Amid the throes on the Great Recession in 2008, the Federal Bank took drastic measures in an attempt to get the economy back on track.

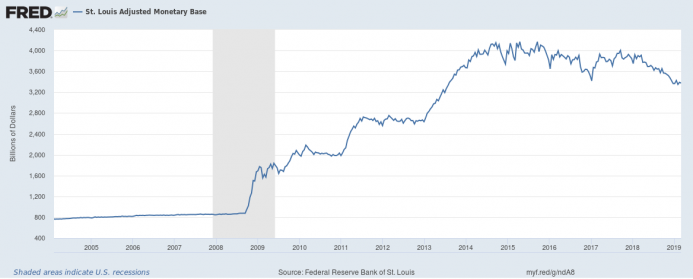

Quantitative easing, the most profound monetary experiment in the history of the world, became the new norm and it happened in three rounds between 2008 and 2014, quadrupling the monetary base of the world’s dominant currency, the U.S. dollar from less than $1 trillion to more than $4 trillion.

The Fed simply printed new money, bought Treasury and mortgage-back debt from commercial banks, and in turn gave them new reserves of cash.

Per Mises Institute:

It was a great trick. If QE can be done without adverse effects or with few adverse effects, it represents nothing short of monetary alchemy (h/t Nomi Prins). Everything we thought we knew about the Fed as backstop lender of last resort to commercial banks, as hallway monitor of inflation and unemployment, is out the window.

If QE works, then every government on earth must take notice of the opportunity to effectively recapitalize their own banks and industries free of charge. QE turns central banks into kings of capital markets, into active participants in the economy. As one twitterati put it, expansionary QE created the biggest untold American story of the last twenty years: the Fed can now inflate and deflate assets, devalue savings, influence wages and productivity, encourage corporate malfeasance, and engineer balance sheets — all the while creating economic winners and losers.

What politician or central banker could resist?

Recall how defenders of QE not only argued it was necessary, but beneficial. Paul Krugman was among the worst offenders, insisting that low interest rates would mitigate any harms from such rapid monetary expansion. These defenders dismissed, and continue to dismiss, what is now obvious: since 2008 the US economy has experienced significant asset inflation in equity markets and certain housing markets, plus a creeping but steady rise in many consumer prices.

This is no surprise. Did it never occur to QE cheerleaders that 1% money market yields might chase money into the stock market? Or that 2% interest rates might not encourage US businesses, households, and individuals to get solvent?

But monetary stimulus, like fiscal stimulus, is a heady drug for politicians and their central bank enablers. Once you accept consumption rather than production as the basis for a healthy economy, creating new money starts to sound like a good idea. And if creating money is a good idea, why not create a lot of it—especially in the midst of an economic crisis?

In 2008 Ben Bernanke was at least honest about the radical nature of what the Fed had embarked upon. He used the term “extraordinary monetary policy” for the unprecedented expansionary QE program, a program he insisted was made necessary by a potentially catastrophic global financial crisis.

But there were dissenters. David Stockman, for one, strongly disputes whether Main Street needed to save Wall Street. Chapter 26 of The Great Deformation lays out Stockman’s case against more debt and credit in an already overleveraged corporate landscape, not to mention the moral hazard of bailing out investment banks by creating money. And of course virtually all Austrian economists, plus plenty of non-Austrians, loudly opposed QE from the start: new bank reserves don’t magically create new goods and services in the economy. Low interest rates discourage capital formation and encourage malinvestment. More debt is not the answer for too much debt. And why should banks, flush with QE reserves, lend at all in a shaky economy when (since 2008) the Fed pays them interest on those excess reserves?

So here’s a modest proposal for the Federal Reserve officials, and a challenge to economists who reject Austrian views on QE and business cycles in general:

Return the Fed’s balance sheet to its pre-2008 level, by selling assets and/or letting assets mature. Do this over an identical six year period that mirrors the timeline for QE 1, 2, and 3. Do so at a rate and volume similar to which purchases were made during that period. For transparency, and to calm markets, announce this plan ahead of time.

In other words, return the country to “ordinary” monetary policy. After all, the crisis is over and the economy is healthy, right? If Austrians are wrong, if in fact QE saved the country and wasn’t merely an artificial process of juicing the economy and monetizing debt, it can and must be fully unwound.

In fact the St. Louis Fed president James Bullard nearly promised as much back in those quaint days of 2010:

The (FOMC) has often stated its intention to return the Fed balance sheet to normal, pre-crisis levels over time. Once that occurs, the Treasury will be left with just as much debt held by the public as before the Fed took any of these actions.

So how about it, Mr. Powell? A real economy operates without ultra-low interest rates and activist central bank stimulus. You’ve wavered lately; suggesting even the painfully slow process of QE tapering may be halted. Don’t make Mr. Bullard a liar, or at least a bad prognosticator. And don’t make Mr. Bernanke your permanent silent partner when it comes to Fed governance. Do what must be done, take the patient off its feeding tube, and make history as the first modern Fed Chair who allowed the US economy to rebuild itself on real capital instead of debt.

Shrink the Fed’s balance sheet and we can talk about whether QE “worked.” Until then, we can’t know if economic growth is real or artificial.