Every investor wants the answer to a simple question…

“What’s the single best investing strategy?”

Experts have dedicated a tremendous number of resources to find the answer.

They’ve thrown research studies, sophisticated algorithms, and countless hours against a seemingly simple question.

And much like the legendary quest for the Holy Grail, some claim to have solved the problem. One of the solutions worth looking at is in the work of Ray Dalio…

Ray Dalio’s Holy Grail of Investing

Dalio grew his hedge fund, Bridgewater Associates, into the largest in the world. His investment success is enviable. His “radical transparency” management philosophy — where employees can openly rate each other (even Dalio) — is another feather in his cap.

But that’s probably not what he’s best known for.

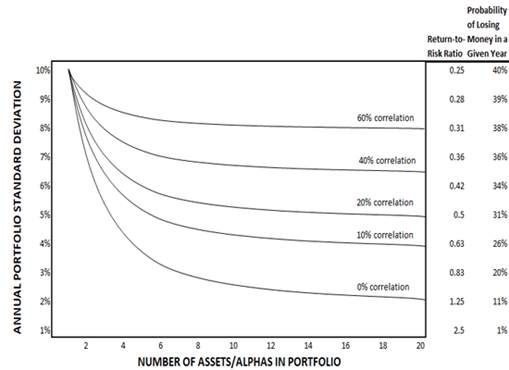

Dalio’s most important contribution might be what he calls the Holy Grail of investing. He summarizes it in the chart below.

Dalio is highlighting the power of diversification. Looking at the y-axis of the chart, if you can find 20 different assets that have no correlation to each other, you have a portfolio with an 11% probability of losing money in any given year.

That shows the power of diversification. But as individual investors, we don’t have access to 20 different asset classes.

However, we can diversify with different investment strategies.

We can diversify by time frame — mixing long-term investments in value or growth stocks with short-term strategies designed to benefit from bounces lasting one to three days.

Some investors do take advantage of this idea. Others go even further in their quest to find the best market-beating approach.

A Perfect Diversification of Strategies

Academic studies searching for the Holy Grail have provided some clues. They have shown that value stocks can beat the market. In other studies, researchers found that growth stocks can deliver market-beating gains.

One researcher found that these studies identified 215 different factors that could beat the market. Not all of them can be replicated, and many of them measure the same thing.

This study showed that just two factors were uncorrelated with the others.

One is the consistency of earnings growth. That helps investors beat the market in the long run.

The other deals with time frames. In the short run, seasonality is a market beater.

Seasonality is the idea that stocks do well at certain times of the year. For example, tech stocks often do well in the summer while other stocks underperform.

While we have many ways to identify seasonal trends, just like with tech stocks in the summer, the reasons aren’t always readily evident. Buying stocks without a clear understanding of why can be risky.

So to reduce the risk of seasonality, we can look at confirming factors. When we use confirmation, we’re backed with two reasons to buy a stock.

In my stock trading service — Apex Alert — I combine seasonality with Adam O’Dell’s Green Zone Power Ratings system.

I use seasonals to find the right time to buy into the best-performing sector. Then, I use the Green Zone Power Ratings to find the best stock for us to enter within that top sector.

So Apex Alert uses two powerful strategies to find the right stock at the right time.

In backtesting, my Apex Profit Calendar had the power to deliver an annualized gain of 64%, trouncing the 11% annualized gain of the broader market.

And now in real-time, our results have been mirroring the system’s back test. So far, all of our positions have delivered gains.

And we have many more promising trades lined up. This week, I’m closing two positions and jumping into two new ones, so now is a perfect starting point.

To see the full details behind this powerful strategy — and to access our next Apex Alert signals, click here.

Until next time,

Mike Carr

Chief Market Technician