For today’s Marijuana Market Update, I dug into our mailbox to respond to an email from our reader Joe:

Good Morning Matt! I am a member of Green Zone Fortunes, probably 90% because of you. I, too, am a numbers guy and enjoy listening to your breakdowns.

I have been in a few of your watchlist positions and have to say you’ve been spot on so far. GRWG was certainly the best.

My question is on POTN. I opened a position a couple of years ago on a recommendation from another source. Saw a spike, then it fell off. Could you take a look at this one for me?

Again, thanks for what the three of you guys do!

Thank you, Joe, for the kind words. We all enjoy providing you with safe, simple and profitable investment information.

About PotNetwork Holdings (POTN)

I’m happy to look into PotNetwork Holdings Inc. (OTC: POTN).

Keep reading to find out more about what the company does, as well as its financials and stock performance.

PotNetwork Holdings is a holding company for subsidiaries focused on the cannabis industry.

These include:

- Blue CBD Crystals Isolate — A “high-end premium CBD brand” that’s made from 100% natural hemp.

- Diamond CBD — A CBD brand that makes a variety of CBD products.

- Chill Plus Gummies — Flavored, hemp-derived CBD treats.

- Relax Extreme CBD — A CBD oil delivered through drops under the tongue.

- CBD Biotech Cream — A topical cream used for sore muscle areas.

- Relax Vape Liquid — A juice used for vaping.

- CBD Re-Leaf — A CBD re-leafing vape pen in a variety of flavors.

- CBD Double Shot — A portable, organic shot of CBD.

- Pet CBD Food — Available for cats and dogs of all sizes.

- Liquid Gold — A CBD oil the company said is “in thousands of stores around the country.”

- PotNetwork — A cannabis business website.

The company also has partnerships with Tommy Chong and retired NFL player Lawrence Taylor.

In all, PotNetwork Holdings has 24 subsidiaries.

It seems like a robust set of holdings that will bring in a good amount of revenue. However, the books tell a different story.

PotNetwork Financials: Red Flags

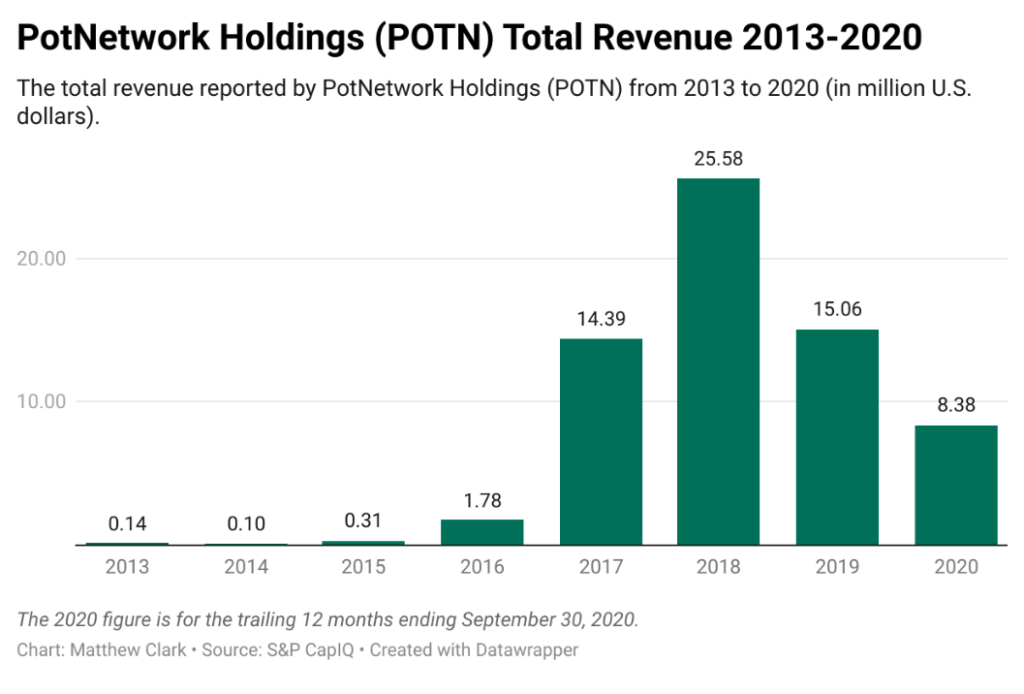

As you can see from the chart below, the company’s total revenue was well under $1 million per year from 2013 to 2015.

After a huge spike from 2016 to 2018, it reached a high of $25.6 million.

But revenue fell just as fast in the following years.

Take a look at the chart of net income below. Its trailing 12-month total income as of September 30, 2020, was just $8.38 million — a 205% drop from its 2018 high.

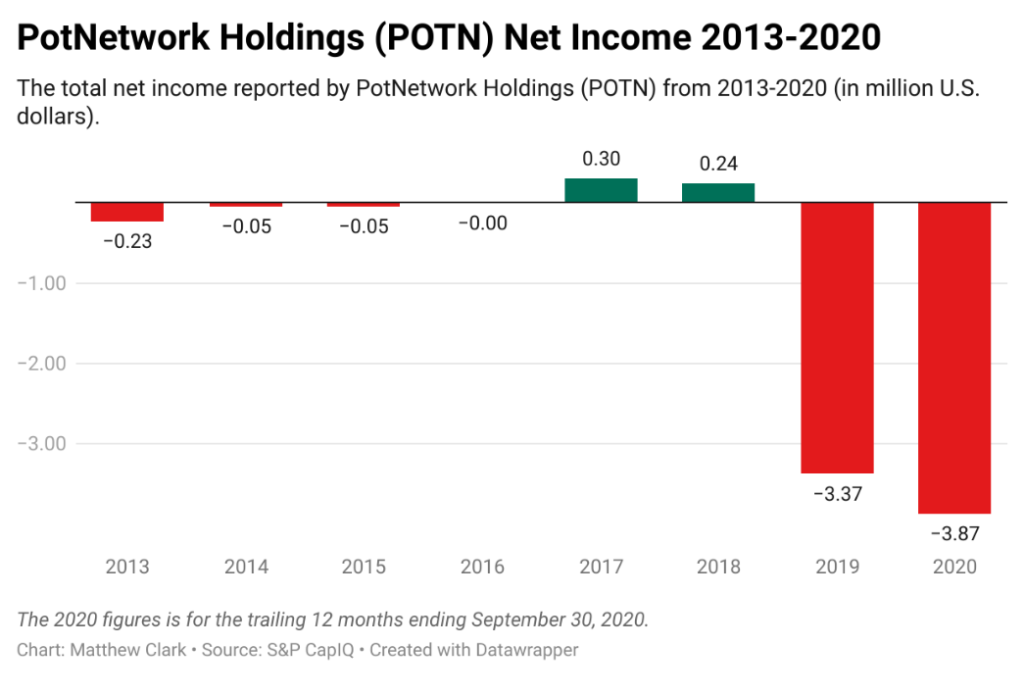

It’s no coincidence that 2017 and 2018 were the only years PotNetwork reported positive net income.

And, as you can see, net income took a nosedive in 2019 and for the trailing 12 months ending September 30, 2020.

For the first nine months of 2019, the company registered a net loss of $384,000. That loss deepened to $884,000 in the first nine months of 2020.

Bear in mind that PotNetwork reduced its operating expenses in 2020 by more than $2 million and still lost more money.

The struggles in 2020 led the company to name a new CEO after its former CEO resigned. It also appointed a new VP of product development.

POTN Stock

PotNetwork announced a 10:1 reverse split of its common shares and a simultaneous decrease in authorized common stock down to 750 million shares.

The theory here is that the company will consolidate its shares and boost the company’s share price.

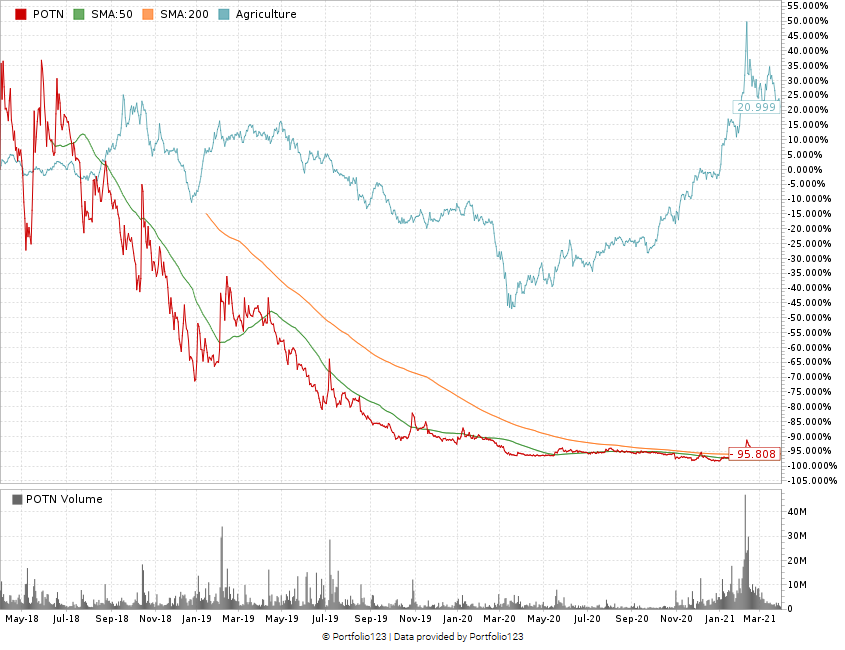

PotNetwork (Red) vs. Ag Stocks (Blue) — POTN’s Nosedive

Note: I couldn’t find that the stock split happened yet.

PotNetwork Holdings stock hit a high of $0.85 back in January 2018. Since then, the share price has nose-dived — even trading below $0.01.

In the last three years, the stock price dropped 95%.

Its comparative industry — agriculture — rose 21% in the same time.

This told me all I need to know.

This company was in trouble leading up to November 2020, so it made some changes to get out of it.

But it will take more than a stock split and some changes in management.

PotNetwork will need to work hard and take time to recover from its financial difficulties from the last two years.

The bottom line: The light at the end of the tunnel for PotNetwork is still quite far off.

Cannabis Watchlist Update

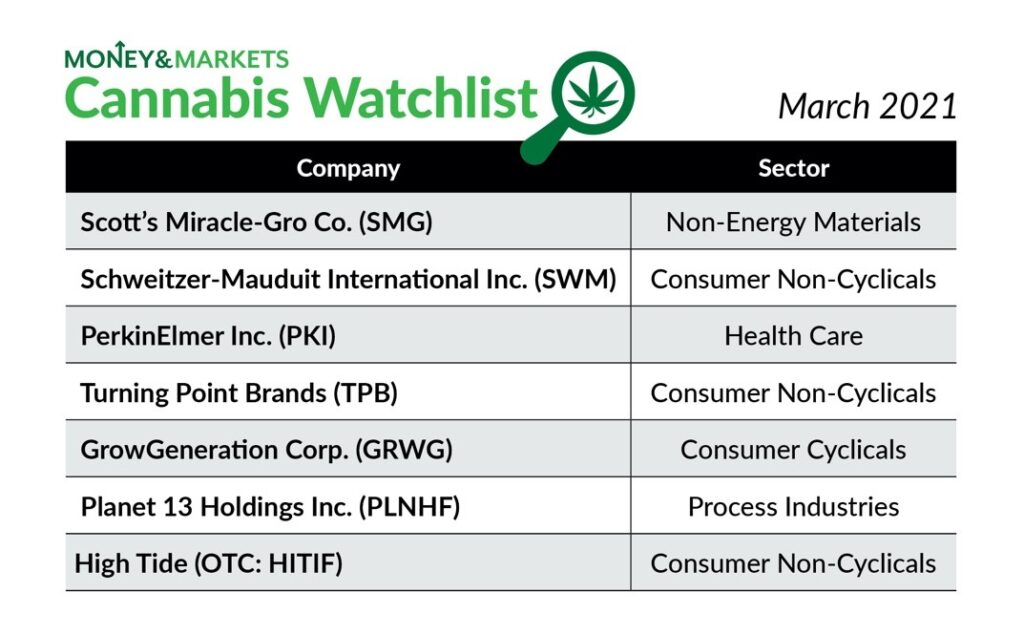

Now, I want to look at our Money & Markets Cannabis Watchlist.

Cannabis stocks have experienced headwinds recently, especially our best performer, GrowGeneration.

Of course, the big recent news is legalization in New York. Recreational use is now legal in the Empire State after Gov. Andrew Cuomo signed cannabis legislation on Wednesday (after this Marijuana Market Update was recorded), but it will be at least a year before sales start.

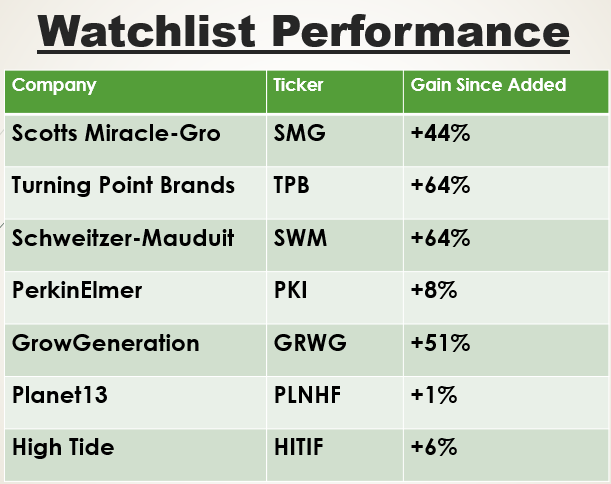

As I look at our watchlist, the average total gain of our seven stocks is 46%:

Numbers pulled on March 30, 2021.

Here’s what’s notable from the table above:

- Scotts Miracle-Gro Co. (SMG) — There’s added investment interest in the traditional fertilizer company as Zacks Investment recently purchased another 896 shares on top of the 22,202 it already owned.

- PerkinElmer Inc. (PKI) — The testing company recently announced an expansion of its genetic portfolio with CRISPR Interference.

- Turning Point Brands Inc. (TPB) — Equity research analysts at B. Riley increased their earnings estimate for TPB for the current quarter to $0.65 per share — up from $0.64.

- GrowGeneration Corp. (GRWG) — GrowGeneration released its quarterly and yearly earnings report. The company said it increased Q4 revenue by 144%, but its quarterly earnings per share missed Wall Street projections by $0.05, which put pressure on the stock.

- Planet 13 Holdings Inc. (PLNHF) — The Nevada-based company’s California expansion continues, and it increased its presence in Nevada to 53 dispensaries.

- High Tide Inc. (HITIF) — The company purchased Smoke Cartel Inc. (OTC: SMKC) for $8 million and opened two stores in underserved areas of Calgary in Canada. High Tide also released earnings this week. It reported revenue increased by 179% to $38.3 million CAD in the first quarter of 2021 when compared to the same quarter last year.

I’ll keep a watch on the cannabis market and let you know if I make any changes to our watchlist.

Coming up this week, we’ll have more on The Bull & The Bear podcast and our Money & Markets Week ahead, so stay tuned.

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.