Last week was extremely exciting for me and the rest of the Money & Markets team.

We were part of the Total Wealth Symposium in Orlando, Florida, where we met with several regular readers of our investment research.

It was a blast! If you were there, a quick “thank you” for attending.

While in Orlando, I teamed up with Chief Investment Strategist Adam O’Dell to share the power of his Green Zone Power Ratings system.

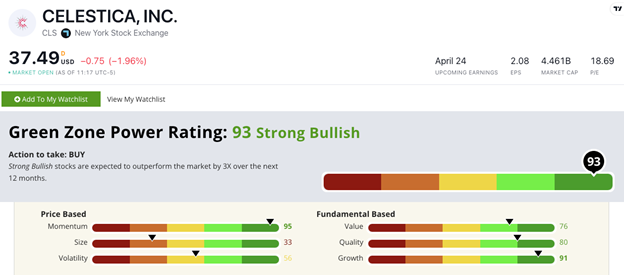

Adam and I walked through how we use his proprietary system, which rates stocks based on six factors Wall Street professionals use daily (Momentum, Size, Volatility, Value, Growth and Quality).

If you attended, you learned just how robust this tool is. If you weren’t there, that’s OK because we highlight how vital Adam’s system is just about every day here in Money & Markets Daily.

Today, I’ll share another stock the system highlights as a buy opportunity.

Then, I want to show you how Money & Markets Chief Market Technician Mike Carr has put his own twist on the system with tremendous results.

Aerospace Stocks: On the Rise

My grandfather spent his career as an aircraft engineer for Boeing.

I loved listening to him talk about his work and how his team was instrumental in building everything from passenger jets to military aircraft.

In fact, I still have some of the promotional posters Boeing would send out when they advertised a new line of aircraft.

And even with the issues Boeing has faced recently, the global aerospace market continues to boom:

According to research firm Precedence Research, the global aerospace market was worth $345 billion in 2023. By 2032, that value will reach $678.2 billion — a 97% increase in just nine years.

Spotting that trend, I turned to Adam's Green Zone Power Ratings system and found an exciting picks-and-shovels company.

It has high marks on Momentum, Value, Quality and Growth … and a "Strong Bullish" 93 out of 100 overall rating:

Celestica Inc. (NYSE: CLS) is a Canadian company that develops components and subsystems for various industries… including aerospace and defense.

The company's technology is found in everything from cockpit avionics and in-flight entertainment systems to landing systems and environmental controls.

The company recorded a 73% annual growth rate in earnings per share and a 10% growth in sales over the last 12 months, leading to its 91 rating on the Growth factor.

CLS Momentum Through the Roof

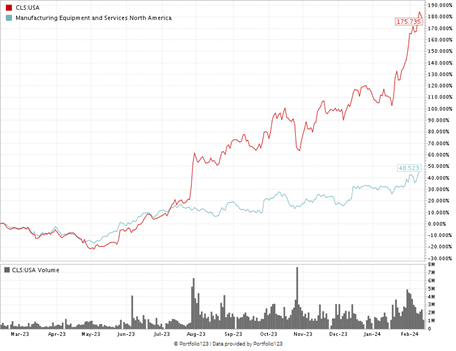

The stock's momentum has been nothing short of market-beating. Over the last 12 months, CLS (red line) jumped more than 175% compared to its industry peer average (blue line) of just 48%.

This is why CLS earns a 95 on Momentum… putting it in the top 5% of all stocks we rank on that factor.

Bottom line: Despite some of the recent issues with Boeing, the global aerospace industry is thriving…

Looking at aircraft manufacturers is an excellent place to start. But I think finding strong companies supplying those manufacturers is even better.

With solid momentum and outstanding fundamentals, CLS is undoubtedly a compelling selection for your portfolio. It's poised to outperform the broader market by 3X over the next 12 months!

But what if you want to think in the shorter term?

Mike's Twist on the Green Zone Power Ratings System

I mentioned earlier that my friend and colleague, Mike Carr, has added his own spin to Adam's Green Zone Power Ratings system.

That twist has yielded significant results… to the tune of a 100% win rate since he launched his Apex Alert premium stock service in October 2023. He just closed his own aerospace trade for a small gain after less than 45 days.

Mike trusts the Green Zone Power Ratings system, then adds his short-term variant using seasonality and his Apex Profit Calendar.

He's essentially rotating into sectors as they reach their peak profitability, and Adam's system helps him find the one stock with the best chance to outperform during that specific period.

I mention this because Mike is making his next round of stock recommendations based on this strategy. He's adding two new positions this week, including one in the natural gas sector — which has a habit of outperforming during this time of year.

Get in now so you don't miss out on the chance to profit on the next round of trades. For more on Mike's Apex Alert, click here.

Until next time…

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets