-per-share (EPS) growth.

In the last year, Pfizer’s EPS grew 44.3%!

That’s on top of impressive sales and net income over the last 52 weeks.

Pfizer has shown short- and long-term positive trends for those three categories.

This all earns Pfizer a 96 on our growth metric.

The Bottom Line

Pfizer scores a “Strong Bullish” 93 out of 100 on our Stock Power Ratings system.

We expect it to beat the broader market by 3X in the next 12 months!

But we have more in store.

To get one highly rated stock you should consider investing in, check out Matt Clark’s Stock Power Daily.

Monday through Friday, he gives you one stock to buy or avoid on our system and tells you why — for free!