Let’s imagine you’re researching a company.

The average salary for employees at this company is $2.7 million, and there are 53 employees, not counting supporting staff.

That puts the payroll of this company — core employees only — at $143 million per year.

This does not include other operational expenses (marketing, administrative costs, facility upkeep, rent, etc.).

In this example, let’s say the business spends about $700 million per year in operating expenses.

It has various streams of income from selling licensing rights for different products.

Ownership makes money, but growth is limited to specific channels of revenue.

Have you guessed the company I’m talking about here?

It’s your average NFL franchise.

And now that owners have approved a deal to allow private equity funds to buy stakes in teams, you may be wondering…

Are private investors going to change America’s biggest game?

I’ll examine why this decision was made after decades of forbidding private equity in the league and consider what’s next.

That’s a Lot of Cheese

According to Forbes, the Cincinnati Bengals have the lowest valuation of the 32 teams at $3.5 billion, while the Dallas Cowboys are valued at $9 billion.

Every franchise increased its valuation in 2023 — from as little as 7% (the Los Angeles Chargers) to as much as 26% (the Tennessee Titans).

When you tear open the books of these franchises, you realize two things:

- These teams don’t make nearly as much money as you might think.

- It’s expensive to be an NFL team owner.

Take, for example, the Green Bay Packers. In 2023, the team generated $577 million in revenue from all sources but only $69 million in operational income — the money left over after paying all the bills.

So, after paying nearly all of its expenses, only 12% of the Packers’ revenue remained.

You might think that teams in larger sports markets make more money. That’s kind of true.

The New England Patriots (valued at $7 billion) generated $684 million in revenue and ended the year with $206 million (30%) in operating income.

The Dallas Cowboys are the most valuable franchise in the NFL — valued at $9 billion. It brought in $1.1 billion in 2023 but spent nearly half of it on expenses.

This is a good margin. But the Cowboys are the exception, not the rule.

Don’t get me wrong … I’m not shedding any tears for NFL team owners. They are still raking in money every year thanks to huge media rights deals, ticket sales and even concessions.

Now, owners are looking for more. They’ve set aside a rule in place for decades to increase their cash flow.

The Private Equity Bounty

Since the inception of the NFL, ownership consisted of limited partners but never allowed institutional investment — money pooled from a group of investors.

Until now.

Last week, NFL owners voted to lessen the restriction of ownership to allow private equity money into franchises.

Now, majority owners can sell small stakes in teams, giving those owners access to hundreds of millions of dollars in cash.

The new rule allows a select list of private equity funds to buy no less than 3% and no more than 10% of a team. A fund cannot hold ownership stakes in any more than six different teams.

Additionally, a firm must hold that stake for at least six years before it can sell.

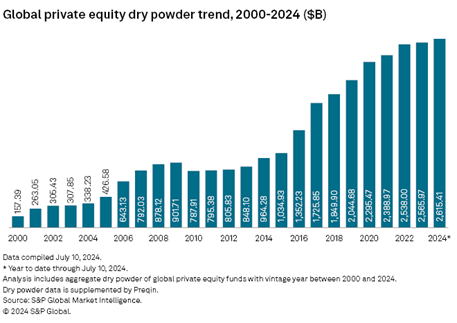

These private equity firms have stored up a lot of uncommitted cash (aka dry powder) for events just like this:

In 2000, private equity firms had $157.4 billion in dry powder, which grew to $2.6 trillion in 2024.

Allowing private capital does two things for owners:

- Gives them an infusion of cash to use for things like stadium and facility upgrades.

- It makes it easier for ownership groups to raise money to buy an NFL franchise… even with soaring valuations.

Because the buy-in is capped at 10%, any private equity firm that jumps into a franchise will be a “silent” partner and not likely to be in any decision-making capacity.

I expect some team owners to start taking advantage of this rule change very soon.

The good news is that fans like us won’t likely see any changes as a result of private equity money infused into the league.

In fact, stadium upgrades may become more frequent and robust as a result.

Does this open the door to public investment like we’ve seen in other sports leagues? Time will tell…

For now, we’ll just enjoy the on-field action, which kicks off with Kansas City hosting Baltimore on Thursday night.

Until next time…

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets