Tracking market trends can lead to unique investment opportunities on the fringes.

I use Home Run Profits, my paid service, in order to get my finger on the pulse, to get an idea of which sector and industries are in high demand at any given moment.

Right now, my service indicates that investors are fueling a boom in the housing market and real estate stocks.

I’m inclined to watch and invest. But I’m taking a different approach.

This week, my stock recommendation is PotlatchDeltic Corp (Nasdaq: PCH), a timberland company. The company owns 1.8 million acres of timberland in various states. It harvests the timber, produces it and sells both timber and land to developers.

Since the COVID-19 pandemic, the price of lumber has increased by 300%. Lumber is valuable and in demand right now.

It’s a lucrative time for this company, and it’s time to invest in its services.

PotlatchDeltic Corp.’s Stock Rating

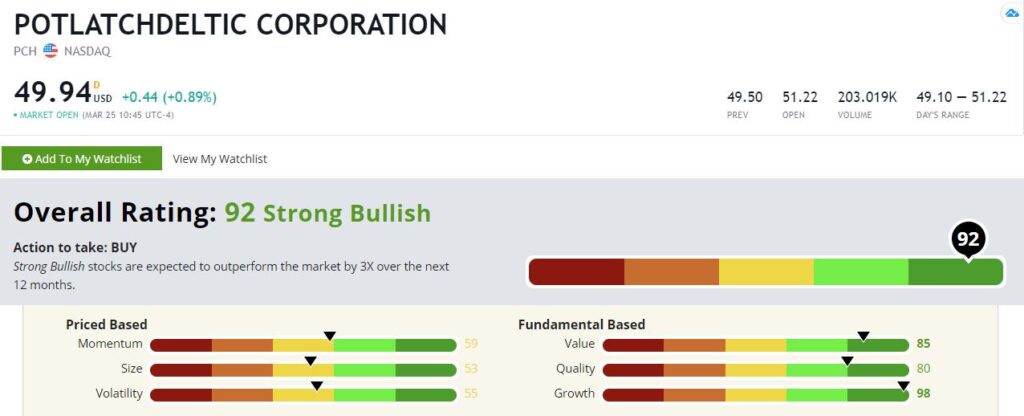

Overall, PCH rates well on my six-factor Green Zone Ratings system. With a score of 92, I am “Strong Bullish” on this stock and its future in the market.

PotlatchDeltic’s Green Zone Rating on March 25, 2021.

Here’s a breakdown of PCH’s top-scoring factors:

Growth — With a growth score of 98, PCH is primed for market expansion. Revenue, sales, net income and cash flow have all grown over the past few years for the company.

Value — PCH is a high-value stock with a score of 85. Shareholders see consistent income when they invest in this company, which raises its value. And there’s strong demand for this stock.

Quality — PCH scores an 80 on quality. When analyzing a stock’s quality factor, my Green Zone Ratings system considers a company’s profitability from a number of perspectives, including return on assets, return on equity and return on invested capital over short- and long-term time frames. And PCH scores well on these metrics.

Bottom line: Lumber is in high-demand right now, and with increased generational interest in the housing market, PotlatchDeltic is in for a strong future. I suggest investing in this stock before it’s too late.

To good profits,

Adam O’Dell

Adam O’Dell is the chief investment strategist of Money & Markets and has held the title of Chartered Market Technician for nearly a decade. He is the editor of Green Zone Fortunes, the trend and momentum options-trading powerhouse Home Run Profits and the time-tested switch system 10X Profits.

P.S. Check out The Bull & The Bear podcast every week for more picks from Adam, Charles and me. You can listen on Apple Podcasts, Spotify, Amazon and Google Podcasts. You can also catch episodes on our YouTube channel here.