Looking for an e-commerce stock to buy?

I’ll be straight with you.

I don’t know what happens next in Ukraine. I don’t see how Russian President Vladimir Putin backs down without risking his regime … and I also don’t see how the West can relax sanctions anytime soon.

Both sides are digging in, and there’s no visible offramp.

We won’t know what that means for GDP growth, inflation or earnings until much later. There are too many uncertainties at this stage of the game.

So, rather than fret about things we can’t properly handicap, let’s instead focus on the things we do know.

Retail and the E-Commerce Trend

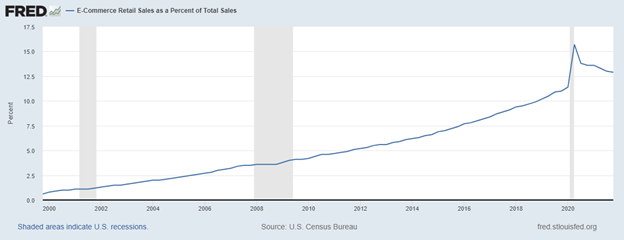

I can’t predict what the retail landscape will look like at the end of 2022. But I know e-commerce is here to stay. You can see that in the chart below.

U.S. E-Commerce Trends Higher

E-commerce accounted for around 11% of retail sales in 2019 before the COVID-19 pandemic hit.

That number spiked above 15% at the height of the pandemic! While sales are reverting to the norm a bit now, I don’t see e-commerce reversing to that 10% level again without Jeff Bezos pulling the plug at Amazon.com.

Unless Russia nukes us and we’re reduced to scavenging for canned goods and shotgun shells, it’s a safe bet that the e-commerce trend is here to stay.

Capitalize With E-Commerce Stock REIT Prologis

And that brings us to logistics real estate investment trust (REIT) Prologis Inc. (NYSE: PLD).

Prologis owns the warehouses and distribution centers that make e-commerce giants like Amazon.com possible.

It owns the brick-and-mortar backbone of the digital economy.

PLD is not the highest-yielding REIT with a dividend yield of just 2.1%.

But its operations are critical within the modern economy.

So, whatever happens — short of actual nuclear apocalypse — it’s safe to assume that PLD’s business will keep trucking along. This is a stock I would feel comfortable buying and forgetting about for the next 20 years.

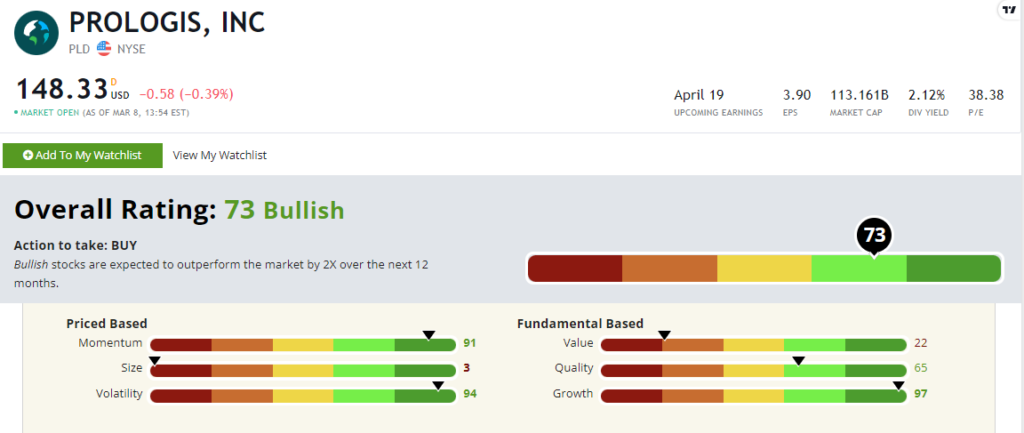

Let’s dig into its Green Zone Rating.

Prologis rates a “Bullish” 73 on our Green Zone Ratings system. Here’s what drives that rating.

Growth — Prologis, a stodgy REIT, is a growth dynamo with a near-perfect 97 out of 100 rating on our growth factor.

That’s right up there with Amazon.com, and it means PLD is in the top 3% of all stocks in our universe in terms of growth in its underlying businesses. (In case you’re curious, AMZN rates a perfect 100 out of 100 on growth.)

Volatility — Despite PLD’s torrid growth rate, it also rates near the top on volatility at 94. Remember, the higher the score here, the lower the volatility.

Prologis’s underlying logistics infrastructure business is durable and recession-proof. This durability is reflected in the stock’s distinct lack of volatility. PLD is a no-drama stock.

Momentum — Prologis rates an attractive 91 on momentum. It seems that the general rotation out of growth and into value has largely left PLD unscathed. As the world looks scarier by the day, I expect investors to continue to flock to stable performers like PLD, which should keep its momentum high.

Quality — Most REITs rate lower on our quality factor because their high debt levels and normally depressed reported earnings skew the rating. But PLD still rates a respectable 65 on quality.

Value — PLD isn’t cheap, rating a 22 on our value factor. But it’s important to remember that investors pay up for quality and growth, and Prologis doesn’t go on sale often. It’s high price here isn’t a deal breaker all things considered.

Size — Prologis is also a huge company with a market cap (current share price times outstanding shares) of $109 billion. It rates a 3 on our size factor. But during a time of widespread market fear, owning a larger company isn’t such a bad thing!

Bottom line: You won’t get rich owning Prologis — at least not tomorrow.

But if you’re looking for a rock-solid e-commerce contributor that should continue to (quite literally) deliver the goods no matter what happens next in the world, Prologis belongs in your portfolio.

To safe profits,

Charles Sizemore Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.