Between the war in Ukraine, raging inflation, and the prospect of months (or years!) of Fed tightening in front of us, it’s tempting to sit on the market sidelines while things shake out.

Even buy-and-hold investing is tough given the expensive starting point.

But even with all of the uncertainty, there are some lucrative investment trends we can follow.

I wrote last week that logistics REITs were about as close to a sure thing as we’re likely to find.

Come what may, internet commerce will continue to grow as a percentage of all sales, which will drive demand for logistical properties.

Well, another trend is still very much in play: reopening America after the COVID-19 pandemic.

Yes, I understand that there are still over 30,000 Americans hospitalized with COVID-19 and that we’re still recording thousands of deaths per week.

But life looks closer to the pre-COVID normal across most of America. And it’s hard to see that trend reversing, even if inflation and Fed tightening push us into recession.

A REIT for America’s Reopening: EPR Properties

For a high-yielding real estate investment trust (REIT) to play this trend, consider EPR Properties (NYSE: EPR).

EPR owns a vast portfolio of 353 “experiential” properties, such as:

- 175 movie theaters across 18 operators.

- 56 “Eatertainment” establishments such as bowling alleys and driving ranges. Topgolf is one of EPR’s partners.

- 18 theme parks and other attractions.

Essentially, EPR provides everything we had to live without for the better part of two years.

The last two years were hard for EPR. Its tenants struggled to pay rent due to restricted operations. The company even had to suspend its dividend for a while.

But today, EPR’s tenants are back in business, paying the rent and giving it the means to support its new 6.3% dividend.

EPR’s Green Zone Rating

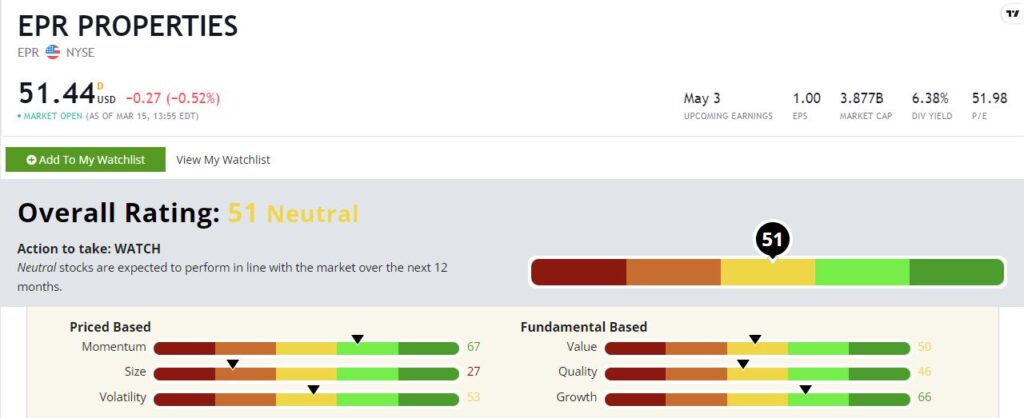

At first glance, EPR looks like an average stock on our Green Zone Ratings system, sitting at a 51 out of 100.

But our metrics are backward-looking. We use historical data to compile this rating because it’s an objective look at the stock.

And EPR exists in a different world than it did a year ago or even six weeks ago.

Let’s dig deeper.

Momentum — EPR rates a 67 on momentum. After getting decimated during the pandemic, EPR’s shares found footing in late 2020.

But what’s most interesting is that EPR is positive year-to-date in 2022 when it seems like everything else is in the red. EPR is up almost 6%, while the S&P 500 is down 12%. Shares have trended higher since late January, and I expect that to continue.

Growth — EPR rates a respectable 66 on growth as well. But remember, this number is skewed lower due to the massive black hole in revenue for most of the pandemic.

EPR’s rating here reflects its strong recent growth and its strong pre-pandemic growth, as our growth factor measures growth over various time frames.

The rating here would be much higher if the pandemic hadn’t hammered its core businesses. I expect to see the REIT enjoy stellar growth in the quarters ahead as life continues to normalize.

Volatility — EPR’s volatility rating is average at 53. That’s fine.

Pre-pandemic, this stock was as volatile, and I expect those trends to reassert themselves in the months ahead.

Investors hungry for yields should help to stabilize the share price. Don’t be surprised to see its volatility factor improve in a hurry.

Value — REITs don’t rate well on our value factor due to quirky accounting. It’s a “known issue” and one that we take into account. Still, EPR’s rating of 50 on value isn’t bad, all things considered.

Quality — As with value, REITs get penalized on our quality factor. Our factor favors high profits as measured by GAAP earnings and low debt. Well, REITs tend have low GAAP earnings and high debt, so they go into this metric handicapped. Take EPR’s quality rating of 46 here with a grain of salt.

Size — Our research confirms that small-cap stocks tend to outperform large-caps with other, similar metrics over time.

Yet in today’s market, having a little size isn’t such a bad thing. While the market remains choppy, I prefer larger, more established companies. EPR is relatively large by REIT standards with a market cap of about $4 billion and a size rating of 27.

Bottom line: I’m not making a lot of aggressive growth picks these days, as I think caution is warranted in this market.

But with EPR, we get the real possibility of fantastic growth irrespective of the nasty macro environment.

To safe profits,

Charles Sizemore, Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.