My grandparents always told me that breakfast was the most important meal of the day.

As a kid, I always ate breakfast before heading off to school.

As an adult … not so much. I just don’t make the time to eat before work (or during the day for that matter).

I know that isn’t healthy.

And the breakfast industry doesn’t need me to bolster its strong market:

In 2020, the revenue from making breakfast cereal was $9.6 billion in the U.S.

By 2024, Statista and the U.S. Census Bureau expect that number to jump to $10.3 billion.

Today’s Power Stock is a $5.3 billion company that makes everything from breakfast cereals to peanut butter in the U.S.: Post Holdings Inc. (NYSE: POST).

Post has a strong lineup of brands you probably recognize:

- Honey Bunches of Oats.

- Peter Pan peanut butter.

- Grape Nuts.

- Fruity and Cocoa Pebbles.

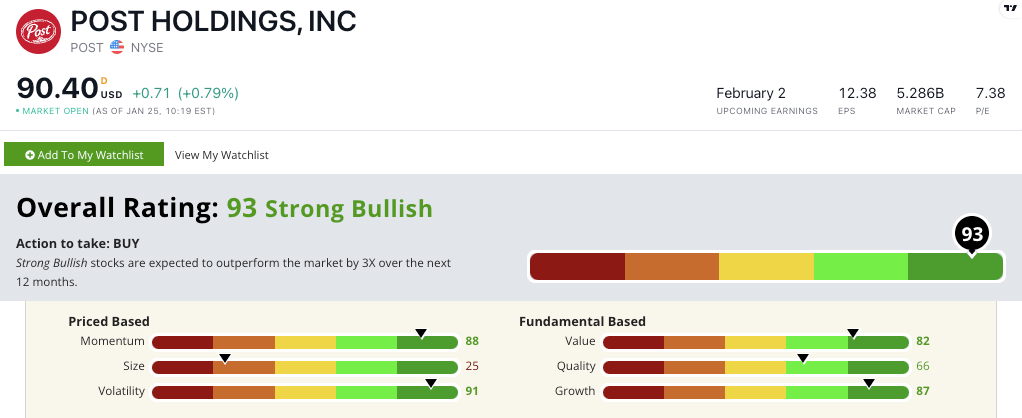

POST scores a “Strong Bullish” 93 out of 100 on our Stock Power Ratings system. We expect it to beat the broader market by 3X in the next 12 months.

POST Stock: Outstanding Growth, Strong Value and Momentum

I discovered two notable items when looking into POST stock:

- Its quarterly net sales were $1.6 billion — a 16.5% increase from a year ago.

- The company’s quarterly gross profit jumped 18.1% over the same period last year.

Those numbers show why POST scores an 87 on our growth metric.

It earns a solid 82 on value, based on its price-to-sales ratio of 7.38, compared to the industry average of 24.9. Remember, lower is better here — and more than three times lower is much better.

Its price-to-cash flow ratio is also more than three times lower than its food and beverage production peers.

Investors tend to flock to stocks with strong brands during economic downturns because they believe the company’s products will carry it through tough times. And these companies can pass some of the cost along to customers since they trust the brand.

That, in turn, boosts the stock price … which is what we see with POST.

Remember, our system adapts to show you what’s working … and POST’s Stock Power Rating reflects that.

Created in January 2023.

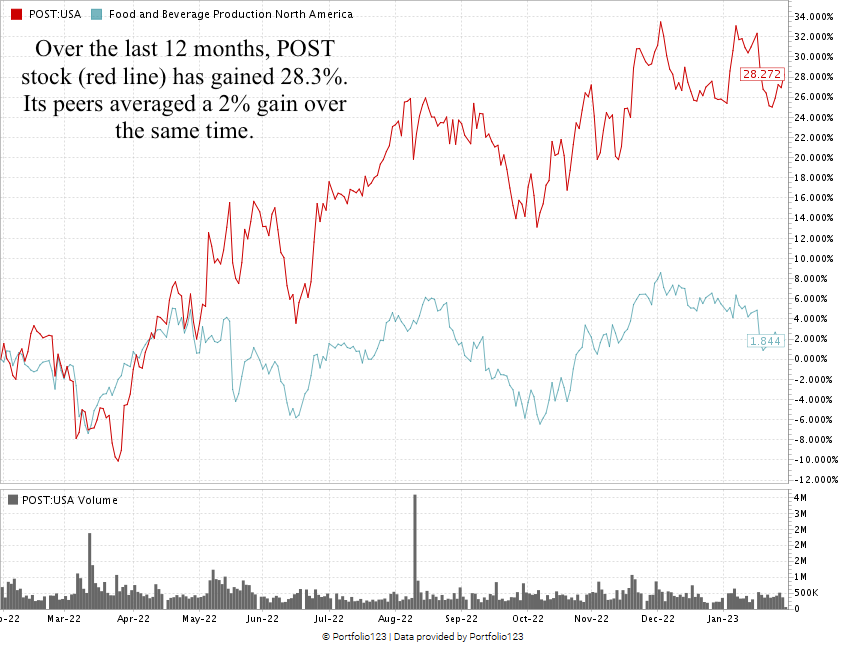

The stock is up 28.3% over the last 12 months. Its industry peers averaged a gain of 2% over the same time.

POST’s run includes a 48% gain from a low point in March 2022 to its January 2023 high.

It shows the “maximum momentum” we love to see in stocks.

Post stock scores a 93 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish.” We expect it to beat the broader market by at least 3X in the next 12 months.

Many believe breakfast is the most important meal of the day. Revenue from breakfast cereals backs that up.

That’s why Post stock is a great contender for your portfolio.

Maybe, one day, I’ll make the time to eat breakfast like my grandparents told me to.

Stay Tuned: A Big Data Flop

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

But sometimes I have to take some time to highlight companies that aren’t worth your valuable investing dollars.

That’s the case with a big data company that is struggling amid the tech shake-up.

Stay tuned!

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets