Investors are wondering whether the stock market will break out — or breakdown — amid the coronavirus pandemic as the number of infected continues to surge.

If you ask professionals who allocate other peoples’ money, the near-future looks grim.

A recent Citigroup survey of asset managers shows a big shift in sentiment. Almost 70% of fund managers polled think a 20% stock market correction is more likely than a 20% move up.

Their cash levels also reflect that pessimism. Average cash holdings for these funds are at 10%. That’s double the amount from one year ago.

So how should retail investors react to such a dire outlook?

Banyan Hill Publishing’s Ted Bauman says sound investing uses “reliable information about the likely future.”

So you should focus on what you can learn from the past.

“That’s the only way you can exercise your investment skills,” Bauman wrote in a recent article. “That’s why we hang on every word of quarterly earnings reports. And eagerly await the latest unemployment and gross domestic product (GDP) figures.”

So much has been turned on its head during this stock market rally since the lows of March.

Retail, Professional Investors Eye More Stimulus

But there’s been one constant for both retail and professional investors alike: stimulus.

The rally has been fueled largely by the Federal Reserve and federal government. Trillions of dollars have entered both Wall Street and Main Street.

But what happens when the printing presses stop?

Bauman, Editor of The Bauman Letter, is worried the recovery will be drawn out without more stimulus. This exact thing happened after the financial crisis of 2008.

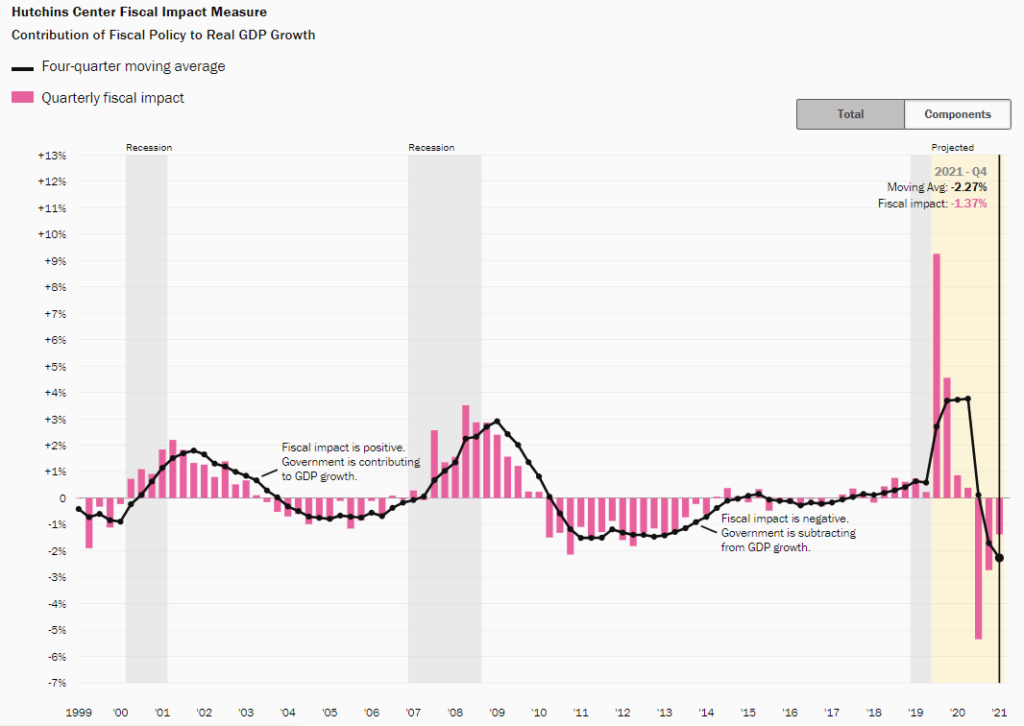

“Congressional Republicans consistently refused to allow additional spending,” Bauman wrote. “Eventually, they passed a budget sequester bill. That led to five years where government fiscal policy actually held GDP growth back.”

The chart below shows the economic recovery out of the Great Recession. It also shows the 2020 fiscal stimulus and GDP projections if stimulus ends.

“That’s precisely the problem,” Bauman wrote. “With the recent dramatic rise in COVID-19 infections, if stimulus isn’t extended, the economy is almost certain to go even deeper into recession.”

That in turn is going to affect the stock market.

“Thousands of companies have retracted their earnings guidance for the rest of this year,” Bauman wrote. “Major economic institutions say they can’t predict what’s going to happen next.”

This is unfamiliar territory for retail and professional investors alike. And Bauman thinks a lot hangs on Washington’s decision to extend stimulus… or not.

“If it does, the economy and stock market may avoid a lengthy period of decline,” Bauman wrote. “If not, we could see things get a lot worse… and quickly. I can’t imagine anything worse than having to depend on politicians … in Washington to determine the fate of my stock portfolio.”

That’s why he’s telling his subscribers to take smart profits.

“Take regular profits,” he wrote. “Hold plenty of cash to grab opportunities at the dip. Load up on stabilizing assets like gold and bonds.”

Bauman’s latest video shows you how to take profits and turn them into even more gains — just like a professional investor. Check out the video below and be sure to join the conversation with his 22,000 YouTube subscribers: